GSTPAM News Bulletin September 2023

CIRCULAR FOR RENEWAL OF MEMBERSHIP/SUBSCRIPTION CHARGES

FOR THE F.Y. 2023 – 24

Dear Members,

RENEWAL OF MEMBERSHIP FOR F.Y. 2023-24

The Membership Fees for the year 2023-24 are due for renewal on 01.04.2023. We appreciate your Continuing support and participation in the activities of our Association.

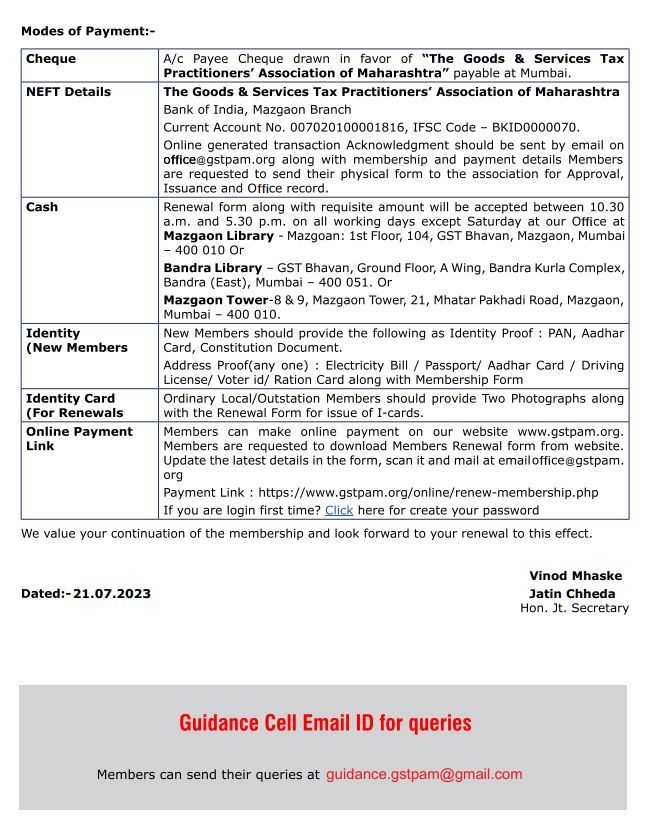

The timely Renewal of Membership will enable the members to continuously receive the updateson various activities of GSTPAM along with the GST Review, News Bulletin, Circulars, Messages, Webinars and online access to the website www.gstpam.org. The Life Members only need to renew the subscription charges for the GST Review. The members can also avail the benefit of discount by paying advance for subsequent two years membership fees /subscription charges.

The Membership Renewal Fees received after 30th April, 2023 will be subject to approval of the Managing Committee. If the Renewal fees for a particular year are not paid, then the member is liable to pay Admission Fees again for Renewal in the subsequent year.

Delayed Renewal Members will be provided Pre Renewal GST Review subject to availability upon payment of such additional courier charges.

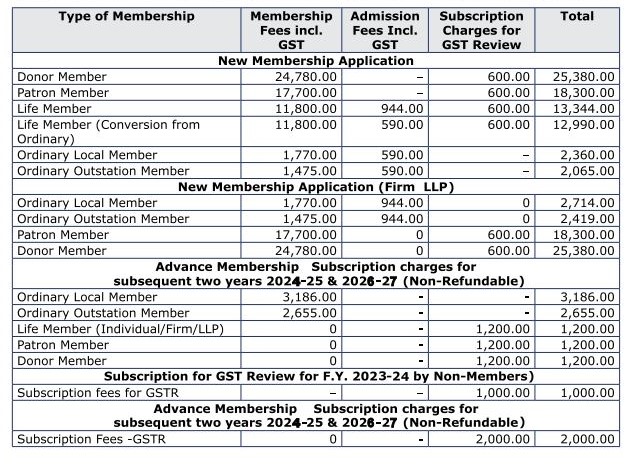

The details of Membership Subscription Fees are given below for your ready reference:

GST, MVAT & ALLIED LAW UPDATESCompiled by Adv. Pravin Shinde |

|

|

Notification under Central Tax |

||

| Notification No. | Date of Issue | Subject |

| 39/2023-Central Tax | 17/08/2023 | Seeks to amend Notification No. 02/2017-Central Tax dated 19.06.2017 |

| 40/2023-Central Tax | 17/08/2023 | Seeks to appoint common adjudicating authority in respect of show cause notice issued in favour of M/s United Spirits Ltd. |

| 41/2023-Central Tax | 25/08/2023 | Seeks to extend the due date for furnishing FORM GSTR-1 for April, May, June and July, 2023 for registered persons whose principal place of business is in the State of Manipur |

| 42/2023-Central Tax | 25/08/2023 | Seeks to extend the due date for furnishing FORM GSTR-3B for April, May, June and July , 2023 for registered persons whose principal place of business is in the State of Manipur |

| 43/2023-Central Tax | 25/08/2023 | Seeks to extend the due date for furnishing FORM GSTR-3B for quarter ending June, 2023 for registered persons whose principal place of business is in the State of Manipur |

| 44/2023-Central Tax | 25/08/2023 | Seeks to extend the due date for furnishing FORM GSTR-7 for April, May, June and July , 2023 for registered persons whose principal place of business is in the State of Manipur |

| 45/2023-Central Tax | 06/09/2023 | Seeks to make amendments (Third Amendment, 2023) to the CGST Rules, 2017. |

|

Notification / Circular Under MGST Act |

||

|

GST Content category |

Date of Issue | Subject |

| 21 T of 2023, CBIC

Circular no. 200/12/2023-GST |

11/08/2023 | Clarification regarding GST rates and classification of certain goods based on the recommendation of the GST Council in its 50th meeting held on 11th July, 2023-reg. |

| 22 T of 2023,

CBIC Circular no. 201/13/2023-GST |

11/08/2023 | Clarification regarding applicability of GST on certain services- reg. |

| Notification No.

32/2023-State Tax Dt.18.08.2023 |

22/08/2023 | Seeks to exempt the registered person whose aggregate turnover in the financial year 2022-23 is up to two crore rupees, from filing annual return for the said financial year. |

| Notification No.

28/2023- State Tax Dt.22.08.2023 |

22/08/2023 | Seeks to notify the provisions of sections 2 to 23 of the Finance Act, 2023 (Mah.XXXII of 2023). |

| Notification No.

29/2023- State Tax Dt.22.08.2023 |

22/08/2023 | Seeks to notify special procedure to be followed by a registered person pursuant to the directions of the Hon’ble Supreme Court in the case of Union of India v/s Filco Trade Centre Pvt. Ltd., SLP(C) No.32709- 32710/2018. |

| Notification No.

30/2023-State Tax Dt.22.08.2023 |

22/08/2023 | Seeks to notify special procedure to be followed by a registered person engaged in manufacturing of certain goods. |

| Notification No.

33/2023-State Tax Dt.22.08.2023 |

22/08/2023 | Seeks to notify “Account Aggregator” as the systems with which information may be shared by the common portal under section 158A of the MGST Act, 2017. |

| Notification No.

34/2023-State Tax Dt.22.08.2023 |

22/08/2023 | Seeks to waive the requirement of mandatory registration under section 24(ix) of MGST Act for person supplying goods through ECOs, subject to certain conditions. |

| Notification No.

06/2023- State Tax (Rate). |

29/08/2023 | Amendment in Notification No.11/2017-State Tax (Rate) |

| Notification No.

07/2023-State Tax (Rate). |

29/08/2023 | Amendment in Notification No.12/2017-State Tax (Rate) |

| Notification No.

08/2023-State Tax (Rate). |

29/08/2023 | Amendment in Notification No.13/2017-State Tax (Rate) |

| Notification No.

09/2023-State Tax (Rate). |

29/08/2023 | Amendment in Notification No.01/2017-State Tax (Rate) |

| Notification No.

10/2023- State Tax (Rate). |

29/08/2023 | Amendment in Notification No.26/2018-State Tax (Rate) |

| Notification No.

36/2023- State Tax Dt.04.09.2023 |

06/09/2023 | Seeks to notify special procedure to be followed by the electronic commerce operators in respect of supplies of goods through them by composition taxpayers. |

| Notification No.

37/2023 State Tax Dt.04.09.2023 |

06/09/2023 | Seeks to notify special procedure to be followed by the electronic commerce operators in respect of supplies of goods through them by unregistered persons. |

| Notification No.

38/2023-State Tax Dt.04.09.2023 |

06/09/2023 | Seeks to make amendments (Second Amendment, 2023) to the MGST Rules, 2017. |

INCOME TAX UPDATESCompiled By By Adv. Ajay Talreja |

|

Navyug Cottn Company Vs ITO (ITAT Pune)

In the case of Navyug Cotton Company vs. ITO, ITAT Pune held that the deduction for claimed bad debts can be allowed based on write-off, thereby eliminating the requirement to prove that the debt actually became irrecoverable. In a notable ruling, the Income Tax Appellate Tribunal (ITAT) Pune, examined the issue of bad debts and certain expenses claimed in the Profit & Loss account. The case in point was Navyug Cotton Company Vs ITO, where the tribunal had to make a decision regarding the confirmation of addition of bad debts and certain expenses.

The ITAT observed that the amount of debt claimed as bad was indeed debited in the company’s Profit & Loss account. Despite the Assessing Officer’s view that the company could not substantiate the debt turning bad, the Tribunal referred to the amendment to section 36(1)(vii) which came into effect on 01-04-1989. According to this amendment, the deduction can be allowed on the basis of write-off, thus eliminating the need to prove that the debt actually turned bad. Concerning the expenses, the Tribunal noted that the firm had deployed vehicles for business use, but no details were provided about the exclusive use of these vehicles for business purposes. Hence, some portion of the expenses was deemed to be for personal use. It was ruled that 10% of such expenses should be disallowed for the purpose of business income deduction. For other expenses like Telephone and Entertainment, the Tribunal reduced the ad hoc disallowance from 20% to 10%.

Case Name : Fashion Group International Vs ACIT (ITAT Delhi)

Appeal Number : ITA No. 122/Del/2019

Date of Judgement/Order : 24/05/2023

Related Assessment Year : 2014-15

Courts : All ITAT ITAT Delhi

ITAT Delhi held that provisions of section 50C of the Income Tax Act applies only in case of transfer of land or immovable property. Invocation of deeming provision of section 50C in case of mere transfer of right in property accrued under agreement without transfer of title is unjustifiable.

Facts- The main issue in this appeal filed by the assessee is an addition of Rs. 1,58,56,968/- made by AO invoking the provisions of Section 50C of the Act, confirmed by CIT (Appeals). The assessee, a partnership firm, has claimed long term capital loss in its return of income for the relevant assessment year on transfer of two properties. AO invoking the provisions of section 50C of the Act and applying stamp valuation of the properties made an addition. The assessee had purchased two properties for construction of factory building via two separate Agreement to Sell. The assessee intended to construct a factory building on the impugned land. However, due to certain restrictions from HUDA, the assessee could not register the land in its name. As the properties were not in its name, the assessee was unable to construct the factory building. The sale consideration / was fully paid at the time of entering into the Agreement to Sell. In this manner the total funds of the assessee in the form of sale consideration was tied up as legally the assessee not being a registered owner, it could not construct the factory building and also could not sell the same to any third party. The assessee and the seller settled the dispute between the two parties holding when the amount was received from the ultimate buyer the same would be forwarded to the assessee. AO invoking the provisions of Section 50C of the Income Tax Act and applying the stamp valuation of the properties, made an addition.

Conclusion- Held that the assessee merely transferred right in the property accrued under agreement without transfer of title, and the language of section 50C is unambiguous and plain which reveals that the said section applies only in a case of transfer of land or immovable property and in the instant case the assessee is not a transferor or property or co-owner of the property but he transferred certain rights under the earlier agreement therefore the Assessing Officer was not correct and justified in invoking deeming provision of section 50C of the Act and ld. CIT(A) has also erred in upholding the same against the scheme of the Act.

ITAT Mumbai held that reasonable amount of addition should be made in case of bogus purchase. Accordingly, CIT(A) has justifiably made addition on the reasonable estimate basis @ 5% of the bogus purchase.

Facts- On receipt of information from the Investigation Wing of the Income-tax Department that assessee obtained accommodation entry of bogus purchases from some of the entities controlled by ‘Shri Bhanwarlal Jain’ who during the course of search at his premises, admitted to have engaged in issuing bogus bills. AO in the assessment order passed u/s 147 of the Act estimated 3% of the invoice amount of said purchase made from M/s Millennium Stars amounting to Rs.2,82,88,673/ -, which was computed at Rs.8,48,660/- and added accordingly. Subsequently, the CIT called for the assessment records and after examination and providing opportunity of being heard to the assessee, passed order u/s 263 of the Act, holding that the assessment order passed by the Assessing Officer u/s 147 of the Act was erroneous and prejudicial to the interest of the Revenue and directed the Assessing Officer to make fresh inquires. AO after considering the material available before him made the addition for the entire amount of bogus purchases and further commission @ 3% for violation of the provisions of section 40A(3) of the Act. CIT(A) restricted the disallowance of bogus purchases @ 5 % of the purchase value of Rs.2,82,88,673/ – which is computed to Rs.14,14,434/ -. As far as the issue of disallowance u/s 40A( 3) of the Act is concerned, same has been sustained by the Ld. CIT(A). Being aggrieved, both the assessee and the Revenue has preferred the present appeal. Conclusion- Held it appropriate to make addition for the benefit assessee has obtained by way of making purchases in cash from the market and for which a reasonable amount of addition could have been made. In the case of the assessee also the Ld. CIT(A) has made addition on the reasonable estimate basis @ 5 % of bogus purchase, which in our opinion is justified.

Conversion Process from Private Limited Company to LLP

The transition of a Private Limited Company into a Limited Liability Partnership (LLP) is regulated by the Limited Liability Partnership Act of 2008. Specifically, Section 56, Section 58, and Schedule III of this Act lay out the rules and steps for executing the transition from a Private Limited Company to an LLP. As per Section 56 in combination with Schedule III and applicable regulations, only private companies are eligible for conversion into an LLP, as per Schedule III Para I Company, which specifically refers to private limited companies. Moreover, it’s important to understand that conversion in this context doesn’t simply involve changing the name of the organization, but also transferring all of its assets, liabilities, property, rights, privileges, obligations, and interests from the private company to the LLP as per the given schedule.

ELIGIBILITY FOR CONVERSION OF PRIVATE COMPANIES INTO LIMITED LIABILITY PARTNERSHIP The discussion now turns to which companies are eligible for conversion and the manner in which they can transform into an LLP. ELIGIBLE COMPANIES For a company to be eligible for conversion, it must meet the following criteria:

- At the time of making the application, there should be no active security interest on the company’s assets. It may have existed prior to making the application for conversion, but it must not be active when making the application. The term “security interest” is not specifically defined under either Schedule III or the LLP Act, 2008. Nor is it defined in the Companies Act, 2013. However, the term “Charge” is defined under Section 2 clause 16 of the Companies Act, 2013 as “an interest or lien created on the property or assets of a company or any of its undertakings or both as security and includes a mortgage.” The concepts of charge and security interest are not synonymous as the concept of security interest is broader than charge. The security interest is defined under Section 2(1)(zf) of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 as “the right, title, and interest of any kind whatsoever upon property, created in favour of any secured creditor and includes any mortgage, charge, hypothecation, assignment other than those specified in section 31.” Section 31 details conditions under which the SARFAESI Act, 2002 does not apply.

- Only the shareholders of the converting company should become partners in the LLP. While the LLP Act of 2008 doesn’t explicitly cover the proposed partnership structure, the capital contribution by those partners, and the distribution of profits among those partners, the Income Tax Act does lay out certain constraints, which we will examine in this discussion.

PROCESS OF CONVERSION A company transitions into an LLP by following the procedures described in the Third Schedule of the LLP Act, 2008, as outlined in Paragraph 2 of the Third Schedule, in addition to Rule 32 and 39 of the LLP Rules, 2009. The Third Schedule of the LLP Act, 2008’s third paragraph highlights the general procedural facets and is largely directive. It specifies two documents that are necessary for a company to convert into an LLP:

- A statement by shareholders in the prescribed format and manner, along with the applicable fees. This statement should include the following details: The Company’s Name and Registration Number. The Company’s Date of Incorporation.

- Documents of incorporation and a statement referred to in section 11, such as a subscriber sheet, etc. The majority of the conversion procedure from a Private Limited Company to an LLP is covered under Rule 39. STEPS TO CONVERT THE COMPANY INTO THE LLP A company transitions into an LLP by following the procedures described in the Third Schedule of the LLP Act, 2008, as outlined in Paragraph 2 of the Third Schedule, in addition to Rule 32 and 39 of the LLP Rules, 2009. The Third Schedule of the LLP Act, 2008’s third paragraph highlights the general procedural facets and is largely directive. It specifies two documents that are necessary for a company to convert into an LLP:

- A statement by shareholders in the prescribed format and manner, along with the applicable fees. This statement should include the following details: The Company’s Name and Registration Number. The Company’s Date of Incorporation.

- Documents of incorporation and a statement referred to in section 11, such as a subscriber sheet, etc. The majority of the conversion procedure from a Private Limited Company to an LLP is covered under Rule 39.

STEPS TO CONVERT THE COMPANY INTO THE LLP The conversion process from a company to an LLP starts with the board passing a resolution to reserve the name. Prior to initiating the conversion process, the company must ensure that:

- There are no pending eForms for payment or processing.

- At least one Financials (AOC-4) and Annual Return MGT-7/7A have been filed by the company.

- The Company is not a Section 8 Company.

- The company must have share capital. The initial step is to reserve the name. The form RUN LLP must be filed to reserve the name. The board resolution approving the reservation of the LLP name for the conversion of the company into the LLP must be attached with Form RUN LLP. After the reservation of the name, the company is to file a conversion form (eForm 18), along with an incorporation form (FiLLiP) and the consent of the Designated Partners in eForm 9. In MCA Version 3, we begin filling out the FiLLiP form after selecting the radio button for conversion of Private Company into LLP. The FiLLiP form is filled out in the same way as for incorporating an LLP.

The following documents must be attached with the FiLLiP form:

Proof of ID and Address for the Partners.

Proof of Registered Office along with NOC Subscribers sheet Form 9 is filed under Section 7, Rule 7, and other applicable provisions of the LLP Act, 2008.

In MCA Version 3, Form 9 is pre-filled and does not require any input. Form 18 is completed after FiLLiP and Form 9.

Form 18 requires providing various details such as if any case is pending, total assets, total financial assets, and total revenue, etc. The required attachments in Form 18 include: Financials drawn as per schedule III and signed by the Directors and Auditor of the Company, not older than 15 days. List of Secured Creditors and their consent. If the company does not have any secured creditors, it is recommended to furnish an affidavit of the same effect. In case the company is regulated by any specific body or authority, then approval from such authority or body is required.

The company needs to file the latest income tax return filed by them.

Auditor Certificate Additional documents as requested by the approving authority, such as: a Certificate from the Auditor certifying that the company is not an NBFC (Non-Banking Financial Company), the most recent Annual Return of the Company, ADT-1 form for the appointment of the Statutory Auditor of the Company, and an Ordinary Resolution or Board Resolution for the appointment of the Auditor.

POST CONVERSION COMPLIANCE AND INCOME TAX PROVISIONS Once the Company is converted into an LLP. The Registrar of Companies shall issue the Certificate of Conversion in Form 19 under Rule 32(1) of the LLP Rules 2009 to be read with the Schedule III and LLP Act, 2008. The LLP Shall file an initial LLP Agreement in Form 3 within 30 days of the conversion. Though, as per Rule 21, the LLP Agreement needs to be filed within 30 days of incorporation, incorporation means registration under the LLP Act, 2008 and includes conversion. After Conversion, LLP and its Partners need to comply with the provisions of the LLP Act 2008 along with Schedule III and Rules made thereunder.

GLIMPSES OF INCOME TAX PROVISIONS We have to analyze income tax implications for conversion of a company to an LLP to achieve tax efficient conversion. Section 45 of the Income Tax Act (‘IT Act’) provides that any profits or gains arising from the transfer of a capital asset shall be chargeable to tax under the head ‘Capital gains’. Section 2(14) of the IT Act defines the term ‘capital asset’ to include property of any kind held by an assessee, whether or not connected with his business or profession. Therefore, in context of a company, following would qualify as capital assets: Assets of the company which are being transitioned to the LLP Shares held in the company by its shareholders. Further, Section 2(47) of the IT Act defines ‘transfer’ in an inclusive manner, so as to include sale, exchange, relinquishment of the asset or extinguishment of any rights therein. Given the wide definition of ‘transfer’, a view is taken that conversion of company should be covered within the ambit of ‘transfer’ and accordingly, any profits or gains arising on conversion of a company to an LLP should be chargeable to tax as capital gains on two accounts: Transfer of capital assets from company to LLP upon conversion; and Transfer of a shares held in the company by a shareholder as a result of conversion of the company into an LLP Furthermore, Section 48 of the IT Act provides the mode of computation of capital gains, wherein full value of consideration received/accrued pursuant to transfer is reduced by the cost of acquisition of the transferred asset to arrive at capital gains. Accordingly, the gains derived on conversion of a company to an LLP may be subject to tax as per Section 45, computed in terms of Section 48 as follows:

EXEMPTION PROVIDED UNDER SECTION 47 FROM LEVY OF CAPITAL GAINS TAX Section 47 (xiiib) of the IT Act provides an exemption from levy of capital gains tax on the abovementioned transfers pursuant to conversion of a company to LLP subject to fulfilment of below specified conditions: a.) Transfer of all assets and liabilities: All the assets and liabilities of the company immediately before conversion become the assets and liabilities of LLP.

b.) All shareholders to become partners in LLP: All the shareholders of the company immediately before conversion become the partners of LLP and their capital contribution and profit-sharing ratio in the LLP are in the same proportion as their shareholding in the company as on the date of conversion.

c.) Consideration to shareholders: The shareholders of the company does not receive any consideration or benefit, other than by way of share in profit and capital contribution in LLP.

d.) Profit sharing ratio of shareholders in LLP: The aggregate of the profit-sharing ratio of the shareholders of the company in LLP should not be less than 50% at any time during a period of 5 years from the date of conversion This point is important to be read with LLP Act, 2008 Schedule III, LLP Act, 2008 does not prohibit the change in partnership structure. However, to enjoy the benefit of taxation one much notice that profit sharing ratio of the shareholder turned partner shall not be less than 50%.

e.) Total sales, turnover or gross receipts in the business of the company: Must not exceed INR 60 lakhs in any of the 3 previous years preceding the previous year in which the conversion takes

f.) Total value of the assets as appearing in the books of account of the company: Must not exceed INR 5 crores in any of the three previous years preceding the previous year in which the conversion takes g.) No amount to be paid to any partner out of accumulated profits of the company as appearing on conversion date for a period of 3 years from the date of Moreover, Section 47A of the IT Act provides that if any of the conditions mentioned above are not complied with, then the amount of gains arising from the transfer pursuant to conversion to LLP which have not been charged to tax by virtue of fulfilment of above mentioned conditions, shall be deemed to be the gains chargeable to tax in the hands of the successor LLP or the shareholder of the predecessor company, as the case may be, for the previous year in which any of such condition is breached. Conclusion: The process of converting a Private Limited Company into a Limited Liability Partnership is multifaceted, involving various stages like ensuring eligibility, proceeding with the conversion process, and following post-conversion compliance norms. It is also vital to consider the income tax implications of such a conversion to avoid legal and financial complications. Successful conversion can bring benefits such as more flexibility in business operations and less stringent compliance requirements.

INCOME TAX CIRCULARS & NOTIFICATIONSCompiled by CA. Aloke R. Singh |

|

Income Tax Circulars

| Circular

No |

Date of Issue | Subject |

| 15/2023 | 16/08/2023 | Guidelines u/s 10(10D) of the Income Tax Act, 1961 |

Income Tax Notifications

| Notification No | Date of Issue | Subject |

| 58/2023 | 09/08/2023 | Income-tax (15th Amendment) Rules,2023notified. In rule 10TD, in sub- rule (3B), for the words and figures “assessment years 2020-21, 2021-22 and 2022-23”, the words and figures “assessment years 2020- |

| 59/2023 | 10/08/2023 | For the purpose of section 10(46) of the Income-tax Act, 1961, the Central Government notifies the ‘Chandigarh Building and Other Construction Workers Welfare Board, Chandigarh'(PAN AALC0595J), a Board constituted by the Administrator, Union territory, Chandigarh, in respect of the income arising to the said Board, as specified in this notification. |

| 60/2023 | 10/08/2023 | For the purpose of section 10(46) of the Income-tax Act, 1961, the Central Government notifies the ‘State Pollution Control Board Odisha’ (PAN AAALS2490J), a Board constituted by the State Government of Odisha, in respect of the income arising to that Board,, as specified in this |

| 61/2023 | 16/08/2023 | Income-tax (16th Amendment) Rules,2023 notified inserting rule 11UACA after rule 11UAC. |

| 62/2023 | 16/08/2023 | For the purpose of section 10(46) of the Income-tax Act, 1961, the Central Government notifies the ‘Urban Improvement Trust Udaipur’, (PAN AAALU0072E), a Trust constituted by the State Government of Rajasthan, in respect of the income arising to that Trust, as specified in this notification. |

| 63/2023 | 16/08/2023 | For the purpose of section 10(46) of the Income-tax Act, 1961, the Central Government notifies the ‘Haryana Water Resources (Conservation, Regulation and Management) Authority’ (PAN AADAH3590A), an Authority established by the State Government of Haryana, in respect of the income arising to that Authority, as specified in this notification. |

| 64/2023 | 17/08/2023 | Income-tax (17th Amendment) Rules,2023notified, substituting the principal rule 26. |

| 65/2023 | 18/08/2023 | Income-tax (17th Amendment) Rules,2023notified, substituting sub-rule (1) and Explanation for clause (v) of rule 3, w.e.f. 01.09.2023 |

| 66/2023 | 23/08/2023 | For the purpose of section 10(46) of the Income-tax Act, 1961, the Central Government notifies the ‘District Mineral Foundation Trust’ as specified in the schedule to this notification, constituted by Government in exercise of powers conferred under section 9(B) of the Mines and Minerals (Development and Regulation) Amendment Act, as a ‘class of Authority’, in respect of the income arising to that Authority, as specified in this notification. |

| 67/2023 | 23/08/2023 | For the purpose of section 10(46) of the Income-tax Act, 1961, the Central Government notifies the ”Punjab Building and Other Construction Welfare Board (PAN: AAALP0698P), a body constituted by the State Government of Punjab, in respect of the income arising to that Board,, as specified in this notification. |

| 68/2023 | 23/08/2023 | For the purpose of section 10(46) of the Income-tax Act, 1961, the Central Government notifies the ”Unique Identification Authority of India'(PAN AAAGU0182Q), a statutory Authority established under the provisions of the AADHAAR Act, 2016 by the Govt. of India, in respect of the income arising to the said Authority, as specified in this notification. |

| 69/2023 | 23/08/2023 | For the purpose of section 10(46) of the Income-tax Act, 1961, the Central Government notifies the ‘Swasthya Sathi Samiti’, Kolkata (PAN: AAQAS4322J), a body established by Government of West Bengal, in respect of the income arising to that Body, as specified in this notification. |

| 70/2023 | 28/08/2023 | Income-tax (19th Amendment) Rules, 2023 notified, inserting rule 13 and 13A after rule 12F. |

| 72/2023 | 29/08/2023 | Corrigendum to Notification no. 65/2023 dated 18.08.2023. |

| 73/2023 | 30/08/2023 | Income-tax (20th Amendment) Rules, 2023 notified, inserting rule 134 after rule 133, w.e.f. 01.10.2023. rule 133, w.e.f. 01.10.2023. |

| 74/2023 | 01/09/2023 | For the purpose of section 10(46) of the Income-tax Act, 1961, the Central Government notifies the ‘Rajasthan State Dental Council’ (PAN AABAR7223E), a body constituted by the Government of Rajasthan, in respect of the income arising to that body, as specified in this notification. |

| 75/2023 | 01/09/2023 | For the purpose of section 10(46) of the Income-tax Act, 1961, the Central Government notifies the ‘E-Governance Society, Department of Food, Civil Supplies and Consumer Affairs, Himachal Pradesh, a body constituted / established by the state Government of Himachal Pradesh in respect of the income arising to that body, as specified in this notification. |

| 76/2023 | 01/09/2023 | For the purpose of section 10(46) of the Income-tax Act, 1961, the Central Government notifies the ‘Real Estate Regulatory Authorities’ under sub- section(1) of Section 20 of The Real Estate (Regulation and Development) Act, 2016 as a ‘class of Authority’ in respect of the income arising to the Authority, as specified in this notification. |

DGFT & CUSTOMS UPDATEBy CA. Ashit K. Shah |

|

1.Notifications issued under Customs Tariff:

| Notifications No | Remark | Date |

| 48/2023

– Customs |

Levy of Custom Duty on export of Onions from India @ 40% levied to control the rising price of the onions. The export duty will make Indian onions more expensive than those from Pakistan, China, and Egypt. This will naturally lead to lower exports and aid in reducing local prices. This levy would be till 31st December, 2023 | 19-08-2023 |

| 50/2023

– Customs |

Conditional exemption on certain variety of rice covered under HSN 1006 30 10. | 25-08-2023 |

| 51/2023

– Customs |

Exempted private companies importing Liquified Petroleum Gas (LPG), Liquified Propane and Liquified Butane from import duty and Agriculture Infrastructure Development Cess (AIDC) of 15 % each w.e.f. 1st September 2023. | 31-08-2023 |

| 58/2023 (NT)- Customs |

Introduction of Deferred Payment of Import Duty (Amendment) Rules, 2023. Where the Central Government considers it necessary and expedient, it may, under exceptional circumstances, and for reasons to be recorded in writing, allow payment of import duty to be made on a different due date.

The eligible importer shall be permitted to make the deferred payment if he has-

|

03-08-2023 |

| 07/2023

– Customs (Add) |

Levy of Anti-Dumping Duty (ADD) on import of Dispersion Unshifted Single – Mode Optical Fiber covered under chapter 9001, originating in, or exported from China PR, Indonesia and Korea RP, and imported in to India for a period of 5 years. | 03-08-2023 |

| 08/2023

– Customs (Add) |

Levy of Anti-Dumping Duty (ADD) on import of “Fishing Net” covered under chapter 5608 11 10, originating in, or exported from China PR & Malaysia and imported in to India. | 29-08-2023 |

| 24/2023

– DGFT |

Regularization of RoDTEP concerning certain HS Codes under Heading 5208 that were added in Appendix 4R vide Notification No. 63 dated 25.03.2023. It identifies an error in the customs EDI directory in ICES which omitted these HS codes, impacting exporters who claimed RoDTEP for export goods classified under tariff lines in Heading 5208. The DGFT has enabled these HS codes in the ICES directory for filing shipping bills from 28.01.2023 and allowed RoDTEP claims from 28.03.2023 after rates were notified. | 03-08-2023 |

| 25/2023

– DGFT |

Amendment in export policy of Red Sanders (Pterocarpus santulinus) outlined in Chapter 44 of ITC (HS), 2018, Schedule – 2 (Export Policy). The updated export policy conditions introduce new restrictions on Red Sanders wood export, enforcing documentation and certain conditions for export licenses.

The policy also sets an annual export quota of 900 MT for Tamil Nadu for artificially propagated Red Sanders and prohibits the export of wild specimens of Red Sanders. This move reflects the government’s commitment to sustainable forestry practices and preservation of natural resources. |

03-08-2023 |

| 23/2023

– DGFT |

Amendment in import policy of items under HSN 8471 viz. Laptops, Tablets, All-in-one Personal Computers and Ultra Small form factor computers, Servers is “Restricted” with immediate effect mean allowing imports only against a valid License for Restricted imports.

Despite the restrictions, few exemptions are provided as under –

|

03-08-2023 |

Non-compliance of CSR Provisions will attract

|

|

Key points of provisions of Section 135 of Companies Act, 2013 [(Corporate Social Responsibility (CSR)]

- Provisions of this section is applicable to all companies having turnover of Rs. 1000 crore or more or Net profit of Rs. 5 crore or more or Net worth of Rs. 500 crore or more in immediately preceding financial year.

- The company shall constitute a committee called Corporate Social Responsibility Committee, however if the total amount to spent by company does not exceeds Rupees 50 lakhs, then constitution of the Corporate Social Responsibility Committee shall not be applicable.

- The company spends, in every financial year, at least two per cent of the average net profits of the company made during the three immediately preceding financial years. If, company has not completed 3 years from its incorporation, then for the purpose of calculation of average net profit, the profit immediately preceding financial year shall be considered. Note: Net profit shall be calculated in accordance with provisions of section 198 of the Companies act, 2013.

- The preference should be given to the local area and areas around it where it operates for spending the amount earmarked for CSR activity.

- A company may undertake the implementation of CSR projects through the following methods: –Undertaking CSR activities by company itself

-Section 8 company/ registered public trust / registered society, registered under section 12A and 80 G of the Income Tax Act, 1961, established by the company, either singly or along with any other company

-Section 8 company/ registered trust/ registered society, established by the Central Government or State Government -any entity established under an Act of Parliament or a State legislature

-Section 8 company/ registered public trust/ registered society, registered under section 12A and 80G of the Income Tax Act, 1961, and having an established track record of at least three years in undertaking similar activities.

Recently, The Registrar of Companies have initiated penalty against a Company for not complying with the provisions of section 135 of the Companies Act,2013.

Facts of the Case: M/s Comviva Technologies Limited was incorporated in 1999 having its registered office in Haryana. The company is engaged in the business of courier services nationally and as well internationally. During the financial year 2020-21, the company was required to spent a total amount of Rs. 2,88,65,811/- towards the CSR activities. However, the company has spent only Rs. 2,83,15,689/- thereby leaving a balance of an unspent amount of Rs. 5,50,122/-. During the end of the financial 2020-2021, the company was required to transfer the unspent amount of Rs. 5,50,122/- to the fund specified in schedule VII of the Companies Act 2013, as per the provisions of section 135 (5) of the Companies Act 2013 read with Rule 10 of the Companies (Corporate Social Responsibility Policy) Rules 2014.

The company, accordingly, transferred the unspent amount of Rs. 5,50,122/- to PM Relief Fund on 22nd April 2021. However due to some technical error, the said amount came back into the company’s bank account on the same day and the same remained unnoticed by the company officials. However, the default was made good by the company and its officers by depositing the said unspent amount to the Prime Minister’s National Relief Fund on

The company admitted its non-compliance towards section 135(5) of the Companies Act 2013 by filing an application with the Registrar of Companies on 26th of July, 2022.

The Registrar of Companies issues a show cause notice to the company and its officers on 7th September 2022 directing the company to provide the requisite information on this matter. The company in response to the show cause notice issued by the Registrar submitted all the required details and also admitted the non-compliance of section 135(5) of the Companies Act 2013 on 16th September 2022.

The Registrar of Companies concluded that the company, its directors and officers have made the default in complying with the provisions of section 135(5) of the Companies Act 2013, by not transferring the unspent CSR amount to a fund specified in schedule VII of the Companies Act 2013, within a period of 6 months from the expiry of the financial year and therefore, are liable for penalties under section 135(7) of the Companies Act 2013.

Decision: The Registrar of Companies has imposed a total penalty of Rs. 15, 40,341.60 on the company and its directors / officers in default for violation of section 135(5) of the Companies Act 2013 read with Rule 10 of the Companies (Corporate Social Responsibility Policy) Rules 2014. Penalty of Rs. 55,012.20 was imposed on each of the directors, MD, CFO and CS. Whereas the penalty of Rs. 11, 00,244.00/- was imposed on the company. The company and the directors were ordered to make the penalty payment through online by using the website www.mca.gov.in (Misc. head) in favour of “Pay and Accounts Officer,” Ministry of Corporate Affairs, New Delhi, payable at Delhi, within 90 days from the receipt of this order and also intimate to the officer of Registrar of Companies with proof of penalty paid.

Please send your feedback on [email protected]

| LEST YOU REGRET

Compiled By By Mr. Tushar P. Joshi |

|

Recently we read the shocking news about the Suicide by the renowned Art Director Mr. Nitin Desai. Despite having relations with all politicians and other top authorities, he started his carrier as an artist in the T. V. Serials. Due to his hard work; his work was well received and appreciated leading to work for various top movies.

During Earlier days all shoots were carried out in nearby locations of Mumbai only. Mr. Nitin Desai had a vision to start a world-class studio. He purchased a piece of land at Karjat and started N. D. Studio. Initially, since it was a new location many directors of T.V. Serials, approached him for their new venture but because of the distance from the city, it was found difficult for the artists to travel up and down frequently from Mumbai. As the time passed, the T.V. Serial shootings stopped but for movies it was okay, because movie shootings continued for a long duration and actors used to stay in the same premises. Later on, the craze for international locations became more popular which reduced the revenue for Mr. Nitin Desai.

In fact he invested all his surpluses in studio expansion work only. That decision according to me was a big mistake. From the beginning of his carrier, he should have kept aside, certain funds for his own future. Normally all businessmen also do the same mistake. Every month salary is paid to the staff and spend for other day to day expenses, but they never keep aside contingency fund for themselves. Only at the end of the year, they prepare profit and loss / income expenditure account, and whatever is left as the surplus, the same is reinvested in the Business.

Ideally every month they should have thought that if they would have hired an employee of his caliber, how much salary would have paid to them. To that extent at least they should have ear marked the amount for themselves. The said amount can be used strictly in the directions of retirement planning.

It is well said that “When Silver Comes on Your Hair, You Should Have Gold in Your Pocket.” This means you should have adequate provisions to meet with your post retirement needs.

Retirement according to me is an integral part of everybody’s Life. Everybody knows that, but majority tend to turn a blind eye to providing any sizable fund for retirement. It is therefore very much necessary to plan in advance for your retired life, throughout your earning period. If you plan during your accumulation stage, then things would roll out financially very well, by the time, you attain senior citizenship.

I started my career with a very simple note. I started savings at a very early age and today I feel I have quite a good amount of wealth. I then thought that this much wealth would be sufficient for my whole life. But as the word ‘retirement’ started to make its presence on a regular basis and on doing the calculations afresh about the amount that I would require to maintain my present standard of living, I received a mental Jolt. I then realized that the accumulated wealth will be insufficient for my retired life, ONCE MY CURRENT INCOME STOP.

Those who are nearing retirement, should not wait for similar situation on retirement. On the contrary they should start working towards building a large capital base. Unfortunately large part of Indians do nothing and blame the circumstances for the adverse situations they find themselves during later part of retirement.

So the conclusion I draw “PEOPLE DO NOT PLAN TO FAIL…..BUT THEY FAIL TO PLAN”….

OUR PUBLICATIONS AVAILABLE FOR SALE

| Sr. No. | Name | Price ₹ |

| 1 | FMCG & Pharmaceutical Industry – GST Issues & Challenges | 150/- |

| 2 | Transitional Provision | 50/- |

| 3 | 46th RRC Book | 175/- |

| 4 | Referencer 2023-24 | 750/- |

| 5 | Mega Full Day Seminar Booklet 2.7.2022 | 130/- |

| 6 | Half Day Seminar Booklet 17.11.2022 | 100/- |

| 7 | Maharashtra Goods & Service Tax Act along with Rules (MGST Bare Act) | 850/- |

| 8 | Short Publication GST practical guides (5 Book Series) | 555/- |

| 9 | 47th RRC Book | 250/- |

Payment Link for Publication on sale : https://www.gstpam.org/online/purchase-publication.php

GSTPAM News Bulletin Committee for Year 2023-24

Pradip Kapadia Chairman |

Aloke R. Singh Jt. Convenor |

Ashish Ruparelia Jt. Convenor |