GSTPAM News Bulletin April 2023

THE GOODS & SERVICES TAX PRACTITIONERS’ ASSOCIATION OF MAHARASHTRAINTENSIVE STUDY COURSE CIRCULAR FOR THE YEAR 2022-23

Respected Members,

It is 6th year of the GST act is implemented. After implementation of GST, whole fraternity of IndirectTax Practitioners and Trade are facing various challenges with regard to implementation, transition,interpretation, practical aspects, prescribed schedule rates, AAR, Department Audit, various noticesrelated to ITC mismatch and so on.

We all are aware about the practical di culties we are facing while applying the rules and proceduresof the GST law and the frequent amendments to the law especially due to frequent lockdown. Withthe view to update our fellow members on the latest development in law and to discuss the practicalissues arising there from, our association has been regularly conducting Intensive Study Course. Thisyear the Intensive Study Course is designed to enable the members to study and discuss variousissues on Indirect Tax Laws mainly on GST Law, as well as on profession tax, etc.

With the same enthusiasm to discuss mainly on various aspects of GST Law, We are starting our hybridmode Intensive Study Course for the year 2022-23 from Friday, 16-09-2022 onwards, uptoJune, 2023.

The Intensive Study Course is such an academic activity of our association which is designed tofacilitate the members to study and discuss various issues in group. At the intensive study Course,one of the members acts as a group leader and leads the discussion on issues of the relevant subject/topic and one of the seniors in the profession monitors the discussion. The meetings are generallyarranged ON Hybrid mode on 1st,3rd and 5th Friday of the month during 3.30 p.m. to 6.00 p.m..There are around 15-16 meetings will be arranged for the Intensive Study Circle.

1st The inaugural meeting of the Intensive Study Course is scheduled to be held on Friday,16-09-2022 onwards, upto June, 2023. between 3.00 p.m. – 6.00 p.m. on hybride mode onthe subject “Issues in Assessment and Recovery proceedings under GST!” The topic will belead by Group Leader CA Dharmen Shah and the Monitor of CA Ashit Shah.

The group strength is restricted to a limited number of members to facilitate better interaction withinthe group. The Intensive Study Course Fee is fixed at Rs. 1,650 – including GST for Members and Rs. 1,850 – including GST for Non members. You are requested to enroll at the earliest to avoid disappointment.

Member interested to act as group leader should inform by filling up the option in the Form of “Iwish to be a group leader for the subject” and are requested to contact the Convener on the mobilenumbers mentioned- on Cell No. 9552451930/ 98211 21433 / 9324541329

Note :

- GST lectures will be in form of group discussion, which will be helpful to study the GST law.

- If the materials are received 3 days earlier to the date of meeting, the same will be circulatedthrough mails to the participants.

- Participants are requested to discuss only the points related to the particular topic of the meetingand to come prepared for the subject, which will be helpful for the discussion.

| Pravin Shinde

Chairman |

Dilip Nathani

Convenor 9821121433 |

Pravin Jadhav

Convenor 9324541329 |

Manakchand Baheti

Convenor 9552451930 |

CIRCULAR FOR RENEWAL OF MEMBERSHIP/SUBSCRIPTION CHARGESFOR THE F.Y. 2023 – 24

Dear Members,

RENEWAL OF MEMBERSHIP FOR F.Y. 2023-24

The Membership Fees for the year 2023-24 are due for renewal on 01.04.2022. We appreciate yourContinuing support and participation in the activities of our Association.

The timely Renewal of Membership will enable the members to continuously receive the updateson various activities of GSTPAM along with the GST Review, News Bulletin, Circulars, Messages,Webinars and online access to the website www.gstpam.org. The Life Members only need to renewthe subscription charges for the GST Review. The members can also avail the benefit of discount bypaying advance for subsequent two years membership fees/subscription charges.

The Membership Renewal Fees received after 30th April, 2023 will be subject to approval of theManaging Committee. If the Renewal fees for a particular year are not paid, then the member is liableto pay Admission Fees again for Renewal in the subsequent year.

Delayed Renewal Members will be provided Pre Renewal GST Review subject to availability uponpayment of such additional courier charges.

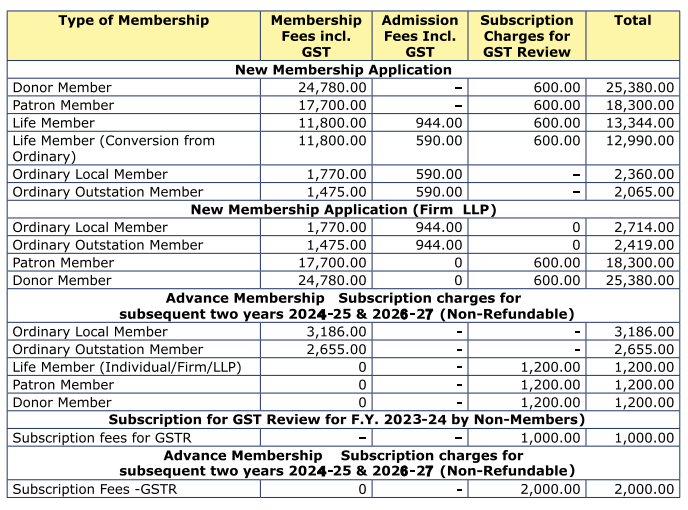

The details of Membership Subscription Fees are given below for your ready reference:

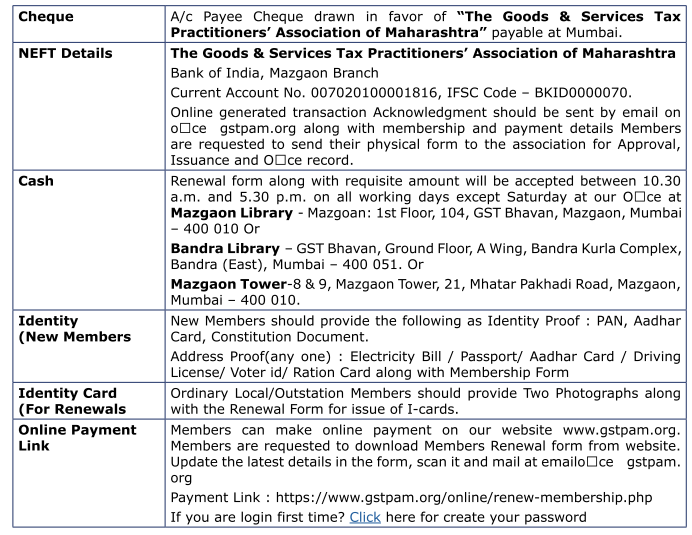

Modes of Payment:-

Dated:-31.01.2023

Parth Badheka

Vinod Mhaske

Hon. Jt. Secretary

ENROLMENT FORM FOR FULL DAY SEMINAR ON GST

| Day & Date | Saturday, 6th May, 2023 | ||

| Timing | 8.30 am to 6.00 pm | ||

| Venue | Zaverben Popatlal Sabhagruha Auditorium, Upashray Lane, Near Rashtriya Shala Compound, Ghatkopar East, Mumbai, Maharashtra 400077. |

||

| Enrollment Fees | Before 25th April 2023 |

Members | 1550/- + GST |

| Non Members | 1700/- + GST | ||

| After 25th April 2023 |

Members | 1700/- + GST | |

| Non Members | 1900/- + GST | ||

SCHEDULE OF THE SEMINAR

| Sr.

No. |

Time | Topic | Speaker |

| 1 | 08.30 am to 09.30 am | Spot Registration and breakfast | |

| 2 | 9.45 am to 10.30 am

(1st Lecture) |

Amnesty and Salient features | Adv. Dinesh Tambde |

| 3 | 10.30 am to 12.00 noon

(2nd Lecture) |

Interplay between Income Tax and GST | CA Pranav Kapadia |

| 4 | 12.00 noon to 1.30 pm

(3rd Lecture) |

ITC Issues – Beyond mis-match | Shri. Parind Mehta |

| 5 | 1.30 pm to 2.30 pm | Lunch | |

| 6 | 2.30 pm to 4.00 pm

(4th Lecture) |

Role of consultants in GST Audits | CA Ashit Shah |

| 7 | 4.00 pm to 5.30 pm (5th Lecture) | Criss Cross of GST provisions and CRPC | Rahul Thakar(GST)

and Nikhil Mendge(CRPC), Advocates |

| 8 | 5.30 pm to 6.00 pm | High Tea |

Applicant Details:

| GSTPAM Membership No. | |

| Name : | |

| Address : | |

| GSTIN of the Member : | |

| Mobile Number : | |

| Email id : | |

| Signature of Member : |

Note :-

- Please issue the Cheque in favour of ‘‘The Goods & Services Tax Practitioners’ Association of Maharashtra’’ (FULL NAME IS REQUIRED TO BE STATED ON THE CHEQUE AS PER RBI DIRECTION).

- For NEFT payment – Bank of India, Mazgaon- Account No. 007020100001816, IFSC – BKID0000070. Acknowledgement generated through online transaction should be emailed on ofce@gstpam.org along with Enrolment Form and payment details.

- The Enrolment Form along with cheque/ DD/ Cash can be submitted at GSTPAM Library, Room No. 104, GST Bhavan, Mazgaon, Mumbai – 400 010 or at GSTPAM Library, A wing, Ground Floor, GST Bhavan, Bandra (E),Mumbai-400050.

- Online Payment Link : https://www.gstpam.org/online/event-registration.php Kindly carry the receipt as a proof of payment for admission to the seminar

- Schedule and speakers are subject to change

GST, MVAT & ALLIED LAW UPDATESCompiled by |

|

|

Notification under Central Tax |

||

|

Notification |

Date of Issue |

Subject |

| 02/2023- Central Tax | 31.03.2023 | Amnesty to GSTR-4 non-filers |

| 03/2023- Central Tax | 31.03.2023 | Extension of time limit for application for revocation of cancellation of registration |

| 04/2023- Central Tax | 31.03.2023 | Amendment in CGST Rules |

| 05/2023- Central Tax | 31.03.2023 | Seeks to amend Notification No. 27/2022 dated 26.12.2022 |

| 06/2023- Central Tax | 31.03.2023 | Amnesty scheme for deemed withdrawal of assessment orders issued under Section 62 |

| 07/2023- Central Tax | 31.03.2023 | Rationalisation of late fee for GSTR-9 and Amnesty to GSTR-9 non-filers |

| 08/2023- Central Tax | 31.03.2023 | Amnesty to GSTR-10 non-filers |

| 09/2023- Central Tax | 31.03.2023 | Extension of limitation under Section 168A of CGST Act |

|

Notification under Compensation Cess |

||

|

Notification |

Date of Issue |

Subject |

| 01/2023 –

Compensation Cess |

31.03.2023 | Seeks to provide commencement date for Section 163 of the Finance act, 2023 |

Notification

Date of Issue

Subject

|

Notification under Compensation Cess (Rate) |

||

| 01/2023 –

Compensation Cess (Rate) |

31.03.2023 | Seeks to further amend notification No. 1/2017-Compensation Cess (Rate), dated 28th June, 2017. |

|

Circular under CGST Act |

||

|

Circular No. |

Date of Issue |

Subject |

| 191/03/2023 | 27.03.2023 | Clarification regarding GST rate and classification of ‘Rab’ based on the recommendation of the GST Council in its 49th meeting held on 18th February 2023 –reg |

|

Notification / Trade Circular under Maharashtra Goods |

||

|

Notification / Circular No. |

Date of Issue |

Subject |

| Corrigendum No.

PWR-GST/2017/01/ADM- 8 dt.02/03/2023. |

02.03.2023 | Corrigendum to order for power delegation & area jurisdiction in case of ACST-INV. |

| 1/2022-State Tax (Rate) | 23.03.2023 | Seeks to amend notification No 12/2017 State Tax (Rate) dated 29th June 2017 |

| 2/2022-State Tax (Rate) | 23.03.2023 | Seeks to amend notification No 13/2017 State Tax (Rate) dated 29th June 2017 |

| 3/2022-State Tax (Rate) | 23.03.2023 | Seeks to amend notification No 01/2017 State Tax (Rate) dated 29th June 2017 |

| 4/2022-State Tax (Rate) | 23.03.2023 | Seeks to amend notification No 02/2017 State Tax (Rate) dated 29th June 2017 |

|

Notification / Trade Circular MVAT Act 2005 |

||

|

Notification / Circular No. |

Date of Issue |

Subject |

| L.A. Bill No. XIII of 2023

Dt. 20th March 2023. (Marathi) |

20.03.2023 | Amendments to section 27A and SCHEDULE I of the PT Act, 1975 |

| L.A. Bill No. XIII of 2023

Dt. 20th March 2023. (English) |

20.03.2023 | Amendments to section 27A and SCHEDULE I of the PT Act, 1975 |

| L.A. Bill No. XII of 2023 Dt. 20th March 2023.

(Marathi) |

20.03.2023 | The Maharashtra Settlement of Arrears of Tax, Interest, Penalty or Late Fees Act, 2023. |

| L.A. Bill No. XII of 2023 Dt. 20th March 2023.

(English) |

20.03.2023 | The Maharashtra Settlement of Arrears of Tax, Interest, Penalty or Late Fees Act, 2023. |

| No. VAT- 1523 /CR 15/

Taxation-1 dated 23rd March 2023. |

23.03.2023 | Reduction in rate of tax (VAT) on AVIATION TURBINE FUEL (ATF – Schedule Entry B-6) |

GST Amendments made on 31st March 2023Compiled by CA Aditya Surte |

|

Introdction

- The CBIC has issued eight notifications on 31st March 2023 to give effect to various recommendations made by the GST Council in its 49th meeting held on 18th February 2023.

- The notifications are primarily aimed at providing amnesty schemes for regularising various compliances.

- Limitation for passing orders u/s 73 has also been extended.

Amnesty to annual return non-filers

Applicable to : Registered persons who failed to furnish the annual return (GSTR-9) by the due date for any of the financial years 2017-18, 2018-19, 2019-20, 2020-21 or 2021-22.

Relevant provision of the Act / Rules : Sec. 47(2) of CGST Act provides for a late fee of Rs. 100 per day of delay subject to a maximum late fee of 0.25% of the turnover in the State. A similar provision exists under the relevant SGST Act making the total late fee Rs. 200 per day. provision of

Scope of amnesty : Total amount of late fee payable shall be restricted to Rs. 10,000 under CGST Act. A similar notification is expected under the SGST Act, making the total maximum late fee payable Rs. 20,000.

Conditions for : Furnish the pending annual return between 1st April 2023 to 30th June 2023. availing amnesty

Source : Notification No. 07/2023 – Central Tax dated 31st March 2023

Amnesty to final return (GSTR-10) non-filers

Applicable to : Registered persons who failed to furnish the final return (GSTR-10).

Relevant provision of the Act / Rules : ➢ Sec. 45 of CGST Act states that every registered person who is required to file return in Form GSTR-3B and whose registration is cancelled, must furnish a final return in Form GSTR-10 within 3 months of the date of cancellation or the date of cancellation order, whichever is later.

: ➢Sec. 47 of CGST Act provides for a late fee of Rs. 100 per day of delay in filing such final return subject tomaximum of Rs. 5,000. Similar provisions exist in the SGST Act taking the total late fee to Rs. 200 per day subject to maximum of Rs. 10,000.

Scope of amnesty : Total amount of late fee payable shall be restricted to Rs. 500 under CGST Act. A similar notification is expected under the SGST Act, making the total maximum latefee payable Rs. 1,000

Conditions for : Furnish the pending final return between 1st April 2023 to 30th June 2023.

availing amnesty

Source : Notification No. 08/2023 – Central Tax dated 31st March 2023

Amnesty to GSTR-4 non-filers

Applicable to : Composition taxpayers who have not filed their annual return in FORM GSTR-4 for F.Y. 2017-18, 2018-19, 2019-20, 2020-21 & 2021-22 till date.

Quantum of waiver : ➢ Zero late fee in case where there is no additional liability payable as pe GSTR-4.

➢In case there is additional tax payable as per GSTR-4, maximum late fee is capped at Rs. 250 under CGST Act. A similar notification is expected under SGST Act. Hence, the maximum late fee shall be Rs. 500.

Conditions for availing amnesty : Registered person must file GSTR-4 between 1 st April 2023 to 30th June 2023.

Source : Notification No. 02/2023 – Central Tax dated 31st March 2023

Amnesty in the form of one-time extension in time limit for filing application for revocation of cancellation of registration

Applicable to : Registered person, whose registration has been cancelled on or before 31st December 2022 for non- filing of returns and who has failed to apply for revocation of cancellation within 30 days from the date of service of cancellation order.

Conditions for availing one time extension : ➢ Furnish all pending returns up to the effective date of cancellation of registration by making payment of taxes due as per such returns, along with applicable interest andlate fee.

➢Thereafter, apply for revocation of cancellation of registration on or before 30th June2023.

➢No further extension of time period for filing application for revocation of cancellatio shall be available.

Note : The benefit of this extension can also be claimed by those whose appeal against the order of cancellation of registration or appeal against the order rejecting application for revocation has been rejected on the ground of failure to adhere to the time limit specified u/s 30(1) of CGST Act.

Source : Notification No. 03/2023 – Central Tax dated 31st March 2023

Amnesty scheme for deemed withdrawal of best judgement assessment orders issued u/s 62

Applicable to : Registered persons who failed to furnish a valid return within a period of 30 days from the service of best judgement assessment (BJA) order u/s 62(1) of CGST Act issued on or before 28th February 2023.

Relevant provision of the Act / Rules

: Sec. 62(1) of the CGST Act provides for assessing the liability of non-filers of return based on best judgement of the tax authority. Sec. 62(2) provides that where a valid return is furnished within 30 days of the service of the BJA order, the said order shall be deemed to be withdrawn.

Scope of amnesty : This notification seeks to provide relief to the registered persons who could not avail the benefit of amnesty sec. 62(2) by providing that the BJA order shall be deemed to be withdrawn if the registered person adheres to the conditions hereunder.

Conditions for availing amnesty : Furnish the pending return on or before 30th June 2023 along with applicable interest and late fee.

Note : Amnesty scheme is applicable whether or not an appeal had been filed against the BJA order and whether or not appeal filed, if any, has been decided.

Source :Notification No. 06/2023 – Central Tax dated 31st March 2023 .

Extension of limitation for passing orders u/s 73

- Time limit for passing orders u/s 73 for recovery of tax not paid / short paid / ITC wrongly availed or utilised relating to F.Y. 2017-18 to F.Y. 2019-20 has been extended as under:

Financial Year Extended date 2017- 18 December 2023 2018- 19 31st March 2024 2018- 19 30st June 2024 - This will allow more time for departmental authorities to issue notices since sec. 73(2) requires issuance of notice by the proper officer at least 3 months prior to the time limit for passing order.

INCOME TAX UPDATESBy Adv. Ajay Talreja |

|

Changes for NGO/ Society/Trust in Budget 2023

APPLICATION OF CORPUS A fund Will Be Treated As A Corpus Only If Followed By A Specific Written Direction Of The Donor. In The Absence Of A Written Direction Of The Donor, A Contribution Or Grant Cannot Be Transferred. Still, The Corpus Fund Is A Closed Fund With No Strings Or Restriction For Future Application Attached For All Practical Purposes. Earlier Provision:- If a charitable organisation decides to use its corpus or borrow by way of a loan, that amount would be considered as application of income only in the year the amount is put back into the corpus fund or the loan is repaid

Proposed Amendment in Budget 2023 :– It is proposed that application out of corpus or a loan before April 1, 2021 shall not to be allowed as application for charitable or religious purposes even when such amount is put back into corpus or the loan is repaid. This is in order to avoid double tax deduction. Also, if the trust or institution invests or deposits back the amount in to corpusor repays the loan within 5 years of application from the corpus or loan, then such investment/depositing back in to corpus or repayment of loan will be allowed as application for charitable or religious purposes and where the application from corpus or loan did not satisfy the conditions as stated above, the repayment of loan or investment/depositing back in to corpus of such amount will not be treated as application hence it will be taxable.

In case of Form 9 (i) The Amount Has To Be Utilised In The FY In Which It Will Be Received Or Subsequent FY. (ii) In Case Where The Same Could Not Be Applied For Any Other Reason Then Amount Has To Be Applied In The Subsequent FY. In case of Form 10 The Amount Can Be Utilised In Any Of The Subsequent 5 Years For The Purpose For Which It Was Accumulated. In every FY a tax exempt charitable organisation is required to spend at least eighty five per cent of its total income. In case income is received late in the financial year the trust can exercise option under section 11(1) to use the income in the immediately following financial year by filing Form 9A or accumulate the unspent income u/s 11(2) for up to five years by filing Form 10.

Earlier Provision:- Both Form 9A and Form 10 could earlier by filed by 31st October and these forms could be filed along with return of income.

Proposed Amendment in Budget 2023:-It is proposed that the due date of filing of Form 9A/10A to two months prior to the due date of filing of return, now Form 9A or Form10 must be filed by 31st August. But now it has to be filed at least two months prior to the due date of filing of ITR. In the event of failure of compliance of the same exemption of income from tax shall not be available.

REGISTRATION FOR TAX EXEMPTION Section 12A registration applies to organisations working not for profit like NGOs, charitable trusts, religious organisations etc. Once duly registered under 12A, these organisations are eligible to avail of tax exemptions on their surplus income. Section 12A is related to trusts or social welfare institutions registered before 1996, Section 12AA deals with those incorporated after 1996. While in section 10(23C), that institution should exist solely for educational or medical purposes, to avail the benefits.

Earlier Provision:- Organisations enjoying tax exemption u/s 10(23C) or 12A / 12AA were required to re-validate their registration for tax exemption as also for tax deduction u/s 80G. Newly established organisations could apply for provisional tax exemption and tax deduction for a period of three years.

Proposed Amendment in Budget 2023:– It has been proposed that Trust or Institutions shall be allowed to make application for provisional approval including provisional approval for Sec 80G before the commencement of the activities. Trust or Institutions in which the activities have already been commenced shall make application for regular approval including the approval for Sec 80G. If the PCIT or ICT is satisfied about the objects the registration shall be granted for 5 Years. It is also proposed that if any trust or institutions fails to make an application for re-registration within the period specified, it shall be deemed to have been converted into any form not eligible for registration in the previous year in which such period expires. It is proposed to clarify that the exemption u/s 11, 12 and 10(23C) will be available only if the return of income is furnished within the time limit specified under section 139(1) or 139(4) of the Act with effect from 1st April 2023, thereby it is clarified that the exemption is not allowed if the updated return u/s 139(8A) is filed.

Case Name : DCIT Vs Rapipay Finvest P. Ltd (ITAT Delhi)

Appeal Number : ITA No. 161 & 162/Del/2019

Date of Judgement/Order : 28/12/2022

ITAT Delhi held that it is fact that depreciation on software/ machinery was claimed and duly allowed in F.Y. 2012-2013. However, due to uncertainty of business revenue could not be generated by using the software in F.Y. 2013-14. Accordingly, depreciation cannot be disallowed alleging non-generation of revenue.

Facts- The Assessee company was incorporated on 06.01.2009 and carrying on the activity of providing IT

enables services and BPO services and have shown purchase and sale of “printed books of voter list” from M/s. Vakrangee Software Ltd and M/s. Mindtree Export Pvt. Ltd amounting to Rs. 2,76,75,720/- and Rs. 2,84,57,520/- respectively. Therefore, in order to verify the identity and creditworthiness of the parties and confirm the genuineness of the transaction, issued the notices u/s 133(6) to the said companies on 24.11.2015 and 07.01.2016 at the address mentioned on their bills/ vouchers. AO alleging that assessee failed to discharge onus of purchases shown from M/s. Vakrangee Software Ltd., the amount of Rs. 2,76,75,720/- is added back to the taxable income of the assessee as bogus purchase. Ld. Commissioner deleted the addition made by AO. Being aggrieved, revenue preferred the present appeal. Further, AO disallowed depreciation on the ground that there was no business activity done by the assessee accordingly the assets of the company have not been put to use during the entire year. CIT(A) allowed the depreciation. Being aggrieved, the present appeal is preferred by revenue.

Conclusion- Held that the ld. Commissioner also held that in case the purchase has to be doubted, then the sale is also not possible and therefore, deserves to be reduced from the assessed income of the Assessee. Admittedly, the Ld. Commissioner made the independent enquires and parties have confirmed the transactions with the Assessee and the sale has been accepted by the Assessing Officer. Even otherwise we do not find any material/reason to controvert the said findings, hence, on the aforesaid analyzations, we concur with the findings of the ld. Commissioner and consequently are inclined not to interfere in the decision of the ld. Commissioner on the issue under consideration. The Hon’ble Delhi High court in the case of CIT vs. Yamaha Motor India Pvt. Ltd. (2010) 328 ITR 0297 also held “as long as the machinery is available for use, though not actually used, it falls within the expression “used for the purposes of the business” and the Assessee can claim the benefit of depreciation.” The Hon’ble High Court also distinguished the discarded and the existing machinery. In the instant case it is not in controversy that the software/machinery on which the Assessee has claimed depreciation, has not been diminished or discarded but in fact, was put to use by the Assessee in the F.Y. 2012-13 (A.Y. 2013-14) itself and revenue was generated by utilizing the said machinery and the depreciation was allowed in that particular year, however, in the subsequent year, i.e., F.Y. 2013-14 (A.Y. 2014-15) the year under consideration, the Assessee due to uncertainty of business, could not generate revenue by using the software that ipso facto cannot be considered as a basis for disallowing the depreciation claimed.

Neelkanth Developers Radhe Homes Vs ADIT (ITAT Ahmedabad) ITAT Ahmedabad TDS credit cannot be denied on the ground that corresponding turnover has been offered to tax in the earlier assessment year.

Facts- The assessee is builder and developer and has offered income on the basis of percentage completion method, whereas the TDS has been deducted by the purchaser of the property u/s. 194-IA of the Act at the time of execution of sale deeds. Therefore, the case of the assessee is that that it is not possible at all times to correlate a specific amount of TDS with the specific amount of income earned by the assessee in a particular year. In the present case, the counsel for the assessee submitted that the assessable income relating to TDS credit claimed in this year has already been offered to tax in the current year as well as earlier years, therefore there is no discrepancy in the TDS credit claimed while filing the return of income. The counsel for the assessee further submitted that when a particular income is received by the assessee after deduction of TDS and the said TDS has been duly deposited with the Government and the assessee has received the requisite certificate to this effect, then on production of such certificate, assessee becomes entitled to credit of TDS, even if the assessee has not directly offered the said income to tax.

Conclusion- In the case of NCC Maytas JV v. ACIT [A.Y. 2006-07, ITA No. 812 (Hyd.) of 2013, dated 13-9-2013, the ITAT held that a part of TDS cannot be denied on the ground that the corresponding turnover has not been shown in the A.Y. in which credit is being claimed, if income relating to such TDS has already been offered for taxation in an earlier assessment year. In the instant facts, in view of the aforesaid rulings, if the assessee has offered income to tax in either in the current year or any earlier year and TDS has been deducted on the same in the current year at the time of execution of sale deed, credit for the TDS so deducted should be allowed to the assessee in the current year, subject to the assessee producing the necessary supporting to show that corresponding income has been offered in tax either during the current year or any of the earlier previous years.

ITO Vs SHM Products Pvt. Ltd. (ITAT Mumbai)

ITAT Mumbai held that appeal of the revenue is hit by the monetary limits as per CBDT circular. Further, filing of appeal based on information from investigation wing (i.e. not external source) is not covered by except mentioned in clause (e) of paragraph 10 of CBDT circular. Facts- The assessee brought to our notice that the addition made by the AO is only to the tune of Rs. 15,25,499/- which has been deleted by the Ld.CIT(A). According to the Ld.AR, the tax effect in this case was only Rs. 4,71,379/- which is less than the prescribed monetary limit given by the CBDT. Therefore, the assessee objected against the admission of this Revenue appeal.

Conclusion- Tribunal in the case of DGIT vs M/s. Pabal Housing Pvt. Ltd. held that addition has been made by the AO on the basis of information received from investigation wing, meaning thereby, it cannot be said that the facts of the present case would be covered by the exception mentioned in clause (e) of paragraph 10 of the Circular issued by CBDT, referred above. Accordingly, I hold that the present appeal of the assessee is hit by the monetary limits and hence the revenue is precluded from pursuing this appeal. Held that the appeal of the Revenue is not maintainable because the source of information on which AO re-opened the assessment was emanating from the investigation wing of the Income Tax Department and not from the external law enforcement agencies to fall in the exception to agitate before this Tribunal despite hit by low tax effect.

Case Name : Vipin Kumar Vs ITO (ITAT Delhi)

Appeal Number : ITA No.7620/Del/2019

Date of Judgement/Order : 16/01/2023

Related Assessment Year : 2011-12

ITAT Delhi held that benefit under section 54B of the Income Tax Act cannot be denied on mere fact that property was valued by the registered authority as a non-agricultural land for the purpose of stamp paper. Facts- The AIR information from sub registrar, Hapur Second in the case was received w.r.t sale of property for total consideration of Rs. 1,42,11,000/- during the F.Y, 2010-11. To verify the correctness of the information, query letter dated 26.08.2016 was issued and duly served upon the assessee. In compliance to the same, assessee filed his reply along with copy of sale deed, Khatauni and report of Gram Pradhan regarding situation of land from municipal limit of Hapur. The assesses in his reply before Ld. AO, has stated that he has sold his agricultural land situated in Viliage-Upeda, Hapur, which is more than 7 km from outside of municipal limit from all sides of Hapur. The land in question is not a capital asset within the meaning of Section 2(14) of the I.T. Act. Besides, after sale of land, he has purchased another agriculture land for cultivation. However, the Ld. Ao observed that the assessee had not, filed any evidence for purchase of agricultural land and claim of exemption u/s 54B of the I.T. Act. The said Immovable property was sold for total sale consideration of Rs. 1,00,00,000/-though the circle rate as per the registering authority is Rs. 1,42,11,000/-. Hence, in view of the provisions of section 50C of the I.T. Act Ld. AO was of view that the sale consideration of Rs. 1,42,11,000/- is required to be adopted for computation of Capital gains. Further that as per the sale deed page no. 36, the land was sold for the purpose of residential use and hence is a capital asset, sale of which renders the assesee for payment of LTCG. AO made an addition of Rs. 71,05,500/- of sales consideration as per section 50C of the Act and also added purchase consideration Rs. 39390/-, thus, arising at long term capital gain of Rs. 68,25,450/-. It was primarily submitted that only on the basis of high stamp duty levied by the registration authority, Ld. AO has concluded the land is a capital asset being non-agricultural land while copy of Khasra and Khatauni and other relevant documents were ignored in which the land was shown as agricultural land.

Conclusion- The crucial point of controversy thus, needs to be restored to the files of CIT(A) to allow the additional evidences of the assessee and to let the assessee establish that the land falling in the share of assessee which was sold by the impugned sale deed was not converted to non-agricultural purposes by any order of revenue authorities. If that stands establish the mere fact that it was sold for the purpose of residence of the vendor or that it was valued for the purpose of stamp papers by the registered authority as a non-agricultural land would not be material and assessee will be entitled to benefit of Section 54B of the Act.

CHARITABLE TRUSTS UPDATESBy Adv. Hemant Gandhi & CA Premal Gandhi |

|

FCRA – Provisions relating to Registration, Renewal, Cancellation and Surrender of Certificates.

Grant of certificate of registration.

An application is to be made by a person, referred to in section 11 for grant of certificate or giving prior permission, shall be made to the Central Government in the prescribed form FC- 3A along with the prescribed fee. Furthermore, every person who makes an application under sub-section (1) shall be required to open “FCRA Account” with State Bank of India, New Delhi Main Brach at 11 Sansad Marg, New Delhi and mention details of such account in his application.

On receipt of the above application the Central Government shall, by an order and after making such

inquiry as it deems fit, either accept the application or, reject the application. However, the rejection must be communicated within a period of ninety days from the date of receipt of application.

However, a person shall not be eligible for grant of certificate or giving prior permission if his certificate has been suspended and such suspension of certificate continues on the date of making application.

The person making an application for registration or grant of prior permission should comply with the followingconditions:

- is not fictitious or benami;

- has not been prosecuted or convicted for indulging in activities aimed at conversion through inducement or force, either directly or indirectly, from one religious faith to another;

- has not been prosecuted or convicted for creating communal tension or disharmony in any specified district or any other part of the country;

- has not been found guilty or diversion or mis-utilisation of its funds;

- is not engaged or likely to engage in propagation of sedition or advocate violent methods to achieve its ends;

- is not likely to use the foreign contribution for personal gains or divert it for undesirable purposes;

- has not contravened any of the provisions of this Act;

- has not been prohibited from accepting foreign contribution;

- the person making an application for registration has undertaken reasonable activity in its chosen field for the benefit of the society for which the foreign contribution is proposed to be utilised;

- the person making an application for giving prior permission under has prepared a reasonable project for the benefit of the society for which the foreign contribution is proposed to be utilised;

- in case the person being an individual, such individual has neither been convicted under any law for the time being in force nor any prosecution for any offence pending against him;

- in case the person being other than an individual, any of its Directors or Office bearers has neither been convicted under any law for the time being in force nor any prosecution for any offence is pending against.

- the acceptance of foreign contribution by the person is not likely to affect prejudicially—

- the sovereignty and integrity of India; or

- the security, strategic, scientific or economic interest of the State; or

- the public interest; or

- freedom or fairness of election to any Legislature; or

- friendly relation with any foreign State; or

- harmony between religious, social, linguistic, regional groups, castes or communities;

- the acceptance of foreign contribution referred to in sub-section

- shall not lead to incitement of an offence;

- shall not endanger the life or physical safety of any person

IMPORTANCE OF PERSONAL ACCIDENT INSURANCE

By Mr. Tushar P. Joshi |

|

NEED OF PERSONAL ACCIDENT INSURANCE.

As per the survey, less than 1% of Insurable population is adequately insured.

- The average sum insurance of Indian Citizen is ONLY Rs. 4 lacs under Life Insurance.

- The width of roads have increased by 4 times in last few decades where as the number of vehicles have increased hundred times.

- Alcohol Consumption was Taboo 40 years ago, now its “Household Story”

- Usage of Mobile phone while driving has increased the number of accidents.

- Natural disasters like Tsunami, Earthquake, landslide cause huge losses.

- Terrorists’ Attacks have increased worldwide

Approx. 32581 Indians died in railway accident.

Road Accident Statics in India.

Over 150000 people were killed in road accidents in 2022 alone, that is more than the number of people killed in all our wars put together.

There is one death every four minutes due to a road accident in India.

Fire accidents kill 54 people daily in India as per Business Standard News.

India’s Cheapest Personal Accident Policy after at only 750/month…. And you get following benefits. Permanent Disability Cover – 1.50 Crore.

Loss of Income cover – 60000/- per month till you fit to resume job.

Immediate Educational Grant for kids up to 20,000/-

- 50000 allowance for Home Interior Modification offer disability.

- 50000 Travel expense compensation for family member to accident location. No claim bonus up to 50% also available.

- 10% discount on premium (if 2 family members take this plan)

- No medical tests required.

Accident Includes:-

- Road/Rail accident, Snake bite, Electric shock, Falling down, Drowning, Plane crash, Bomb blast, etc. and any natural calamity also.

I strongly suggest adding this is your portfolio.

OUR PUBLICATIONS AVAILABLE FOR SALE

| Sr. No. | Name | Price ₹ |

| 1 | FMCG & Pharmaceutical Industry – GST Issues & Challenges | 150/- |

| 2 | Transitional Provision | 50/- |

| 3 | 46th RRC Book | 175/- |

| 4 | Referencer 2022-23 | 750/- |

| 5 | Mega Full Day Seminar Booklet 2.7.2022 | 130/- |

| 6 | Half Day Seminar Booklet 17.11.2022 | 100/- |

| 7 | Maharashtra Goods & Service Tax Act along with Rules (MGST Bare Act) | 850/- |

| 8 | Short Publication GST practical guides (5 Book Series) | 555/- |

| 9 | 47th RRC Book | 250/- |

Payment Link for Publication on sale : https://www.gstpam.org/online/purchase-publication.php

GSTPAM News Bulletin Committee for Year 2022-23

Ashit C. Shah Chairman |

Sunil D. Joshi Jt. Convenor |

Aloke R. Singh Jt. Convenor |