GSTPAM News Bulletin December 2021

CIRCULAR FOR RENEWAL OF MEMBERSHIP/SUBSCRIPTION CHARGES FOR THE F.Y. 2021-22

Dear Members,

RENEWAL OF MEMBERSHIP FOR F.Y. 2021-22

The Membership Fees for the year 2021-22 are due for renewal on 01.04.2021. We appreciate your Continuing support and participation in the activities of our Association.

The timely Renewal of Membership will enable the members to continuously receive the updates on various activities of GSTPAM along with the GST Review, News Bulletin, Circulars, Messages, Webinars and online access to the website

www.gstpam.org. The Life Members only need to renew the subscription charges for the GST Review. The members can also avail the benefit of discount by paying advance for subsequent two years membership fees /subscription charges.

The Membership Renewal Fees received after 30th April, 2021 will be subject to approval of the Managing Committee. If the Renewal fees for a particular year are not paid, then the member is liable to pay Admission Fees again for Renewal in the subsequent year.

Delayed Renewal Members will be provided Pre Renewal GST Review subject to availability upon payment of such additional courier charges.

The details of Membership/Subscription Fees are given below for your ready reference:

| Type of Membership | Membership Fees incl.

GST |

Admission Fees Incl.

GST |

Subscription Charges for GST Review | Total |

|---|---|---|---|---|

|

New Membership Application |

||||

| Donor Member | 24,780.00 | – | 600.00 | 25,380.00 |

| Patron Member | 17,700.00 | – | 600.00 | 18,300.00 |

| Life Member | 11,800.00 | 944.00 | 600.00 | 13,344.00 |

| Life Member (Conversion from Ordinary) | 11,800.00 | 590.00 | 600.00 | 12,990.00 |

| Ordinary Local Member | 1,770.00 | 590.00 | – | 2,360.00 |

| Ordinary Outstation Member | 1,475.00 | 590.00 | – | 2,065.00 |

|

New Membership Application (Firm/LLP) |

||||

| Ordinary Local Member | 1,770.00 | 944.00 | 0 | 2,714.00 |

| Ordinary Outstation Member | 1,475.00 | 944.00 | 0 | 2,419.00 |

| Patron Member | 17,700.00 | 0 | 600.00 | 18,300.00 |

| Donor Member | 24,780.00 | 0 | 600.00 | 25,380.00 |

|

Advance Membership/ Subscription charges for subsequent two years 2022-23 & 2023-24 (Non-Refundable) |

||||

| Ordinary Local Member | 3,186.00 | – | – | 3,186.00 |

| Ordinary Outstation Member | 2,655.00 | – | – | 2,655.00 |

| Life Member (Individual/Firm/LLP) | 0 | – | 1,200.00 | 1,200.00 |

| Patron Member | 0 | – | 1,200.00 | 1,200.00 |

| Donor Member | 0 | – | 1,200.00 | 1,200.00 |

|

Subscription for GST Review for F.Y. 2021-22 by Non-Members |

||||

| Subscription fees for GST | – | – | 1,000.00 | 1,000.00 |

|

Advance Membership / Subscription charges for subsequent two years 2022-23 & 2023-24 (Non-Refundable) |

||||

| Subscription Fees -GST | 0 | – | 2,000.00 | 2,000.00 |

MEMBERSHIP FEES RENEWAL FORM

Link for CIRCULAR FOR RENEWAL OF MEMBERSHIP/SUBSCRIPTION CHARGES

https://www.stpam.org/sites/default/files/4.gstpam_membership_form_0.pdf

SUBSCRIPTION OF GST REVIEW FORM

Link for GST Review

https://www.stpam.org/sites/default/files/1614317239625_1614317015557_subscription_renewal_form_.pdf

Modes of Payment:-

| Cheque | A/c Payee Cheque drawn in favor of “The Goods & Services Tax Practitioners’ Association of Maharashtra” payable at Mumbai. |

| NEFT Details | The Goods & Services Tax Practitioners’ Association of Maharashtra Bank of India, Mazgaon Branch Current Account No. 007020100001816, IFSC Code – BKID0000070. Online generated transaction Acknowledgment should be sent by email on [email protected] along with membership and payment details Members are requested to send their physical form to the association for Approval, Issuance and Office record. |

| Cash | Renewal form along with requisite amount will be accepted between 10.30 a.m. and 5.30 p.m. on all working days except Saturday at our Office at Mazgaon Library – Mazgoan: 1st Floor, 104, GST Bhavan, Mazgaon, Mumbai – 400 010 Or

Bandra Library – GST Bhavan, Ground Floor, A Wing, Bandra Kurla Complex, Bandra (East), Mumbai – 400 051. Or Mazgaon Tower-8 & 9, Mazgaon Tower, 21, Mhatar Pakhadi Road, Mazgaon, Mumbai – 400 010. |

| Identity (New Members) |

New Members should provide the following as Identity Proof : PAN, Aadhar Card, Constitution Document.

Address Proof(any one) : Electricity Bill / Passport/ Aadhar Card / Driving License/ Voter id/ Ration Card along with Membership Form |

| Identity Card (For Renewals) |

Ordinary Local/Outstation Members should provide Two Photographs along with the Renewal Form for issue of I-cards. |

| Online Payment Link | Members can make online payment on our website www.gstpam.org. Members are requested to download Members Renewal form from website. Update the latest details in the form, scan it and mail at email [email protected] Payment Link : https://www.stpam.org/payonline/845 |

We value your continuation of the membership and look forward to your renewal to this effect.

Dated:- 04.08.2021

Mahesh Madkholkar

Parth Badheka

Hon. Jt. Secretary

ORDER FORM FOR GSTPAM REFERENCER 2021-22

(Members are requested to take out the photocopy of the Order Form for booking)

For Office Use Only

| Date | Receipt No. | Coupon No. | Amount |

To

The Convenor,

GSTPAM Referencer Committee

The Goods & Services Tax Practitioners’ Association of Maharashtra Room No. 8 & 9, Mazgaon Tower, Mhatar Pakhadi Road,

Mazgaon, Mumbai

Dear Sir,

Please book my/our order of GSTPAM Referencer for the year 2021-22 as given below.

| Sr. | Particulars | Price per copy if booked prior to 31st May 2021 | Price per copy if booked after 31st May 2021 | Qty | Total Rs. |

|---|---|---|---|---|---|

| 1 | GSTPAM Referencer 2021-22 Part I & II (GST, VAT & Allied Law Referencer) | 650 | 700 | ||

| 2 | Courier Charges (For Outstation members only) (per set) | 100 | 100 | ||

| Grand Total |

Note :

- Referencer will be published in Part I & II (for GST, VAT & Allied Laws Referencer).

- The members, who subscribe for the Referencer, can also view the same online. Along with the referencer a complimentary E-compilation of GST Act, Notifications, Circulars and Press Releases will also be provided to the subscribers on our website

www.gstpam.org.The viewing will be password protected. - Applicants requiring more than 5 copies of the Referencer are required to give a request on their letter head along with the order form. Tax Practitioner’s Associations can place order in bulk quantity by making request on their letterhead signed by the Association’s President and Secretary.

- Applicants will be issued receipt and delivery card at time of placing of their order. Applicants are requested to bring receipt and delivery card together at the time of taking the delivery of the Referencer. No delivery of the Referencer shall be given, unless the receipt for payment along with the delivery cards is submitted at the counter. If the receipt for payment or the delivery cards is lost, than no delivery of the Referencer shall be given.Link For Referencer order form.

https://gstpam.org/sites/default/files/referencer_order_and_circular_form_21-22_0.pdf

RECENT ADVANCE RULINGS UNDER GSTBrief Analysis by CA Aditya Surte |

|

- Whether consideration received for sale of residential apartment and charges for ancillary services collected by builder shall be treated as composite supply?Applicant is engaged in the business of construction and sale of residential apartments and discharges GST liability in respect of supply of construction services for which consideration is received before receipt of Occupancy/Completion Certificate. The terms of under-construction sale of residential apartments by the Applicant are governed by an ‘Agreement for Sale’ made and entered into, between the Applicant and its customers.

Applicant submitted that apart from consideration for the main construction activity, it also collects various other charges such as electric meter installation and security deposit for meter, water connection charges, municipal taxes, advance maintenance, club house maintenance, development charges, share money, legal charges, infrastructure charges, etc. from its customers. Such charges are collected under the Agreement itself with their respective amounts separately mentioned in the Agreement. Applicant contended that the ‘Other Charges’ mentioned in the agreement are primarily for supply of construction services since they are received only from the customers to whom construction services are supplied and therefore the services underlying the ‘Other Charges’ maybe treated as naturally bundled with supply of main construction services which are supplied in conjunction with each other, in the ordinary course of business. Hence, these services should be considered as composite supply with construction services as the principal supply. The Applicant, therefore, contended that 1/3rd of the value of land should be available as rebate even on these ‘other charges’.

The Authority, referring to the receipt of the stamp duty paid by the Applicant, observed that the stamp duty has been paid on the value of sale of flat exclusive of the ‘Other Charges’ mentioned above. Therefore, the Applicant is taking inconsistent shifting stands, one for payment of stamp duty and another for payment of GST.

The Authority further observed that merely because the agreement is common will not make it a supply of bundled services and that from the terms and conditions of the Agreement for Sale, it is clear that the impugned supplies are independent supplies.

Held that ‘Other Charges’ will not be treated as consideration for construction services but will be treated as consideration received against supply of independent services under respective heads.

(Maharashtra AAR Order No. GST-ARA-68/2019-20/B-52 dated 27/08/2021 in the case of Puranik Builders Ltd.)

- Whether ITC is available on purchase of goods which are to be supplied at a discounted nominal price as part of promotional scheme?Applicant intends to manufacture and supply hosiery goods such as briefs, vests, etc. It proposes to implement a retail scheme with the object of incentivising the sale of hosiery goods whereby it would offer various products such as gold coins, refrigerators, coolers, air conditioners at discounted price to retailers who meet certain prescribed targets. However, the retailers shall be at liberty not to purchase the goods offered under such promotional scheme. Separate invoices will be issued for supply of hosiery goods and supply of goods offered under promotional scheme.

Applicant contended that the supply of hosiery goods and supply of goods under promotional scheme shall neither be covered under ‘mixed supply’ nor under ‘composite supply’. The Authority agreed with the Applicant’s contention and held that supply of hosiery goods and goods under promotional scheme are separate supplies and tax on each supply shall be levied at the rate of each such item.

Regarding admissibility of ITC on the promotional goods, the Authority accepted the submission of the Applicant that the retail scheme is aimed and intended to boost the sale of its hosiery goods and, therefore, the provision of said goods under the retail scheme would qualify as an activity undertaken in the course or furtherance of business. Further, since a nominal value shall be assigned to the promotional goods and the same shall not be supplied free of cost, they cannot be termed as a ‘gift’ and, therefore, there shall be no restriction on availment of ITC u/s 17(5)(h).

However, the Authority opined that the value of the promotional goods shall be required to be determined as per the provisions of sec. 15 of the CGST Act r/w rule 27 of the CGST Rules, since price is not the sole consideration for the supply of promotional goods.

(West Bengal AAR Order No. 11/WBAAR/2021-22 dated 30/09/2021 in the case of Kanahiya Realty Pvt. Ltd.)

- Whether grants and donations received by a Charitable Trust are liable to GST where activities of the Trust are not covered by definition of “charitable activities” specified by the GST law?Applicant is a Charitable Trust registered under the Maharashtra Public Charitable Trust Act, 1950, the Societies Act as well as under section 12AA of the Income Tax Act, 1961. The Trust provides care to 50 orphans and homeless children by way of shelter, education, guidance, clothing, food and health. It also renders services to destitute women who are litigating divorce or are homeless or victims of domestic violence by representing them before legal forums and counselling them through expert counsellors. Major source of income of the Trust is by way of grants received from Government of Maharashtra’s Women and Child Welfare Department, Central Government’s Women and Child Welfare Ministry and other donations received from public at large.

The Applicant had not obtained registration under GST on the ground that the activity of the trust are fully exempted from levy of tax in terms of Sl. No. 1 of Notification No. 12/2017-Central Tax (Rate), dated 28-06-2017 which exempts the services by an entity registered under sec. 12AA of the Income-tax Act, 1961 by way of charitable activities from levy of GST.

Referring to the definition of “charitable activities” given under Notification No. 12/2017 (supra) the Authority observed that the Applicant does not satisfy the conditions mentioned at Sl. No. 1 of Notification No. 12/2017 and hence the supply of services undertaken by the trust is not exempt on this count.

Referring to the provisions of sec. 7 relating to ‘scope of supply’ and definition of ‘business’ and ‘consideration’, the Authority observed that almost all the activities of the Applicant are covered by the scope of supply, ‘consideration’ includes grants and profit motive is not important for an activity to fall within the ambit of ‘business’.

Held that (a) the Applicant is required to obtain registration under GST; (b) GST is not payable where donations are received and GST @ 18% is payable in other cases.

(Maharashtra AAR Order No. GST/ARA/97 OF 2019-20/B-91 dated 10/11/2021 in the case of Jayshankar Gramin Va Adivasi Vikas Sanstha)

- Whether providing Toyota Innova or equivalent vehicles registered under the tourist category to MCGM for carrying COVID-19 patients would be considered as exempted services?Applicant is engaged in the business of tours and travels and carries on the business as package tour operators, daily passenger service operators, travel agents, etc. and is also engaged in running of buses, conveyances of all kinds and to transport passengers. It has entered into a contract with Municipal Corporation of Greater Mumbai (MCGM) to provide AC SUV and Innova equivalent car services for carrying COVID-19 patients for medical treatment.

Applicant is treating the supply of vehicles for carrying COVID patients for medical treatment as a taxable service. MCGM, however, is of the opinion that the same is an exempted service and covered under Sl. No.3 of Notification No. 12/2017 which provides exemption to, “Pure services (excluding works contract service or other composite supplies involving supply of any goods) provided to the Central Government, State Government or Union Territory or Local Authority or a Governmental Authority by way of any activity in relation to any function entrusted to a panchayat under article 243G of the constitution or in relation to any function entrusted to a Municipality under article 243W of the constitution”.

Applicant submitted before the Authority that the impugned services would fall under Entry No. 6 of Twelfth Schedule to Article 243W of the Constitution of India, i.e., “Public health, sanitation conservancy and solid waste management”. However, no evidence or documents were submitted to substantiate the claim. Only a ‘Service Purchase Order’ was submitted which mentioned the description of service as “Adv for ambulance like Innova COVID-19”.

The Authority observed that the Applicant has neither submitted anything on record to show that the Innova vehicles supplied by them have been converted into ambulances or registered as such, nor have they submitted proof of having transported only COVID-19 patients for medical treatment. Further, the vehicles are not registered with RTO for use as ambulance, but they are registered as tourist vehicles.

Held that the impugned services would be considered as taxable services.

(Maharashtra AAR Order No. GST/ARA/55/2020-21/B-82 dated 25/10/2021 in the case of Geetee Tours Pvt. Ltd.)

INCOME TAX UPDATESBy CA. Ajay Talreja |

|

Why increasing threshold limit Under Section 44AB of the Income Tax Act, 1961 is not a good move

Introduction

In the recent union budget our Honorable Union Finance Minister increased the threshold limit for mandatory audit Under Section 44AB of the Income Tax Act, 1961 to Rs 10 Crores in cases where 95% or more transactions are done in digital mode. The main objective behind this move has been to reduce the burden of compliances on small businesses and to promote ease of doing business. However, this increase in threshold limit has certain shortcomings which we will discuss in this article.

- Issues in income tax scrutinyAudit report Under Section 44AB of The Income Tax Act has over the years served as the basic document for the income tax department for choosing cases for scrutiny under various provisions of the Income Tax. A simple example of this can be reporting Under Section 269SS and 269ST. These two sections deals with receipts and payments of unsecured loans. In the audit report Under Section 44AB there are various clauses where compliances with these two sections are required to be reported. Another example can be reporting of compliance with the ESIC and PF laws, calculation of depreciation etc. All these compliances are basic in nature but are part of criteria for selecting cases for scrutiny assessments.

Not only income tax but officers in TDS department also rely very much on the audit report Under Section 44AB for ensuring whether a particular deductor has complied with the applicable TDS laws or not. However, since now the requirement for mandatory audit has been increased many small and medium size businesses will not get covered in the new provision and hence will not get their accounts audited. Hence, both income tax and TDS departments have to change their methods for choosing cases of scrutiny.

In cases where audit report Under Section 44AB is available the questions in the scrutiny notices revolve around the reporting done in it. However, now since the same will not be available the range of questions in the scrutiny notices will widen and this will in turn bring more burden on the assessee.

Now one will argue that Companies are still required to get their accounts audited and hence the reporting gap created due to the changes in Section 44AB will be taken care of by the Independent Auditor’s Report under companies act. But thing is that companies act does not apply to entities other than companies. Hence reporting gaps in those entities will not get fixed.

- Reporting in income tax return formsOne will argue that the even though there will not be audit report Under Section 44AB of the Income Tax Act, 1961 but there are enough provisions made in the Income Tax Return forms where compliances with various provisions of the Income Tax Act is required to be mentioned and hence reporting of non-compliances will be ensured in the income tax return forms.

Reporting in income tax return forms are done by the tax payer himself and it depends upon the morality of the tax payer. If a particular reporting will bring additional tax burden on the tax payer then there are chances that he may avoid reporting that in the income tax returns and since audit report Under Section 44AB is not applicable there won’t be any tool to verify the contents reported by the tax payer. In such cases taxpayers will get away with non-compliances and even end up getting more refund amount then what he is entitled to.

- Commitment towards tax compliancesOver the years Income tax assesees have been ensuring compliance with the various provisions of the income tax laws so that they can avoid getting qualifications in the audit report Under Section 44AB. However, now since not many small and medium size businesses will be required to get their accounts audited their commitment towards compliances will not be as high as it used to be when their accounts were getting audited.

The basic example of such non-compliances can be adherence to the TDS provisions. Earlier business owners used to strictly abide with the TDS provisions since audit report Under Section 44AB extensively covered such compliances and non-adherence to them used to get qualifications. This decline in commitment towards the non-compliance can lead to loss of revenue to the ex- chequer.

- Loss of confidence in the financial statementsDoing away with the mandatory requirement of getting accounts audited will not only affect the revenue of the state but it will also decrease the confidence of the users of the financial statements who heavily rely on the financial statements to understand the position of the business.

Business owners regularly requires capital for running their businesses. This requirement can be working capital or for long term funding. Whenever any business entity approaches lender for capital requirements the first thing that the lender ask for is the audited financial statements of the entity. The main reason behind asking for the audited financial statements is that it ensures the lender that the entity has been doing a legitimate business and the funds given by the lender will put to use for a legitimate purpose.

Now, since the audited financial statements will not be available the lenders will get more suspicious about the business of the entity and will require them to submit additional details so that they can satisfy themselves about the legitimacy of the entity’s business and its funds requirements. This will create more hurdles for the business owners and will delay their funding.

Further, the government departments are also among the users of the financial statements. In case of any enquiry they rely upon the audited financial statements to get a basic picture of the entity’s transactions. However, due to non-availability of audited financial statements there will be suspicion on the accounts of the entity and to cast away such suspicions the investigative officers will have to dig deeper which put more strain on the machinery of the department.

Conclusion

Though intention of the government behind increasing the limit Under Section 44AB of the Income Tax Act, 1961 has been to reduce the burden of compliance and to provide the ease of doing business but whether it is able to achieve its objective or not will be seen in the coming years.

Further, the said relaxation will work only if both the taxpayers and taxmen fulfill their duties with utmost honesty without being prejudiced towards each other.

Don’t Forget to Include these Incomes in Your Income Tax Return

Are you filing Income Tax Return? If yes, this article is for you.

The due date for filing of Income Tax Return is extended to 31st December 2021 from 30th September 2021 for the Financial Year 2020-21 i.e. A.Y. 2021-22.

In this article, we will discuss the incomes that are part of taxable income but many taxpayers don’t include these incomes in their income tax returns.

Interest Income

Many taxpayers think that interest earned from banks, post offices is exempt. In reality, interest earned on bank deposits, bonds, and some small savings schemes is fully taxable. Even the interest on saving bank balance is also fully taxable and to be reported under the head of “Income from other sources” in the tax return.

TDS is to be deducted by banking company or post office or any person on interest paid or credited to a taxpayer in a year of amount Rs. 40,000 or more. Even if TDS is not being deducted, it does not mean that the interest income is exempt. All interest payments are reported to the tax department by the financial institution paying the interest.

Some taxpayers even believe that no tax is payable if their bank has deducted TDS on the interest. This is also a misconception. TDS is only 10% of the interest (20% if PAN is not provided). If a taxpayer is in a higher tax slab, he needs to pay additional tax on the interest. Check your interest income for the financial year in Form 26AS. It will have details of the TDS deducted from interest payments. If Interest Income is up to Rs. 40,000 then it may not be shown in the Form 26AS. Taxpayers need to collect Interest Certificates from banks.

The income declared in your income tax return must be equal and more than from information in Form 26AS, otherwise, be ready for a tax notice. (Interest Income declared in your ITR can not be less than from information in the Form 26AS.)

There are some interest incomes that are exempt from income tax such as interest on tax-free bonds, PPF, and the Sukanya Samriddhi Yojana. You also have to report this interest income in your tax return.

Taxpayers can claim deduction under section 80TTA up to Rs. 10,000 in respect of interest on deposit (other than a fixed deposit) in a saving account with a bank, post office, and co-operative society.

However, the limit of deduction for senior citizens is Rs. 50,000 in respect of interest on deposit including fixed deposit under section 80TTB.

Rental Income

Rent received from commercial or house property is also taxable. After allowing a 30% deduction on rental income, the balance amount is taxable under the head “income from house property”.

However, interest on borrowed capital is allowed as a deduction on an accrual basis, if capital is borrowed for the purpose of purchase, construction, repair, renewal, or reconstruction of the house property.

Capital Gain

We all know that Income from salary, rental income, and business income is taxable. But what about income from sale or purchase of shares whether quoted or unquoted, house property, mutual funds, Jewelry? Income/Loss from sale of equity shares is covered under the head ‘Capital Gains’. There are a number of people taking to mutual fund and stocks in recent years, capital gains are now common.

If equity shares listed on a stock exchange are sold after 12 months of purchase, the seller may make a long-term capital gain or incur long-term capital loss and in case of holding period of shares less than 12 months then short-term capital loss or profit occurs.

Short-term capital gains are taxable at 15%. A special rate of tax of 15% is applicable to short-term capital gains, irrespective of your tax slab. Also, if your total taxable income excluding short-term gains is below taxable income i.e. Rs 2.5 lakh – you can adjust this shortfall against your short-term gains. The remaining short-term gains shall be then taxed at 15% + 4% cess on it.

The long-term capital gain of more than Rs 1 lakh on the sale of equity shares or equity-oriented units of the mutual fund will attract a capital gains tax of 10% and the benefit of indexation will not be available to the seller.

Short-term capital loss from the sale of equity shares can be set off against short-term or long-term capital gain from any capital asset. If the loss is not set off entirely, it can be carried forward for a period of 8 years and adjusted against any short-term or long-term capital gains made during these 8 years.

Gift Income

A common man does not know the applicability of income tax on the gift and so he does not report the same in his income tax return.

As per the income tax act, the amount sum of money received without consideration exceeds Rs.50, 000 the whole of such value is chargeable to tax. If the amount of sum of money is less than Rs.50, 000 then nothing will be taxable. For the ceiling of Rs. 50,000 all transactions of the previous year will be considered.

However, there are some exemption has been given in some cases where gift received from relative and on the occasion of marriage. You also have to report these exempt incomes in your tax return.

Dividend Income

From the removal of dividend distribution tax, dividends are now fully taxable in the hands of a recipient from the financial year 2020-21 under the head “Income from other sources”.

Companies are liable to deduct the TDS at the rate of 10% on the declaration and payment of a dividend of an amount exceeding Rs. 5000 in a year.

INCOME TAX CIRCULARS & NOTIFICATIONSCompiled by |

|

| Income Tax Circulars | ||

|---|---|---|

| Circular No. | Date of Issue | Subject |

| 20/2021 | 25/11/2021 | Guidelines under sub-section (4) of section 194-O, sub-section (3) of section 194Q and sub-section (1-I) of section 206C of the Income- tax Act, 1961 |

| Income Tax Notifications | ||

|---|---|---|

| Notification No. | Date of Issue | Subject |

| 131/2021 | 10.11.2021 | For the purposes of clause 10(46) of the Income Tax Act, 1961, the Central Government hereby notifies ‘Assam Building and Other Construction Workers Welfare Board’ (PAN AAAJA2255M), a Board constituted by the State Government of Assam, in respect specified income arising to that Board, as specified in this notification. |

| 132/2021 | 23.11.2021 | Income-tax (32nd Amendment) Rules, 2021, notified. Substitution in Appendix II for Form No. 52A, prescribed u/s 285B and rule121A, made. |

| 133/2021 | 23.11.2021 | For the purposes of clause 10(46) of the Income Tax Act, 1961, the Central Government hereby notifies ‘Haryana State Legal Services Authority’ Panchkula (PAN AAALH0475J), an authority constituted by the State Government of Haryana, in respect of the following specified income arising to that Authority, as specified in this notification. |

SPECIAL CORNERBy Adv. Sunil G. Khushalani |

|

Penalty for False Entry in Books of Account or Fake Invoices under The Income-tax Act and The GST Act

- IntroductionThe Finance Act, 2020 has introduced new penalty provision under section 271AAD to curb malpractices of issuing fake invoice. Section 271AAD shall apply with effect from 1st April, 2020.

- ObjectThe Explanatory Memorandum to the Finance Bill, 2020 has stated that in the recent past after the launch of Goods & Services Tax (GST), several cases of fraudulent claims of Input Tax Credit (ITC) have been caught by the GST authorities. It has been revealed in these cases that fake invoices are obtained by suppliers registered under GST to fraudulently claim ITC and reduce their GST liability. These invoices are found to be issued by racketeers who do not actually carry on any business or profession. They only issue invoices without actually supplying any goods or services. The GST shown to have been charged on such invoices is neither paid nor is intended to be paid. Such fraudulent arrangements deserve to be dealt with harsher provisions under the Act.

The penalty provision has been inserted to discourage taxpayers to manipulate their books and claim wrong input credit under GST.

- Penalty in what circumstancesThe new provision has been inserted to provide for levy of penalty on a person, if it is found during any proceeding under the Act that in the books of account maintained by him there is a

(i) false entry or (ii) any entry relevant for computation of total income of such person has been omitted to evade tax liability.Thus, the new section 271AAD has been inserted to penalise person maintaining books of account in case of a false entry or omission of an entry relevant for computing total income.

- Quantum of Penalty under section 271AADThe penalty payable by such person shall be equal to the aggregate amount of false entries or omitted entry. It has also been provided that any other person, who causes in any manner a person to make or cause to make a false entry or omits or causes to omit any entry, shall also pay by way of penalty a sum which is equal to the aggregate amounts of such false entries or omitted entry.

- What will be considered “false entries” for the purpose of penalty under section 271AADWhat is false entry is explained vide explanation below the said section 271AAD. The false entries will include use or intention to use –

- forged or falsified documents such as a false invoice or, in general, a false piece of documentary evidence; or

- invoice in respect of supply or receipt of goods or services or both issued by the person or any other person without actual supply or receipt of such goods or services or both; or

- invoice in respect of supply or receipt of goods or services or both to or from a person who do not exist.

Therefore, false entries will include forged or falsified documents, false invoices, receipt of goods or services without actual supply or receipt of such goods or invoices using fake IDs. Thus, we may summarise that False entry include use or intention to use:

- forged documents or falsified documents (such as false or fake invoices)

- invoice in respect of supply or receipt of goods or services or both without actual supply or receipt thereof

- invoice in respect of supply or receipt of goods or services or both to or from a person who does not exist

It may be noted that in case of false entry in books of account, it is immaterial whether it has impact on computation of income or not. If there is false entry in books of account, penalty shall be levied.

However, in case of omission of entry in books of account, it must have impact on computation of income in order to attract penalty provision under section 271AAD.

Conclusion

In my opinion this Section is very harsh as an accountant who passes an entry into Books of Account as per the instructions of his employer, he shall also be covered and he has to prove to the satisfaction of authorities his innocence or motive.

Suggestion

We the professionals need to be very careful while doing Audit/ filing Returns under GST & Income Tax.

In my opinion we the professional should take back up of every documents and mail confirmation for every submission to be made to the department.

DGFT & CUSTOMS UPDATEBy CA. Ashit Shah |

|

- Anti-dumping Duty on Medium Density Fiberboard (MDF)Anti-dumping duty (ADD) levied on imports of “‘Medium Density Fiberboard (MDF)” originating in or exported from Indonesia and Vietnam vide N. No. 34/2016 – Customs (ADD) dated 14th July, 2016, is rescinded w.e.f. 11-11-2021.

[N. No. 65/2021 – Customs (ADD), dated 11-11-2021]

- Anti-dumping Duty on Untreated Fumed SilicaAnti-dumping Duty (ADD) is imposed on import of “Untreated Fumed Silica” falling under the heading 2811 22 00 of the First Schedule to the Customs Tariff Act, 1975, originating in or exported from Republic of China and Korea RP w.e.f. 11-11-2021 for a period of 5 years.

[N. No. 66/2021 – Customs (ADD), dated 11-11-2021]

- Anti-dumping Duty on Steel and Fibre Glass Measuring Tapes and their P & AAnti-dumping Duty (ADD) is levied on “Steel and Fibre Glass Measuring Tapes and their Parts and Components”, falling under tariff items 9017 80 10 or 9017 90 00 of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975) originating in or exported from the People’s Republic of China and imported into India.

The anti-dumping duty imposed under this notification shall be effective from the date of publication of this notification in the Official Gazette and shall be co-terminus with the anti- dumping duty on Steel and Fibre Glass Measuring Tapes and their parts and components as levied vide aforesaid notification No. 17/2020- Customs (ADD), dated the 8th July, 2020.

[N. No. 67/2021 – Customs (ADD), dated 12-11-2021]

- Import Policy of UreaIn addition to Rashtriya Chemicals & Fertilizers Limited (RCF), Import of Urea is allowed through National Fertilizers Limited (NFL) and Indian Potash Limited (IPL) subject to Para 2.20 of Foreign Trade Policy, 2015-2020. The NFL and IPL are designated as STE for import of Urea on Government account. However, IPL is allowed to import Urea on Government account till 31.03.2022 only. Henceforth, the MMTC and STC are de-notified as STE for import of Urea. Import of Technical Grade Urea (TGU) meant for non-agricultural purpose / industrial use / NPK Manufacturing shall be “Free”.

[N. No. 40/2015-2020 – DGFT, dated 03-11-2021]

- Import & Export Policy of DiamondsImports & Exports of rough diamonds shall not be permitted unless the concerned importer is registered with Gem & Jewellery EPC (G&JEPC), which is the designated importing and exporting authority of India for Kimberley Process Certification Scheme (KPCS).

[N. No. 43/2015-2020 – DGFT, dated 22-11-2021]

CHARITABLE TRUSTS UPDATESBy Adv. Hemant Gandhi & CA Premal Gandhi |

|

TAXATION FOR ANONYMOUS DONATION – PART II

The CBDT Circular No. 14 dated 28.12.2006 explains the provisions of section 115BBC, as follows:

“With a view to prevent channelization of unaccounted money to these institutions by way of anonymous donations, a new section 115BBC has been inserted to provide that any income of a wholly charitable trust or institution by way of anonymous donation shall be included in its total income and taxed at the rate of 30 per cent. Anonymous donation made to wholly charitable and religious trusts or institutions, i.e. mixed purpose trusts or institutions shall be taxed only if it is for any university or educational institution or any hospital or other medical institution run by them. Anonymous donations to wholly religious trusts or institutions will not be taxed.

Anonymous donation has been defined in the new section to mean any voluntary contribution referred to in section 2(24) (iia) of the Act, where a person receiving such contribution does not maintain a record of the identity indicating the name and address of the person making such contribution and such other particulars as may be prescribed. Consequential amendments have been made in section 10 (23C) and section 13 to provide that nay income by way of anonymous donation which is taxable under section 115BBBC, shall be included in the total income of the assessee.”

Sub-sec (1) of section 115BBC provides that where total income includes any income by way of any anonymous donation, the income tax payable thereon shall ne the aggregate of-

- the amount of income tax calculated at the rate of thirty per cent on the aggregate of anonymous donations received in excess of the higher of the following namely:

- five percent of the total donations received by the assesse, or

- one lakh rupees, and

- the amount of income tax with which the assesse would have been chargeable had his total income been reduced by the aggregate of anonymous donations received in excess of the amount referred to in sub-clause (A) or sub-clause (B) of clause (i), as the cause may be

ANONYMOUS DONATION IS DIFFERENT FROM UNACCOUNTED DONATION

Anonymous donation is different from unaccounted donation. In case of anonymous donation, the donations are on record but the donors are not traceable. However unaccounted donations may attract the provisions of section 13(1)(c). In case of Vidyavardhini v. Asst. CIT, Central Circle-2 Thane (2012) 20 taxmann.com81/51 SOT 17 (Mum.) (URO), it was held that since trust is an artificial judicial person and has to act through trustees, or anybody authorized by trustees, acts if trustees or person so authorized have to be considered as acts on behalf of trust. Therefore, considering material on record and entire surrounding circumstances, it was to be held that unaccounted donations collected by Secretary were on instructions of trustees on behalf of trust and had been rightly assessed as income of assessee trust. It was further held that having regard to fact that donations were not accounted in books of assessee trust and had been used by trustees and secretary who were persons specified in section 13(3), provisions of section 13(1)(c) were applicable and exemption under section 11 would not be available.

CAN THE PROVISIONS OF SECTIONS 68, 69, 69A TO 69C BE INVOKED for ANONYMOUS DONATIONS?

Under sections 68 to 69D, unexplained cash credits, money, investments, expenditure, etc., are subjected to income tax. The provisions of section 68 and 69A can be invoked only when the assesse does not treat a particular receipt as income. But, in case of charitable organizations, since anonymous donations are shown as a part of the income of the trust, it would not be possible on the part of the Assessing Officer to invoke section 68, 69, 69A or 69C. In recent case, the Delhi High Court in DIT (Exemption) v. Keshav Social and Charitable Foundation (2005) 146 Taxman 569-278 ITR 152 held that anonymity of the donors cannot lead to the inference hat unaccounted money has been introduced. Section 68 had no application to the facts of the case because the assessee had disclosed the donation as a part of its income. Therefore, there was full disclosure of income and its application by the assessee.

Burden of proof is entirely on the assesse to establish identity of the donors

The ITAT Bombay Bench in the case of Madhavi Raksha Sankalp Nirmal Niketan v. Dy. CIT (2017) 83 taxman.com 316165 ITD 627 (Mum. – Trib) that the onus as well burden of proof is entirely on the assessee to provide to the AO all relevant details as contemplated u/s 115BBC to the satisfaction of the AO as to compliance of section 115BBC and as to genuineness of the said donation and if the assessee failed to do so the entire transaction was hit by provisions of section 115BBC.

SMALL COLLECTION THROUGH DONATION BOXES ARE NOT COVERED

In the case of Gurudev Siddha Peeth, Shrish Thakkar v. ITO, Ward-1 (1), Kalyan 59 taxmann.com 400 (Mumbai – Trib.) held that in the case of a religious or charitable trust it is generally not only difficult but also not possible to maintain such type of record. A perusal of the entire section 115bbc shows that the provisions of said section are not applicable to the institutions like that of assessee trust as the same are meant to check the inflow of unaccounted/ black money into the system with modus operandi to make out a part of the accounts of the institutions like university, medical institutions were the problem relating to the receipt of capitation fees, etc. is generally highlighted. Under such circumstances, we do not find any justification in taxing the offerings received in the hundis/donation boxes as income of the assessee under section 115BBC.

In the case of ITO (E)- I (1), Mumbai v. Bombay Panjrapole (ITA No. 5414/M/2010, dated 25-7-2012) ITAT Mumbai held that in case of a charitable trust engaged in maintaining gaushalas and veterinary hospital for treatment of wounded and sick animals and birds, the donations received from public.

PROTECTION AGAINST CANCERBy Mr. Tushar P. Joshi |

|

We regularly hear from our near acquaintances that Mr. XYZ have been diagnosed to be suffering from Cancer. Most of us are not prepared for it physically, mentally and financially.

Cancer is no longer attributable only to the habits such as chewing tobacco, smoking cigarettes directly or passively or residing near a chemical factory.

Nowadays there is liberal use of plastics, in the form of bottles, tetra packs, etc, pesticides sprayed over fruits & vegetables, cosmetics loaded with chemicals and constant use of mobile phones which are harmful because of its radiations. In many cases, it may be due to genetic reasons; so it is not guaranteed that people with non risky habits are safe.

The occurrence is very common with in all age group and gender. As per the recent survey, over 10 lakh people are found to be affected by this deadly disease every year and sadly, it is increasing year after year basis.

It is shocking to note that according to the survey 30% of Indians are likely to suffer from Cancer by 2030 and 70% of Indians will not have financial arrangement to fight medically with cancer. So indirectly, it does not attack only body physically but it destroys the finance too of the patient and of his family members.

In many cases it so happens that Cancer patients are unable to work, which indirectly results in loss of regular flow of money / income. And this will be dangerous if the sole earning member is diagnosed with this deadly disease.

Patient needs money on immediate basis for long drawn treatment along with the hospitalisation. There are ways to deal with such a disease, atleast financially, provided you have dedicated critical illness cover and more specifically for Cancer only.

There are various policies available in the market with different features and benefits.

It hardly costs a cup of tea per day for a cover of 25Lakhs for age upto 30yrs.

I am highlighting the welcome features of the plan for your easy understanding, so that you can add the same to your portfolio with the help of your advisor.

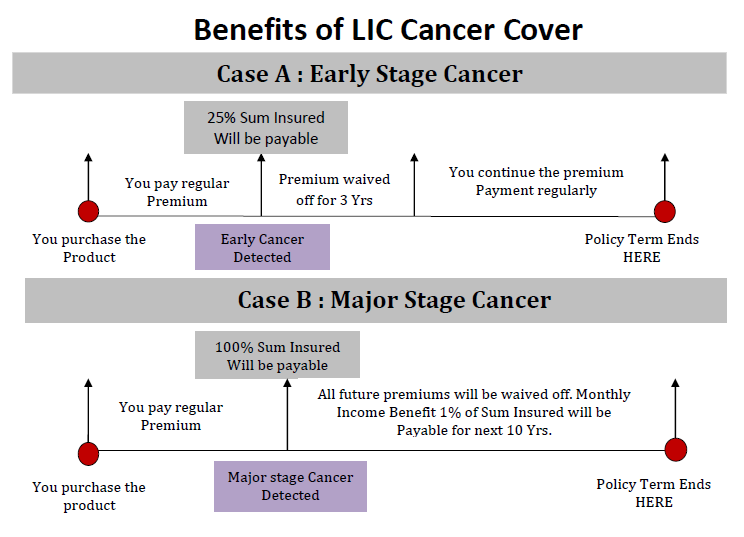

Benefits of LIC Cancer Cover

Note: This policy offers no Maturity Value, no surrender value and no loan facility.

Please do remember one thing again. THERE IS NO MATURITY VALUE, NO SURRENDER VALUE AND THIS POLICY IS NOT ELIGIBLE FOR LOAN.

You would notice; as compared to the benefits offered as mentioned above; it would hardly cost anything to you and the best benefit is that the premiums paid for Cancer cover are eligible for tax benefit u/s 80D of the Income Tax Act, 1961.

UPDATES ON FINANCECompiled by CA. Pratik B. Satyuga |

|

Highest 1 Year FD Rates (As on 01st December 2021) < Rs 2 Crore.

| Institution | 1 Year FD Rate |

|---|---|

| Equitas Small Finance Bank | 6.35% |

| Yes Bank | 6.25% |

| Jana Small Finance Bank Bank | 6.25% |

| RBL Finance Bank | 6.10% |

| Indusind Bank | 6.00% |

Note : Senior Citizens would generally get 0.50% more than the above mentioned rates.

Post Office Deposit Rates (As on 01st December 2021)

| Particulars | Rate of Interest | Maximum Deposit (Rs) |

|---|---|---|

| Post Office Saving Account | 4.00% p.a. | No Limit |

| National Saving Recurring Deposit Account | 5.8% p.a.(QuarterlyCompounded) | No Limit |

| National Saving Time Deposit Account | 5.5% p.a. (Upto 3 Yrs) | No Limit |

| Senior Citizen Saving Scheme Account (SCSS) | 7.40% p.a. | 15,00,000/- p.a. |

| Public Provident Fund (PPF) | 7.1% p.a. (Annually Compounded) | 1,50,000/- p.a. |

| National Savings Certificates (NSC) | 6.8% p.a. (Annually Compounded) | No Limit |

| Kisan Vikas Patra (KVP) | 6.9% p.a. (Annually Compounded) | No Limit |

| Sukanya Samriddhi Accounts | 7.6% p.a. (Annually Compounded) | 1,50,000/- p.a. |

Lowest Home loan Rates for Self Employed Professionals (As on 01st December 2021)

| Institution | Rate |

|---|---|

| Union Bank of India | 6.40% onwards |

| Kotak Mahindra Bank | 6.50% onwards |

| Saraswat Co-op Bank | 6.45% onwards |

| HDFC Bank | 6.75% onwards |

| HSBC Bank | 6.80% onwards |

Top Performing Mutual Funds (As on 01st December 2021)

| Fund Name | Current NAV | 1 Year Returns |

|---|---|---|

| Invesco India Infra – Direct (G) | 35.12 | 63.8% |

| Axis Small Cap Fund – Direct (G) | 65.9 | 62.2% |

| Invesco India Infra –(G) | 30.77 | 61.8% |

| Axis Small Cap Fund (G) | 59.59 | 59.6% |

Major Currency Rates (As on 01st December 2021)

| Country | In Rs. on 01/04/21 | In Rs. on 01/11/21 | In Rs. on 01/12/21 | Change MoM (Rs) | YTD Returns |

|---|---|---|---|---|---|

| United States of America

(USA) – USD($) |

73.13 | 74.68 | 74.90 | 0.29% | 2.42% |

| United Kingdom (UK) – GBP (₤) | 101.34 | 102.44 | 99.68 | -2.69% | -1.64% |

| European Union (EU) – Euro (€) | 86.30 | 86.68 | 84.86 | -2.10% | -1.67% |

Major Commodity Rates (As on 01st December 2021)

| Commodity | Rate on 01/04/21 | Rate on 01/11/21 | Rate on 01/12/21 | Change MoM | YTD Returns |

|---|---|---|---|---|---|

| Gold (MCX) – 10 Gms | 45,420.00 | 47,751.00 | 47,783.00 | 0.77% | 5.20% |

| Silver (MCX) – 1 Kg | 65,092.00 | 64,731.00 | 60,772.00 | -6.12% | -6.64% |

| Crude Oil (MCX) – 1 Unit (BBL) | 4,515.00 | 6,356.00 | 5,013.00 | -21.13% | 11.03% |

Indian Indices

| Index | 1st April 2021 | 1st November 2021 | 1st December 2021 | MoM Returns | YTD Returns |

|---|---|---|---|---|---|

| Sensex (BSE) | 50,029.83 | 60,138.46 | 57,684.79 | -4.08% | 15.30% |

| Nifty 50 (NSE) | 14,867.35 | 17,929.65 | 17,166.90 | -4.25% | 15.47% |

| Bank Nifty | 33,858.00 | 39,763.75 | 36,364.90 | -8.55% | 7.40% |

Global Indices

| Index | 1st April 2021 | 1st November 2021 | 1st December 2021 | MoM Returns | YTD Returns |

|---|---|---|---|---|---|

| Dow Jones (USA) | 33,153.21 | 35,913.84 | 34,022.04 | -5.27% | 2.62% |

| Nasdaq (USA) | 13,480.11 | 15,905.28 | 15,254.05 | -4.09% | 13.16% |

Disclaimer : Utmost care has been taken to present accurate figures. However, the reader is advised to verify the same and consult a Financial Advisor before taking any financial decision.

OUR PUBLICATIONS AVAILABLE FOR SALE

| Sr. No. | Name | Price ` |

|---|---|---|

| 1 | Export of Goods and Services & Supplies to & form Special economic zones under the GST Laws | 60/- |

| 2 | Import of Goods and Services under the Goods & Services Tax Laws | 50/- |

| 3 | Transitional Provision | 50/- |

| 4 | MSTT Case Law Digest 2009-14 | 400/- |

| 5 | GST Referencer 2021-22 | 700/- |

| 6 | E Way Bill under GST | 100/- |

| 7 | GST Refunds- Law, Procedure Practice (Practical Guide) | 200/- |

Payment Link for Publication on Sales : https://gstpam.org/payonline1/847

GSTPAM News Bulletin Committee for Year 2021-22

Parth Badheka Chairman |

Jatin N. Chheda Jt. Convenor |

Aloke R. Singh Jt. Convenor |

This News Bulletin is available on GSTPAM website

www.gstpam.org/news

The opinions and views expressed in this

Bulletin are those of the contributors.

The Association does not necessarily concur with the opinions/views expressed in

this Bulletin.