GSTPAM News Bulletin August 2024

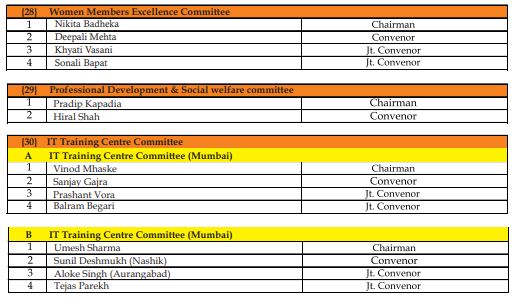

WOMEN EXCELLENCE COMMITTEE

The team of GSTPAM feels proud to announce the setting up of the Women Excellence Committee which would undertake various projects to bring out the best in women professionals and other aspiring women.

Those who become members of GST Practitioners Association of Maharashtra will benefit by attending the various activities being undertaken by our esteemed association like seminars on direct and indirect taxes, coaching classes, intensive study courses, etc. including procedures and compliances relating to income tax and GST law.

For women members, there would be medical checkup camps, talks by motivational speakers and many other activities. The Women’s day would be celebrated in a grand way.

We request women professionals and other aspiring women to become members of GSTPAM and take advantage of the various activities that would be held throughout every year.

We also would like to provide facilities for those women who are ready to work from home or would like to do part time work. There are a number of firms which are in need of efficient staff. Our committee will be facilitating the women members for the benefit of professional fraternity .

| Regards | ||

| For GSTPAM President: | Chairman: | Convenor: |

| CA Mahesh Madkholkar | Adv. Nikita Badheka | CA Deepali Mehta |

CIRCULAR FOR RENEWAL OF MEMBERSHIP/SUBSCRIPTION CHARGES FOR THE F.Y. 2024-25

Dear Members,

RENEWAL OF MEMBERSHIP FOR F.Y. 2024-25

The Membership Fees for the year 2024-25 are due for renewal on 01.04.2024. We appreciate your Continuing support and participation in the activities of our Association.

The timely Renewal of Membership will enable themembers to continuously receive the updates on various activities of GSTPAM along with the GSTReview, News Bulletin, Circulars, Messages, Webinars and online access to the website www.gstpam.org. The Life Members only need to renew the subscription charges for the GST Review. The members can also avail the benefit of discount by paying advance for subsequent two years membership fees /subscriptioncharges.

The Membership Renewal Fees received after 30th April, 2024 will be subject to approval of the Managing Committee. If the Renewal fees for a particular year are not paid, then the member is liable to pay Admission Fees again for Renewal in the subsequent year.

Delayed Renewal Members will be provided Pre Renewal GST Review subject to availability upon payment of such additional courier charges.

The details of Membership/Subscription Fees are given below for your ready reference

| Type of Membership | Membership Fees incl. GST | Admission Fees Incl.GST | Subscription Charges for GST Review | Total |

|

New Membership Application |

||||

| Donor Member | 24,780.00 | – | 600.00 | 25,380.00 |

| Patron Member | 17,700.00 | – | 600.00 | 18,300.00 |

| Life Member | 11,800.00 | 944.00 | 600.00 | 13,344.00 |

| Life Member (Conversion from Ordinary) | 11,800.00 | 590.00 | 600.00 | 12,990.00 |

| Ordinary Local Member | 1,770.00 | 590.00 | – | 2,365.00 |

| Ordinary Outstation Member | 1,475.00 | 590.00 | – | 2,065.00 |

| Student Member | 590.00 | 590.00 | – | 1,180.00 |

New Membership Application (Firm/LLP)

| Ordinary Local Member | 1,770.00 | 944.00 | 0 | 2,174.00 |

| Ordinary Outstation Member | 1,475.00 | 944.00 | 0 | 2,419.00 |

| Patron Member | 17,700.00 | 0 | 600.00 | 18,300.00 |

| Donor Member | 24,780.00 | 0 | 600.00 | 25,380.00 |

Advance Membership/ Subscription charges for subsequent two years 2025-26& 2026-27 (Non-Refundable)

| Ordinary Local Member | 3,186.00 | – | – | 3,186.00 |

| Ordinary Outstation Member | 2,665.00 | – | – | 2,665.00 |

| Life Member (Individual/Firm/LLP) | 0 | – | 1200.00 | 1,200.00 |

| Patron Member | 0 | – | 1200.00 | 1,200.00 |

| Donor Member | 0 | – | 1200.00 | 1,200.00 |

Subscription for GST Review for F.Y. 2024-25 by Non-Members

| Subscription fees for GSTR | – | – | 1000.00 | 1,000.00 |

Advance Membership / Subscription charges for subsequent two years 2025-26& 2026-27 (Non-Refundable)

| Subscription Fees -GSTR | 0 | – | 2000.00 2,000.00 |

Modes of Payment:-

| Cheque | A/c Payee Cheque drawn in favor of “The Goods & Services Tax Practitioners’ Association of Maharashtra” payable at Mumbai. |

| NEFT Details | The Goods & Services Tax Practitioners’ Association of Maharashtra

Bank of India, Mazgaon Branch Current Account No. 007020100001816, IFSC Code – BKID0000070.Online generated transaction Acknowledgement should be sent by email on [email protected] along with membership and payment details Members are requested to send their physical form to the association for Approval, Issuance and Office record. |

| Cash | Renewal form along with requisite amount will be accepted between 10.30 a.m. and 5.30 p.m. on all working days except Saturday at our Office at

Mazgaon Library – Mazgoan: 1stFloor, 104, GST Bhavan, Mazgaon, Mumbai – 400 010 Or Bandra Library – GST Bhavan, Ground Floor, A Wing, Bandra Kurla Complex, Bandra (East), Mumbai – 400 051. Or Mazgaon Tower- 8 & 9, Mazgaon Tower, 21, Mhatar Pakhadi Road, Mazgaon, Mumbai – 400 010. |

| Identity

(New Members) |

New Members should provide the following as Identity Proof : PAN, Aadhar Card, Constitution Document.

Address Proof(any one) : Electricity Bill / Passport/ Aadhar Card / Driving License/ Voter id/ Ration Card along with Membership Form |

| Identity Card (For Renewals) | Ordinary Local/Outstation Members should provide Two Photographs along with the Renewal Form for issue of I- cards. |

| Online Payment Link | Members can make online payment on our website www.gstpam.org. Members are requested to download Members Renewal form from website.Update the latest details in the form, scan it and mail at email [email protected]

Payment Link : https://www.gstpam.org/online/renew-membership.php If you are login first time? Click here for create your password |

We value your continuation of the membership and look forward to your renewal to this effect.

Dated:- 19.07.2024

Jatin Chheda

Rahul Thakar

Hon. Jt.Secretary

Guidance Cell Email ID for queriesMembers can send their queries at [email protected] |

ORDER FORM FOR GSTPAM REFERENCER 2024-25

(Members are requested to take out the photocopy of the Order Form for booking)

To

The Convenor,

GSTPAM Referencer Committee

The Goods & Services Tax Practitioners’ Association of Maharashtra

Room No. 8 & 9, Mazgaon Tower, Mhatar Pakhadi Road,

Mazgaon, Mumbai – 400 010

Dear Sir,

Please book my/our order of GSTPAM Referencer for the year 2024-25 as given below.

| Sr. | Particulars | Price per copy if booked prior to 15th July 2024 | Price per copy if booked after to 15th July 2024 | Qty | Total RS. |

| 1 | GSTPAM Referencer 2024-25 Part I & II

(GST, VAT & Allied Law Referencer & Updated GST Rate schedules). |

700 | 750 | ||

| 2 | Courier Charges (For Outstation members only) (per set) | 130 | 130 | ||

| 3 | Courier Charges (For Local members only) (per set) | 100 | 100 |

Note:

- Referencer will be published in Part I & II (for GST, VAT & Allied Laws Referencer & Updated GST rate schedules).

- Applicants requiring more than 5 copies of the Referencer are required to give a request on their letter head along with the order form. Tax Practitioner’s Associations can place order in bulk quantity by making request on their letterhead signed by the Association’s President and Secretary.

- Applicants will be issued receipt at the time of placing of their order. Applicants are requested to bring receipt at the time of taking the delivery of the Referencer. No delivery of the Referencer shall be given, unless the receipt for payment is submitted at the counter. If the receipt for payment is lost, than no delivery of the Referencer shall be given.

The payment for the above order of………………………………………………………………………… (Rupees in words) is made herewith by Cash /Card /Cheque /Demand Draft No. ……………dated ……………………………drawn on……………………………………………… Bank…………………………… Branch, Mumbai.

Signature …………………………….

Membership Number………………………………………… Address.………………………………………………………

Name ……………………………………… ………………………………………………………………………………

……………………………………………… ………………………………………………………………………………

Office Tel No………………………………………… Residence Tel No……………………………………………………………

E-mail: …………………………………………………… Mobile No.………………………………………………………………

PROVISIONAL RECEIPT

Received with thanks payment of. ………………… from…………………………… vide Cash /Card /Cheque /NEFT/Demand Draft No. …………………………. Date…………………………… drawn on………………………………………………… Bank …………………………………… Branch, Mumbai.

Signature ……………………………

Date…………………………………. Name of staff of GSTPAM……………………

Note:

- Please fill in all the details in the above form and send the same to the GSTPAM’s office at Tower or at Mazgaon library along with requisite payment.

- For Direct Deposit / NEFT payment – Bank of India, Mazgaon – Account No. 007020100001817, IFSC Code – BKID0000070. Acknowledgement of the same should be sent by email: [email protected] along with duly filled form.

- Online Payment Link : https://www.gstpam.org/online/purchase-publication.php

- Please mention your name and membership number on the reverse side of the Cheque / Demand Draft.

- The counter timings are from 10.30 a.m. to 5.30 p.m. on Monday to Friday.

- The Cheque / DD should be drawn in the name of “THE GOODS AND SERVICES TAX PRACTITIONERS’ ASSOCIATION OF MAHARASHTRA

|

Topics |

|

CHAPTER – I |

| • Basic Concepts of GST |

| • Time and Value of Supply of Goods and Services |

| • Input Tax Credits |

| • Determination of Nature of Supply |

| • Registration under GST |

| • Returns |

| • Payment of Taxes, Interest ,Penalties & Other levies |

| • Refunds |

|

CHAPTER – II |

| • Demand & Recovery |

| • Assessements and Audit Under GST |

| • Liability to pay in Certain Cases |

| • Inspections, Search, Seziure and Arrest |

| • Advance Ruling Provisions |

| • Appeals Provisions |

| • Offences and Penalties |

| • E-way Bill |

| • E-Invoice |

| • AAR Referncer 23-24 |

| • Input Service Distributor & Cross-Charge |

| • TDS/TCS Provisions |

| • GST Composition Scheme |

| • Reverse Charge Mechanism |

| • Anti-Profiteering Provisions |

|

CHAPTER – III |

| • GST Rates of Taxable Goods |

| • GST Rates for Taxable Services |

| • Index of Exempted Goods |

| • Index of Notified Exempted Services |

| • Index of Notified Goods under RCM |

| • Index of Notified Services under RCM |

|

CHAPTER – IV |

| • Gist of Important Judgments of the Tribunals, High Courts and Supreme Court |

| • Central Sales Tax Act, 1956 |

| • Maharashtra State Tax on Professions Trades, Callings & Employments Act, |

| • The Maharashtra Stamp Act, 1958 |

| • Maharashtra State Budget Highlights 2024-2025 |

GST, MVAT & ALLIED LAW UPDATESCompiled by Adv. Pravin Shinde |

|

|

Notification under Central Tax |

||

| Notification No. | Date of Issue | Subject |

| 12/2024-Central Tax | 10/07/2024 | Seeks to make amendments (Amendment, 2024) to the CGST Rules, 2017. |

| 13/2024-Central Tax | 10/07/2024 | Seeks to rescind Notification no. 27/2022-Central Tax dated 26.12.2022. |

| 14/2024-Central Tax | 10/07/2024 | Seeks to exempt the registered person whose aggregate turnover in FY 2023-24 is upto Rs. two crores, from filing annual return for the said financial year. |

| 15/2024-Central Tax | 10/07/2024 | Seeks to amend Notification No. 52/2018-Central Tax, dated 20.09.2018. |

| 16/2024-Central Tax | 06/08/2024 | Seeks to notify section 11 to 13 of Finance Act (No.1) 2024 |

|

Notification under Cetral Tax (Rate) |

||

| Notification No. | Date of Issue | Subject |

| 02/2024-Central Tax (Rate) | 12/07/2024 | Seeks to amend notification No. 1/2017- Central Tax (Rate) |

| 03/2024-Central Tax (Rate) | 12/07/2024 | Seeks to amend notification No. 2/2017- Central Tax (Rate) |

| 04/2024-Central Tax (Rate) | 12/07/2024 | Seeks to amend Notification No 12/2017- Central Tax (Rate) dated 28.06.2017. |

|

Notification under Integrated Tax |

||

| Notification No. | Date of Issue | Subject |

| 01/2024- Integrated Tax | 10/07/2024 | Seeks to amend Notification No. 02/2018-Integrated Tax, dated 20.09.2018. |

|

Notification under Integrated Tax (Rate) |

||

| Notification No. | Date of Issue | Subject |

| 02/2024-Integrated Tax (Rate) | 12/07/2024 | Seeks to amend notification No. 1/2017- Integrated Tax (Rate) |

| 03/2024-Integrated Tax (Rate) | 12/07/2024 | Seeks to amend notification No. 2/2017- Integrated Tax (Rate) |

| 04/2024-Integrated Tax (Rate) | 12/07/2024 | Seeks to amend Notification No 09/2017- Integrated Tax (Rate) dated 28.06.2017. |

|

Notification under Compensation Cess (Rate) |

||

| Notification No. | Date of Issue | Subject |

| 01/2024-Compensation Cess (Rate) | 12/07/2024 | Seeks to provide exemption from Compensation Cess on supplies under heading 2202 by URCs to authorised customers. |

|

Circular under CGST Act |

||

| Notification No. | Date of Issue | Subject |

| 207/01/2024-GST | 26/06/2024 | Reduction of Government Litigation – fixing monetary limits for filing appeals or applications by the Department before GSTAT, High Courts and Supreme Court |

| 208/02/2024-GST | 26/06/2024 | Clarifications on various issues pertaining to special procedure for the manufacturers of the specified commodities. |

| 209/03/2024-GST | 26/06/2024 | Clarification on the provisions of clause (ca) of Section 10(1) of the Integrated Goods and Service Tax Act, 2017 relating to place of supply |

| 210/04/2024-GST | 26/06/2024 | Clarification on valuation of supply of import of services by a related person where recipient is eligible to full input tax credit. |

| 211/05/2024-GST | 26/06/2024 | Clarification on time limit under Section 16(4) of CGST Act, 2017 in respect of RCM supplies received from unregistered persons |

| 212/06/2024-GST | 26/06/2024 | Clarification on mechanism for providing evidence of compliance of conditions of Section 15(3)(b)(ii) of the CGST Act, 2017 by the suppliers |

| 213/07/2024-GST | 26/06/2024 | Seeking clarity on taxability of re-imbursement of securities/shares as SOP/ESPP/RSU provided by a company to its employees. |

| 214/08/2024-GST | 26/06/2024 | Clarification on the requirement of reversal of input tax credit in respect of the portion of the premium for life insurance policies which is not included in taxable value |

| 215/09/2024-GST | 26/06/2024 | Clarification on taxability of wreck and salvage values in motor insurance claims. |

| 216/10/2024-GST | 26/06/2024 | Clarification in respect of GST liability and input tax credit (ITC) availability in cases involving Warranty/ Extended Warranty, in furtherance to Circular No. 195/07/2023-GST dated 17.07.2023 |

| 217/11/2024-GST | 26/06/2024 | Entitlement of ITC by the insurance companies on the expenses incurred for repair of motor vehicles in case of reimbursement mode of insurance claim settlement. |

| 218/12/2024-GST | 26/06/2024 | Clarification regarding taxability of the transaction of providing loan by an overseas affiliate to its Indian affiliate or by a person to a related person. |

| 218/12/2024-GST | 26/06/2024 | Clarification regarding taxability of the transaction of providing loan by an overseas affiliate to its Indian affiliate or by a person to a related person. |

| 219/13/2024-GST | 26/06/2024 | Clarification on availability of input tax credit on ducts and manholes used in network of optical fiber cables (OFCs) in terms of section 17(5) of the CGST Act, 2017 |

| 220/14/2024-GST | 26/06/2024 | Clarification on place of supply applicable for custodial services provided by banks to Foreign Portfolio Investors |

| 221/15/2024-GST | 26/06/2024 | Time of supply on Annuity Payments under HAM Projects |

| 222/16/2024-GST | 26/06/2024 | Time of supply in respect of supply of allotment of Spectrum to Telecom companies in cases where an option is given to the Telecom Companies for payment of licence fee and Spectrum usage charges in instalments in addition to an option of upfront payment. |

| 223/17/2024-GST | 10/07/2024 | Time of supply in respect of supply of allotment of Spectrum to Telecom companies in cases where an option is given to the Telecom Companies for payment of licence fee and Spectrum usage charges in instalments in addition to an option of upfront payment. |

| 224/18/2024-GST | 11/07/2024 | Guidelines for recovery of outstanding dues, in cases wherein first appeal has been disposed of, till Appellate Tribunal comes into operation. |

| 225/19/2024-GST | 11/07/2024 | Clarification on various issues pertaining to taxability and valuation of supply of services of providing corporate guarantee between related persons. |

| 226/20/2024-GST | 11/07/2024 | Mechanism for refund of additional Integrated Tax (IGST) paid on account of upward revision in price of the goods subsequent to export. |

| 227/21/2024-GST | 11/07/2024 | Processing of refund applications filed by Canteen Stores Department (CSD). |

| 228/22/2024-GST | 15/07/2024 | Clarifications regarding applicability of GST on certain services -reg. |

| 229/23/2024-GST | 15/07/2024 | Clarification regarding GST rates & classification (goods) based on the recommendations of the GST Council in its 53rd meeting held on 22nd June, 2024, at New Delhi –reg. |

Just one positive thought in the morning can change the whole day” – Dalai Lama

| SUMMARY OF RECENT ADVANCE RULINGS UNDER GST

Compiled by CA Aditya Surte |

|

- Levy – GST on bonus recovery

Retention bonus, joining bonus, work from home allowance and expenses under Tuition Assistance Program (TAP) are in the nature of perquisites provided by applicant-employer to its employees. Therefore, recovery of joining bonus, retention bonus, work from home allowance and expenses under TAP are not taxable under GST.

(Karnataka Authority for Advance Rulings vide Advance Ruling No. KAR ADRG 31/2024, decided on 02/07/2024 in the case of Fidelity Information Services India Pvt. Ltd.) - Exemption – Pure services to State Government

Consultancy services provided to State Government’s Roads and Buildings Department for preparing plans, estimates and tender documents for building works would not be considered as activity in relation to functions entrusted to Panchayat or Municipality under Articles 243G or 243W of Constitution to claim exemption. Blanket exemption not available. Exemption could be considered only if applicant establishes that building constructed is in relation to specified functions of Panchayat or Municipality on case-to-case basis.

(Gujarat Authority for Advance Rulings vide Advance Ruling No. GUJ/GAAR/R/2024/10, decided on 30/05/2024 in the case of Devendra K. Patel) - Exemption – Pure services to State Government

Applicant is providing professional services by way of assistance in filing of corporate tax returns to Bangalore Water Supply and Sewerage Board (BWSSB). These services are not provided by way of any activity in relation to any function entrusted to a Panchayat under article 243G of Constitution or in relation to any function entrusted to a Municipality under article 243W of Constitution. Hence, services provided by applicant to BWSSB are not exempt as per entry No. 3 of Notification 12/2017-Central Tax (Rate) dated 28-6-2017.

(Karnataka Authority for Advance Rulings vide Advance Ruling No. KAR ADRG 30/2024, decided on 02/07/2024 in the case of Ernst & Young LLP) - Exemption – Pure services to State Government

Applicant has rented out a building to Department of Social Welfare, Government of Karnataka and same is used by Department of Social Welfare to run hostel for boys. Since applicant has rented out the building to run Scheduled Tribe welfare department’s hostel, the service is in relation to function entrusted to a panchayat under Article 243G of Constitution which is covered by 27th entry of 11th Schedule which covers welfare of weaker sections. Therefore, pure services provided by applicant to State Government are exempted as per Entry No. 3 of Notification No. 12/2017 Central Tax (Rate) dated 28-6-2017 and hence not taxable.

(Karnataka Authority for Advance Rulings vide Advance Ruling No. KAR ADRG 32/2024, decided on 02/07/2024 in the case of K.A. Sujit Chandan) - Levy of GST and ITC eligibility – Recovery for canteen facilities

-

- Deduction of nominal amount from employees’ salary is not a ‘supply’ u/s 7 of CGST Act and GST is not applicable on the same.

- ITC is available to Applicant on GST paid to canteen service provider for providing canteen facility to permanent employees, to extent of cost borne by Applicant, as providing such facility is obligatory under Factories Act.

(Gujarat Authority for Advance Rulings vide A.R. No. GUJ/GAAR/R/2024/12, decided on 30/05/2024 in the case of Dormer Tools India Pvt. Ltd.)

-

- Levy of GST and ITC eligibility – Recovery for canteen and transport facilities

- GST is not leviable on portion of amount recovered from employees towards canteen facility or transportation, being perquisites under contractual agreement.

- ITC is available on GST charged by canteen service provider for facilities provided to permanent employees, as mandated by section 46 of Factories Act, 1948, r/w Gujarat Factory Rules, 1963, but restricted to cost borne by Applicant. GST Council’s 28th meeting recommendations, leading to amendment of section 17(5)(b) w.e.f. 01/02/2019, made ITC available on goods/services obligatorily provided by employer under any law. CBIC Circular No. 172/4/2022-GST dated 06/07/2022 clarified applicability of proviso to entire clause 17(5)(b).

(Gujarat Authority for Advance Rulings in Advance Ruling No. GUJ/GAAR/R/2024/14, decided on 30/05/2024 in the case of Zentiva Pvt. Ltd.)

- Classification of ‘Mix Mukhwas’ and ‘Roasted Til & Ajwain’‘Mix Mukhwas’ and ‘Roasted Til & Ajwain’ are classifiable under CTH 12074090 and leviable to GST at the rate of 5% under entry no. 70 of Schedule I of Notification No.1/2017-Central Tax (Rate). Considering the composition, process, and application of GRI 3(b), the products are essentially sesamum seeds-based mixtures, classifiable under Chapter 12. Heat treatment and additives like salt, citric acid, and turmeric powder do not alter the character of sesamum seeds as natural products or make them suitable for a specific use. Relevant HSN chapter notes and explanatory notes support the classification.

(Gujarat Authority for Advance Rulings in Advance Ruling No. GUJ/GAAR/R/2024/06, decided on 30/05/2024 in the case of Bhagat Dhanadal Corporation)

“Opportunities don’t happen, you create them.” —Chris Grosser

| GIST OF TRIBUNAL JUDGEMENTS (VAT)

Compiled by CA Rupa Gami |

|

- Prime Agencies in Vat S.A. No. 830 of 2018 dated on 06/03/2024

Appeal filed under the CST Act as the refund under the MVAT Act as per returns and Form 704 was not adjusted against the CST dues as per the Assessment Order. Now, the Assessment Order under the MVAT Act was attached showing the refund under MVAT Act was adjusted against the CST dues. Order set aside and matter remanded for recalculation of liability.

(Petitioner represented by Adv Deepak Bapat) - Mehul Transline Pvt. Ltd. in M.A. Nos. 20, 21, 22 and 23 of 2024 dated 06/03/2024

Delay in filing of appeal by 1082 days. Considering the COVID period and the suo moto writ petition by Apex Court whereby limitation period had been extended from 13.03,2020 to 28.02.2022 and also to 90 more days, the delay was of 598 days. The Company had filed a writ petition in its own case and the Court had passed an order dated 20.12.2023 to file the appeal within 4 months of the date of the order. Also, no pre-deposit to be made. The Company filed the appeal within time. Relying on the Apex Court judgement in the case of M.P.Steel Corporation reported in 2015 (319) ELT 373 (SC) and West Coast Paper Mills Ltd. reported in 2004 (166) ELT 290 (SC) where it was held that if any proceeding was pending then the time consumed for that has to be excluded under Section 14 of the Limitation Act. Thus, the delay was condoned.

(Petitioner represented by Adv. Prakash Shah) - M/s Della Tecnica Interior Design Pvt. Ltd. in Vat Appeal No. 371 of 2017 dated 19/03/2024

Branch transfer of materials on F Form was disallowed in the case of Works Contract carried out at the site by the Department treating at it as interstate sale u/s 3(a) of the CST Act. It was contended by the appellant that it was only the material which was transferred to the branch which was not as a result of any order and the property transferred to the buyer was in some other form. Movement of goods had not occasioned on account of contract of sale. As per the Department, goods have been sent from Maharashtra to another state for the execution of the interior works contract and this movement of goods constitutes an interstate sale in accordance with section 3(a) of the CST Act. The Hon’ble Tribunal observed that the word ‘such’ occurring in Section 6A was important since it referred to the goods, the movement of which from one state to another was occasioned by way of sale. The principle of ejusdem generis and noscitur a socii was relevant for the purpose. Also, in the asseessee’s own case for the next period, the claim of branch transfer had been allowed. The appeal was allowed and remanded for verification of F Forms.

(Petitioner represented by Mr. D.B.Talati) - Omkar Speciality Chemicals Ltd. in Vat S.A. No. 937 of 2017 dated 05/04/2024

Set off is disallowed on account of purchases from non-genuine dealers, purchases from parties whose RC is cancelled prior to the date of purchase, purchases from suppliers who have not filed returns, suppliers who were not showing taxable sales in their returns and parties who were showing lesser sales than the purchases shown by the appellant. Interest under section 30(3) of the MVAT Act was increased and levied upto the date of appeal order. Penalty under section 29(3) was reduced by 75% in appeal. The Hon’ble Tribunal held that where ledger confirmations were produced, the same were to be considered for grant of set off after proper verification. Interest was to be levied only upto the date of the assessment order as per the provision of section 30(3). Penalty was to be deleted in toto considering that there was no concealment and all the transactions were recorded in the books of accounts.

(Petitioner represented by CA Sujata Rangnekar) - M/s Central Automobile Pvt. Ltd. in M.A. Nos. 55 to 61 of 2024 dated 02/04/2024

Application made for condonation of delay of 113 days for preferring appeals. The order was received by email. However, in the absence of the Managing Director, the appellant was of the belief that only on receiving the original order, appeal could be filed. The delay caused was bona fide and the appellant had a good case on merit. The Hon’ble Tribunal condoned the delay imposing a nominal cost.

(Petitioner represented by Adv. Rutuja Pawar) - Gas Projects India Pvt. Ltd. in Vat Appeal Nos. 616 of 2016, 133 of 2017, 623 of 2017 and Vat S.A No. 186 of 2017 dated 04/04/2024

Works contract order received from Oil Companies for construction of Auto LPG Dispensing Stations (ALDS) at various sites across India. The appellant has branches in 16 states across India registered as works contractor. The inputs are transferred from the State of Maharashtra to various branches where they are further processed upon at site to construct ALDS. After completion of the project, it has to be inspected by a competent person appointed by the Chief Controller of Explosives (CCOE). Only after the necessary approvals are given by the CCOE, that the project is completed and handed over to the customer.The Assessing officer disallowed branch transfers on the ground that the branch transfers were pursuant the contract of sale and that there was a preexisting order of the branch. The first appellate authority upheld the assessment order. In second appeal, the Hon’ble Tribunal relied on the following four case laws and decided the matter in favour of the appellant.-

- M/s B.T. Patil and Sons

- M/s K.T.C. Automobiles

- M/s B.G.R. Energy Systems Ltd.

- M/s Multi Flex Lami Prints Ltd.

(Petitioner represented by Adv. C.B. Thakar)

-

“It is never too late to be what you might have been.” —George Eliot

CSR EXPENDITUREBy Adv. Hemant Gandhi & CA Premal Gandhi |

|

Recently ruling in favour of allowing tax deductions under Section 80G of the Income Tax Act for corporate donations made as part of companies’ corporate social responsibility (CSR) expenses.

The ITAT (Income Tax Appellate Tribunal) judgment in the case of Wordley India Private Limited vs. Principal Commissioner of Income Tax (Pr CIT) is an important case concerning the deductibility of Corporate Social Responsibility (CSR) expenses under the Income Tax Act in India.

Background

Wordley India Private Limited, a company engaged in the business of manufacturing and trading, had incurred certain expenditures in the course of its CSR activities. The company claimed these expenditures as deductible expenses under the Income Tax Act. The Principal Commissioner of Income Tax (Pr CIT) disallowed these deductions, contending that CSR expenses are not allowable under the provisions of the Income Tax Act.

Key Issues

-

- Nature of CSR Expenses: Whether CSR expenses qualify as business expenditures and are deductible under Section 37 of the Income Tax Act.

- Compliance with CSR Requirements: Whether CSR expenditures are treated differently for tax purposes as compared to other business expenses.

Judgment

ITAT’s Observations and Findings:

- CSR Expenditure and Section 37:

- The ITAT examined the nature of CSR expenditure in the context of Section 37 of the Income Tax Act, which allows a deduction for expenses incurred wholly and exclusively for the purposes of business.

- The Tribunal noted that while CSR activities are generally mandated under Section 135 of the Companies Act, 2013, the Income Tax Act does not specifically mention CSR expenditures as deductible or non- deductible.

- The ITAT clarified that for an expense to be deductible under Section 37, it must be incurred for business purposes and must be wholly and exclusively related to the business. However, the Tribunal recognized that CSR expenses, although mandated by law, do not necessarily fit this description as they might not directly contribute to the business’s profit-making activities.

- Furthermore, since the assessee has specifically disallowed the expenditure incurred towards the CSR expenditure in the return of income and claimed the same as exemption under Chapter VIA as payments made to approved institutions under section 80 G and thereby claiming only 50% of the total payments made to these approved institutions. Furthermore, there was no dispute on the genuineness of the contributions and the activities of the Données.

- Precedents and Interpretation:

- The Tribunal referred to various judicial precedents and the principle that the Income Tax Act should be interpreted based on its plain language. It was noted that there is no explicit provision in the Income Tax Act allowing CSR expenses as a deductible expense.

- The judgment emphasized that CSR expenditure, while important, does not automatically qualify as a deductible expense under the Income Tax Act unless specifically allowed.

- Legislative Intent and Practical Implications:

- The ITAT considered the legislative intent behind CSR expenditure requirements and acknowledged the broader social responsibilities of companies.

- However, the Tribunal maintained that the income tax laws are clear about the deductibility of business expenses and that CSR spending, as mandated by other legislation, does not automatically translate into a deductible expense for tax purposes unless explicitly provided for.

Conclusion

The ITAT upheld the decision of the Pr CIT in disallowing the CSR expenses as a deductible expenditure under the Income Tax Act. The Tribunal held that CSR expenditures do not qualify as business expenses under Section 37 of the Income Tax Act, and there is no provision in the Act that specifically allows for their deduction.

However, this judgement distinguishes the fact that though CSR expenses incurred by way of payment to approved institutions may not be allowed as an expenditure under 37 of the Income-tax Act, 1961 or “ACT”. They may still be claimed as a donation under section 80G of the Act under Schedule VI A, provided the other conditions are fulfilled for claiming the above exemptions.

Implications

For Companies: Businesses should be cautious in their accounting for CSR expenses and should not automatically assume such expenditures will be deductible for tax purposes. Furthermore, they may be claimed as an exemption under section 80G provided the other conditions as provided in the section is complied with.

For Tax Practitioners: It’s crucial to differentiate between CSR mandates and tax-deductible business expenses when advising clients on tax matters. However, the judgement may get challenged at higher forum as the Government intension is very clear to not allow the deductibility of the CSR expenditure in any form.

“One secret of success in life is for a man to be ready for his opportunity when it comes.” —Benjamin Disraeli

Financial Independence as a Mindset.Compiled By By Mr. Tushar P. Joshi |

|

Financial independence isn’t just a destination. It’s a way of life. Embracing a financially independent lifestyle involves making choices that support long-term well-being. Here are some tips you can incorporate into your journey.

Surround yourself with like-minded individuals who share your financial goals. This can provide motivation, accountability and the right role models to help support you.

By viewing financial independence as a lifestyle, you can create habits that support a sustainable and enjoyable way of living now and throughout your entire financial life.

Achieving financial independence is a journey that unfolds over time.

Review plans: Regularly review and adjust your financial plan to ensure you stay on track. Annual reviews are a good cadence to aim for.

Optimize investments: Adjust your investment strategy to balance growth and risk appropriately as you approach retirement.

Manage expenses: Monitor your spending closely, especially on healthcare-related costs.

Invest and withdraw prudently: Ensure your assets are properly invested for the retirement withdrawals you need, while taking taxes and the markets into consideration. It might be helpful to work with a qualified retirement planning professional to help guide you on this.

Understanding financial independence as a process helps you prepare for the different financial needs and challenges at each stage of life. If you find yourself feeling a little behind, go back to financial independence as a goal to make the adjustments that will help get you back on track.

Lastly, financial independence is about cultivating a mind-set that empowers you to make the best decisions and embrace opportunities. Here are some key ways to uplift that.

Focus on the personal benefits you can derive from financial independence.

Be prepared for setbacks and remain flexible. Life is full of curveballs. So, it’s best to expect that they are going to happen. Establishing emergency savings and not carrying debt with a high interest rate are great ways to build this financial resilience. Remember, you can always adjust your plans as needed to stay on course or change the course.

By adopting a financial independence mind-set, you empower yourself to intentionally take control of your financial future and live a fulfilling life.

As you can see, financial independence is more than just having enough money to retire. It’s about setting and achieving goals, adopting a sustainable lifestyle, navigating a lifelong process, and cultivating a positive and resilient mind-set along the way. By incorporating some or all of the action steps in each of these areas to your life, you can work toward a financially independent and fulfilling future while fully enjoying the journey.

“The most difficult thing is the decision to act; the rest is merely tenacity.” —Amelia Earhart

| Members Name | Date of Birth |

| Parikh Tushar Madhuvandas | 01 – August |

| Jain Sureshkumar B. | 01 – August |

| Nalawade Eknath Dnyandeo | 01 – August |

| Dhumal Prakash Rajaram | 01 – August |

| Singh Durgvijay Rikhai | 01 – August |

| Vastani Kaplesh Dilip | 01 – August |

| Laddha Shabbir Fakhruddin | 02 – August |

| Parab Gajanan M | 02 – August |

| Chandak Rajesh R. | 02 – August |

| Chhajed Balchand Inderchand | 02 – August |

| Shah Rahul Rasiklal | 02 – August |

| Tilve Anil Vasant | 02 – August |

| Vyas Shrawan Kumar | 02 – August |

| Jakhotia Surajkaran R. | 03 – August |

| Parmar Dilipkumar Narayandas | 03 – August |

| Tendulkar Sachin Vijay | 03 – August |

| Damle Kiran S. | 03 – August |

| Zatkare Rupesh Sitaram | 03 – August |

| Khasgiwala A. F. | 04 – August |

| Lotankar Ashok Govind | 04 – August |

| Bhavsar K. H. | 04 – August |

| Derashri Kanaiyalal P. | 04 – August |

| Pathak Girish M | 04 – August |

| Tankarwala Hakimuddin Abid | 04 – August |

| Mehta Jay Shailesh | 04 – August |

| Parekh Gaurav Mayur | 04 – August |

| Jain Hukamichand N | 05 – August |

| Sheth Vijay B. | 05 – August |

| Dhing Lalit M. | 05 – August |

| Yadav Ramasare Shivshankar | 05 – August |

| Nawal Suyog Naresh | 05 – August |

| Sheth Pranav Pravin | 05 – August |

| Deodhar Mangesh Prakash | 05 – August |

| Shah Priten Bhupendra | 05 – August |

| Makawana Subhashchandra Kalidas | 07 – August |

| Domadia Kishore J | 07 – August |

| Relekar Sanjay Sharad | 07 – August |

| Ahuja C. D. | 07 – August |

| Bhatt Dushyant Kishor | 07 – August |

| Dalmia Shailesh Shrikant | 07 – August |

| Dedhia Hitesh V. | 07 – August |

| Trivedi Jaimin Shailesh | 07 – August |

| Panjwani Girish Ashoklal | 07 – August |

| Nakade Ramnath Dhanaji | 07 – August |

| Agrawal P R | 08 – August |

| Kala S. M. | 08 – August |

| Mishra Devamani Chandrama | 08 – August |

| Mahadeokar Makarand Vasant | 08 – August |

| Baig Kaiser Kousar | 08 – August |

| Mehta Bhaven D. | 08 – August |

| Toraskar Vishwanath Mahadev | 08 – August |

| Nadaf Sarfaraj Maulana | 08 – August |

| Solanki Ashok Manilal | 09 – August |

| Bhonde Milind M | 09 – August |

| Chopra Praveen Amritlal | 09 – August |

| Malde Tara Ashwin | 09 – August |

| Varia Narendra Dharamshi | 09 – August |

| Chhanang Pradeep Kanayalal | 09 – August |

| Dhokiya Girish Dahyabhai | 09 – August |

| Pirankar Shashikant Krishna | 10 – August |

| Dias Lawrence Joaquim | 10 – August |

| Kunder Pradeep Mahabala | 10 – August |

| Racharla Nagesh Limbayya | 10 – August |

| Kulkarni Girish Ramchandra | 10 – August |

| Tiwari Vishnunand D. | 10 – August |

| Bedekar Sandip Tukaram | 10 – August |

| Kanhurkar Abhijit Ashok | 10 – August |

| Shah Kamlesh Vrajlal | 11 – August |

| Paranjape Mohan Vishnu | 12 – August |

| Ansari Shakeelahmed Mohammedhanif | 12 – August |

| Varadachari Sridharan | 12 – August |

| Joshi Rajeev Shrikrishna | 12 – August |

| Bheda Atul C. | 12 – August |

| Ansari Noorul Huda Mohiuddin | 12 – August |

| Bind Badelal Jiledar | 12 – August |

| Tapadia Sameer Gokul | 12 – August |

| Ashfaque Ahmed K. | 13 – August |

| Momaya Ullas Laxmichand | 13 – August |

| Jain Santosh Mangilal | 13 – August |

| Krishnasamy Periasamy | 13 – August |

| Pawar Dattatraya Jagatsingh | 13 – August |

| Baheti Ashish G | 13 – August |

| Shewale Sidram Jaykumar | 13 – August |

| Jose Ajay | 13 – August |

| Doshi Prakash J | 14 – August |

| Kulkarni Vishwas Laxman | 14 – August |

| Ranade Ajit Prabhakar | 14 – August |

| Bauva Chandresh Premchand | 14 – August |

| Shah Vaibhav Ramesh | 14 – August |

| Manjrekar Harshada V. | 14 – August |

| Shaikh Mohammedrafique Md.husain | 15 – August |

| Shetty Prakash S | 15 – August |

| Talreja Ajay S. | 15 – August |

| Mehta Rajesh Anantray | 15 – August |

| Chheda Kalpesh Talakshi | 15 – August |

| Zanwar Mayur Ashok | 15 – August |

| Jhunjhunwala Mukesh Kumar | 15 – August |

| Borde Sudhakar Kaduba | 15 – August |

| Gejage Dinesh S. | 15 – August |

| Krishnan Ramanujam | 16 – August |

| Thakkar Paresh Vallabhdas | 16 – August |

| Deshpande Hemant Padmakar | 16 – August |

| Kariat Krishnakumar K. | 16 – August |

| Mahajan Nitin S. | 16 – August |

| Waghmare Devendra Dashrath | 16 – August |

| Sheth Pratapray B | 17 – August |

| Thakkar Aruna Vijay | 17 – August |

| Wakalkar Dhananjay Ghanshyam | 17 – August |

| Pansare Babaji Ramdas | 17 – August |

| Swar Mahesh Shridhar | 17 – August |

| Jaorawala M. N | 18 – August |

| Dube Ashok R. | 18 – August |

| Farooqui Abdul Waray Safiullah | 18 – August |

| Bapat Deepak K. | 18 – August |

| Kodali Praveen Suryaprakash Rao | 18 – August |

| Shaha Amol Navnitlal | 18 – August |

| Patil Bhushan R. | 18 – August |

| Maldar Jabak Najir | 18 – August |

| Palav Pooja Amey | 18 – August |

| Hingwani Kishore Srichand | 19 – August |

| Maru Paras L. | 19 – August |

| Kumbar Shidlingappa Shidramappa | 20 – August |

| Shetty Jayaram Gopal | 20 – August |

| Shah Bhavik Vinodray | 20 – August |

| Shah Sapna Surendrakumar | 20 – August |

| Chheda Viral Kantilal | 20 – August |

| Bader Sumit | 20 – August |

| Gokhale Shreekant Madhusudh | 21 – August |

| Laddha Madhusudan Gangabisan | 21 – August |

| Maharana Manoj Subhash | 21 – August |

| Redasani Nikhil Hemant | 21 – August |

| Shah Ankit Harendra | 21 – August |

| Jalan Purushottam Asharamji | 21 – August |

| Sanghavi M. V. | 22 – August |

| Gandhi Jagat D. | 22 – August |

| Haldankar Yogesh Ramesh | 22 – August |

| Shukla Yogesh Jiledar | 22 – August |

| Deomane Arvind Dinkar | 22 – August |

| Baldia Vinesh Surajmal | 22 – August |

| Taralekar Ninad Sunil | 22 – August |

| Ashra Manoj Pranjivan | 23 – August |

| Thakkar Manish Mohanlal | 23 – August |

| Gadia Manish Rajendraprasad | 23 – August |

| Choudhuri Debrup Dutta | 23 – August |

| Shah Hemang Ramesh | 23 – August |

| Shah Vipul Jinendra | 24 – August |

| Chablani Jitendra Vashu | 24 – August |

| Shetty Girish Kantappa | 24 – August |

| Joshi Yatin Dilip | 24 – August |

| Amberkar Shrikrishna Suresh | 24 – August |

| Somani Satish | 25 – August |

| Godse Vaidehi Dhananjay | 25 – August |

| Sancheti Santosh C. | 25 – August |

| Patel Jitesh Harendra | 25 – August |

| Thik Rupesh Laxman | 25 – August |

| Tiwari Roopali Dilip | 25 – August |

| Bodas P. L. | 26 – August |

| Badgujar Sunil Babulal | 26 – August |

| Karande Vinayak Dinkar | 26 – August |

| Maimoon Murtuza Jaffer | 26 – August |

| Kolte Vikram Dattatray | 27 – August |

| Bakal Nitin Jayprakash | 27 – August |

| Jain Arpit Fatechand | 27 – August |

| Momaya Musaiyab Mohammed Hussain | 27 – August |

| Shah Saurabh Rajendra | 27 – August |

| Kadakia Kanaiyalal M. | 28 – August |

| Jain Manoj Valchand | 28 – August |

| Tambde Dinesh M. | 28 – August |

| Tirodkar Girish Suresh | 28 – August |

| Mehta Vasudev Vikram | 28 – August |

| Agrawal Omprakash Shivchand | 28 – August |

| Palan Manohar Shantilal | 29 – August |

| Doshi Viral Dhirajlal | 29 – August |

| Khamkar Sangram Prakash | 29 – August |

| Shinde Pravin Vasant | 29 – August |

| Shinde Ravindra A. | 29 – August |

| Takale Saurabh Jaywant | 29 – August |

| Bhambhaney Jaikumar J. | 30 – August |

| Murudkar Subodh Madhusudan | 30 – August |

| Patkar V. P | 30 – August |

| Shah Dimple Snehal | 30 – August |

| Shetty Vishwanath Narayan | 30 – August |

| Gala Mahesh Murji | 30 – August |

| Choudhary Amit Chunnilal | 30 – August |

| Dubey Vikram Bholanath | 30 – August |

| Hiranand V. G. | 31 – August |

| Rasotra Sanjay Kumar | 31 – August |

| Dodhiya Paresh Tarachand | 31 – August |

| Yewale Ganesh Laxman | 31 – August |

OUR PUBLICATIONS AVAILABLE FOR SALE

| Sr. No. | Name | Price ₹ |

| 1 | FMCG & Pharmaceutical Industry – GST Issues & Challenges | 150/- |

| 2 | Transitional Provision | 50/- |

| 3 | 46th RRC Book | 175/- |

| 4 | Referencer 2022-23 | 375/- |

| 5 | Referencer 2023-24 | 750/- |

| 6 | Mega Full Day Seminar Booklet 2.7.2022 | 130/- |

| 7 | Half Day Seminar Booklet 17.11.2022 | 100/- |

| 8 | Maharashtra Goods & Service Tax Act along with Rules (MGST Bare Act) | 850/- |

| 9 | Short Publication GST practical guides (5 Book Series) | 555/- |

| 10 | 47th RRC Book | 250/- |

| 11 | Charitable Trusts | 300/- |

| 12 | Mega Full Day Seminar Booklet 09.02.2024 | 150/- |

| 13 | 48th RRC Book | 250/- |

Payment Link for Publication on sale : https://www.gstpam.org/online/purchase-publication.php

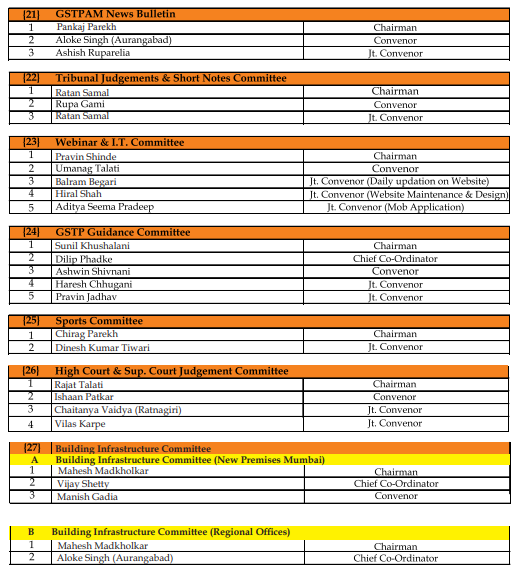

GSTPAM News Bulletin Committee for Year 2024-25

Pankaj Parekh Chairman |

Aloke R. Singh Convenor |

Ashish Ruparelia Jt. Convenor |