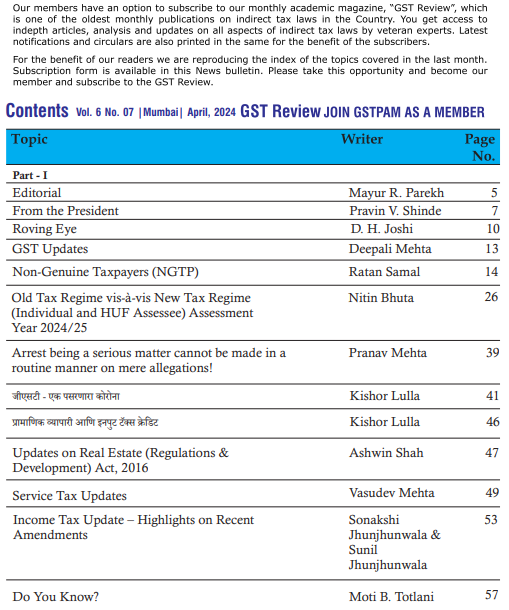

GSTPAM News Bulletin June 2024

CIRCULAR FOR RENEWAL OF MEMBERSHIP/SUBSCRIPTION CHARGES FOR THE F.Y. 2024-25

Dear Members,

RENEWAL OF MEMBERSHIP FOR F.Y. 2024-25

The Membership Fees for the year 2024-25 are due for renewal on 01.04.2024. We appreciate your Continuing support and participation in the activities of our Association.

The timely Renewal of Membership will enable the members to continuously receive the updates on various activities of GSTPAM along with the GSTReview, News Bulletin, Circulars, Messages, Webinars and online access to the website www.gstpam.org. The Life Members only need to renew the subscription charges for the GST Review. The members can also avail the benefit of discount by paying advance for subsequent two years membership fees /subscriptioncharges.

The Membership Renewal Fees received after 30thApril, 2024 will be subject to approval of the Managing Committee. If the Renewal fees for a particular year are not paid, then the member is liable to pay Admission Fees again for Renewal in the subsequent year.

Delayed Renewal Members will be provided Pre Renewal GST Review subject to availability upon payment of such additional courier charges.

The details of Membership/Subscription Fees are given below for your ready reference

| Type of Membership | Membership Fees incl. GST | Admission Fees Incl.GST | Subscription Charges for GST

Review |

Total |

|

New Membership Application |

||||

| Donor Member | 24,78000 | – | 600.00 | 25,380.00 |

| Patron Member | 17,700.00 | – | 600.00 | 18,300.00 |

| Life Member | 11,800.00 | 944.00 | 600.00 | 13,344.00 |

| Life Member (Conversion from Ordinary) | 11,800.00 | 590.00 | 600.00 | 12,990.00 |

| Ordinary Local Member | 1,770.00 | 590.00 | – | 2,365.00 |

| Ordinary Outstation Member | 1,475.00 | 590.00 | – | 2,065.00 |

New Membership Application (Firm/LLP)

| Ordinary Local Member | 1,770.00 | 944.00 | 0 | 2,174.00 |

| Ordinary Outstation Member | 1,475.00 | 944.00 | 0 | 2,419.00 |

| Patron Member | 17,700.00 | 0 | 600.00 | 18,300.00 |

| Donor Member | 24,780.00 | 0 | 600.00 | 25,380.00 |

Advance Membership/ Subscription charges for subsequent two years 2025-26& 2026-27 (Non-Refundable)

| Ordinary Local Member | 3,186.00 | – | – | 3,186.00 |

| Ordinary Outstation Member | 2,665.00 | – | – | 2,665.00 |

| Life Member (Individual/Firm/LLP) | 0 | – | 1200.00 | 1,200.00 |

| Patron Member | 0 | – | 1200.00 | 1,200.00 |

| Donor Member | 0 | – | 1200.00 | 1,200.00 |

Subscription for GST Review for F.Y. 2024-25 by Non-Members

| Subscription fees for GSTR | – | – | 1000.00 | 1,000.00 |

Advance Membership / Subscription charges for subsequent two years 2025-26& 2026-27 (Non-Refundable)

| Subscription Fees -GSTR | 0 | – | 2000.00 2,000.00 |

Modes of Payment:-

| Cheque | A/c Payee Cheque drawn in favor of “The Goods & Services Tax Practitioners’ Association of Maharashtra” payable at Mumbai. |

| NEFT Details | The Goods & Services Tax Practitioners’ Association of Maharashtra

Bank of India, Mazgaon Branch Current Account No. 007020100001816, IFSC Code – BKID0000070.Online generated transaction Acknowledgement should be sent by email on [email protected] along with membership and payment details Members are requested to send their physical form to the association for Approval, Issuance and Office record. |

| Cash | Renewal form along with requisite amount will be accepted between 10.30 a.m. and 5.30 p.m. on all working days except Saturday at our Office at

Mazgaon Library – Mazgoan: 1stFloor, 104, GST Bhavan, Mazgaon, Mumbai – 400 010 Or Bandra Library – GST Bhavan, Ground Floor, A Wing, Bandra Kurla Complex, Bandra (East), Mumbai – 400 051. Or Mazgaon Tower- 8 & 9, Mazgaon Tower, 21, Mhatar Pakhadi Road, Mazgaon, Mumbai – 400 010. |

| Identity

(New Members) |

New Members should provide the following as Identity Proof : PAN, Aadhar Card, Constitution Document.

Address Proof(any one) : Electricity Bill / Passport/ Aadhar Card / Driving License/ Voter id/ Ration Card along with Membership Form |

| Identity Card (For Renewals) | Ordinary Local/Outstation Members should provide Two Photographs along with the Renewal Form for issue of I- cards. |

| Online Payment Link | Members can make online payment on our website www.gstpam.org. Members are requested to download Members Renewal form from website.Update the latest details in the form, scan it and mail at email [email protected]

Payment Link : https://www.gstpam.org/online/renew-membership.php If you are login first time? Click here for create your password |

We value your continuation of the membership and look forward to your renewal to this effect.

Dated:- 01.04.2024

Vinod Mhaske

Jatin Chheda

Hon. Jt.Secretary

Guidance Cell Email ID for queriesMembers can send their queries at [email protected] |

ORDER FORM FOR GSTPAM REFERENCER 2024-25

(Members are requested to take out the photocopy of the Order Form for booking)

To

The Convenor,

GSTPAM Referencer Committee

The Goods & Services Tax Practitioners’ Association of Maharashtra

Room No. 8 & 9, Mazgaon Tower, Mhatar Pakhadi Road,

Mazgaon, Mumbai – 400 010

Dear Sir,

Please book my/our order of GSTPAM Referencer for the year 2024-25 as given below.

| Sr. | Particulars | Price per copy if booked prior to 15th July 2024 | Price per copy if booked after to 15th July 2024 | Qty | Total RS. |

| 1 | GSTPAM Referencer 2024-25 Part I & II

(GST, VAT & Allied Law Referencer & Updated GST Rate schedules). |

700 | 750 | ||

| 2 | Courier Charges (For Outstation members only) (per set) | 130 | 130 | ||

| 3 | Courier Charges (For Local members only) (per set) | 100 | 100 |

Note:

- Referencer will be published in Part I & II (for GST, VAT & Allied Laws Referencer & Updated GST rate schedules).

- Applicants requiring more than 5 copies of the Referencer are required to give a request on their letter head along with the order form. Tax Practitioner’s Associations can place order in bulk quantity by making request on their letterhead signed by the Association’s President and Secretary.

- Applicants will be issued receipt at the time of placing of their order. Applicants are requested to bring receipt at the time of taking the delivery of the Referencer. No delivery of the Referencer shall be given, unless the receipt for payment is submitted at the counter. If the receipt for payment is lost, than no delivery of the Referencer shall be given.

The payment for the above order of………………………………………………………………………………

… (Rupees in words) is made herewith by Cash /Card /Cheque /Demand Draft No. ………….…………… dated ……….……………… drawn on……………………………………………… Bank Branch, Mumbai.

Signature …………………………….

Membership Number………………………….. Address.………………………………………………………

Name ……………………………………… ……………………………………………………………………..

……………………………………………… ……………………………………………………………………..

Office Tel No…………………………………… Residence Tel No……………………………………………

E-mail: …………………………………………. Mobile No.…………………………………………………

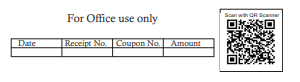

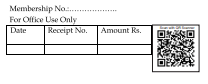

PROVISIONAL RECEIPT

Received with thanks payment of. ………………… from………………………………………….. vide

Cash /Card /Cheque /NEFT/Demand Draft No. …………………………. Date………………………………. drawn

on………………………………………………… Bank …………………………………… Branch, Mumbai.

Signature ……………………………

Date…………………………………. Name of staff of GSTPAM……………………

Note:

- Please fill in all the details in the above form and send the same to the GSTPAM’s office at Tower or at Mazgaon library along with requisite payment.

- For Direct Deposit / NEFT payment – Bank of India, Mazgaon – Account No. 007020100001817, IFSC Code – BKID0000070. Acknowledgement of the same should be sent by email: [email protected] along with duly filled form.

- Online Payment Link : https://www.gstpam.org/online/purchase-publication.php

- Please mention your name and membership number on the reverse side of the Cheque / Demand Draft.

- The counter timings are from 10.30 a.m. to 5.30 p.m. on Monday to Friday.

- The Cheque / DD should be drawn in the name of “THE GOODS AND SERVICES TAX PRACTITIONERS’ ASSOCIATION OF MAHARASHTRA

| Topics |

| CHAPTER – I |

| • Basic Concepts of GST |

| • Time and Value of Supply of Goods and Services |

| • Input Tax Credits |

| • Determination of Nature of Supply |

| • Registration under GST |

| • Returns |

| • Payment of Taxes, Interest ,Penalties & Other levies |

| • Refunds |

|

CHAPTER – II |

| • Demand & Recovery |

| • Assessements and Audit Under GST |

| • Liability to pay in Certain Cases |

| • Inspections, Search, Seziure and Arrest |

| • Advance Ruling Provisions |

| • Appeals Provisions |

| • Offences and Penalties |

| • E-way Bill |

| • E-Invoice |

| • AAR Referncer 23-24 |

| • Input Service Distributor & Cross-Charge |

| • TDS/TCS Provisions |

| • GST Composition Scheme |

| • Reverse Charge Mechanism |

| • Anti-Profiteering Provisions |

|

CHAPTER – III |

| • GST Rates of Taxable Goods |

| • GST Rates for Taxable Services |

| • Index of Exempted Goods |

| • Index of Notified Exempted Services |

| • Index of Notified Goods under RCM |

| • Index of Notified Services under RCM |

|

CHAPTER – IV |

| • Gist of Important Judgments of the Tribunals, High Courts and Supreme Court |

| • Central Sales Tax Act, 1956 |

| • Maharashtra State Tax on Professions Trades, Callings & Employments Act, |

| • The Maharashtra Stamp Act, 1958 |

| • Maharashtra State Budget Highlights 2024-2025 |

THE GOODS & SERVICES TAX PRACTITIONERS’ ASSOCIATION OF MAHARASHTRA

INTENSIVE STUDY COURSE CIRCULAR FOR THE YEAR 2023-24

Respected Members,

It is 7th year of the GST act is implemented. After implementation of GST, whole fraternity of Indirect Tax Practitioners and Trade are facing various challenges with regard to implementation, transition, interpretation, practical aspects, prescribed schedule rates, AAR, Department Audit, various notices related to ITC mismatch and so on.

We all are aware about the practical difficulties we are facing while applying the rules and procedures of the GST law and the frequent amendments to the law especially due to frequent lockdown. With the view to update our fellow members on the latest development in law and to discuss the practical issues arising there from, our association has been regularly conducting Intensive Study Course. This year the Intensive Study Course is designed to enable the members to study and discuss various issues on Indirect Tax Laws mainly on GST Law, as well as on profession tax, etc.

With the same enthusiasm to discuss mainly on various aspects of GST Law, We are starting our hybrid mode Intensive Study Course for the year 2023-24 from Friday, 15-12-2023 onwards.

The Intensive Study Course is such an academic activity of our association which is designed to facilitate the members to study and discuss various issues in group. At the intensive study Course, one of the members acts as a group leader and leads the discussion on issues of the relevant subject / topic and one of the seniors in the profession monitors the discussion. The meetings are generally arranged ON Hybrid mode on 1st, 3rd and 5th Friday of the month during 3.30 p.m. to 6.00 p.m. There are around 15-16 meetings will be arranged for the Intensive Study Circle.

1st The inaugural meeting of the Intensive Study Course is scheduled to be held on Friday, 15-12-2023 between 3.30 p.m. & 6.00 p.m. on hybrid mode on the subject “Issues and Intricacies in GSTR 9 / 9C along with implications on Notices by GST Department”. The topic will be lead by Group Leader CA Dharmen Shah and the Monitor of CA Mayur Parekh.

The group strength is restricted to a limited number of members to facilitate better interaction within the group. The Intensive Study Course Fee is fixed at Rs. 1,650/- including GST for Members and Rs. 1,850/- including GST for Non members. You are requested to enroll at the earliest to avoid disappointment. Kindly use photocopy of the Enrolment form printed here in below. Also write your email address and mobile number for better communication.

Member interested to act as group leader should inform by filling up the option in the Form of “I wish to be a group leader for the subject” and are requested to contact the Convener on the mobile numbers mentioned- on Cell No. 9224386682/9821441740 / 9892512345/9870008752

Note :

- The First Meeting of the ISC is proposed to be a HYBRID meeting. The members joining the ISC are requested to fill the attached form for selection of Only Physical Mode or Only Virtual Mode. The Physical mode will be continued only if majority participants opt for the Physical Mode. (Else only Virtual meetings shall be held no Hybrid Meeting shall be held)

- GST lectures will be in form of group discussion, which will be helpful to study the GST law.

- If the materials are received 3 days earlier to the date of meeting, the same will be circulated through mails to the participants.

- Participants are requested to discuss only the points related to the particular topic of the meeting and to come prepared for the subject, which will be helpful for the discussion.

| Pranav Kapadia

Chairman |

Hiral Shah

Convenor |

Sanjay Gajra

Jt.Convenor |

Sujoy Mehta

Jt.Convenor |

Bhavin Mehta

Jt.Convenor |

| 9224386682 | 9821441740 | 9892512345 | 9870008752 |

THE GOODS & SERVICES TAX PRACTITIONERS’ ASSOCIATION OF MAHARASHTRA ENROLMENT FORM FOR INTENSIVE STUDY COURSE CIRCULAR FOR THE YEAR 2023-24

To,

Convener,

Intensive Study Course

The GSTPAM, Mazgaon, Mumbai – 400 010.

Dear Sir,

Please enroll me as a participant for the Intensive Study Course for the year 2023-24. The Registration fees of Rs.1,650/- (for members) / and Rs.1,850/- (for non-members) 18% Including GST is enclosed herewith by Cash /DD / Cheque No._________________dated__________________drawn on______________________________

Particulars of Member/Participant :

Name:_________________________________________________

Educational Qualification:________________________________________

Address for Communication:__________________________________________________

Telephone No. Office : _______________________________Res. ________________________

Email ID :__________________________ Mob. No,_________________________________

GSTPAM Membership No:________________________________________________________

GSTIN (if Applicable):__________________________________________________________

I also wish to be a group leader for the subject of _____________________ and suitable available date will be :________________________________

I would like to attend the Meeting (Please Tick only one option)

Only Physical Mode

Only Virtual ModeThe Physical mode will be continued only if majority participants opt for the Physical Mode

Signature_____________________

Note :-

- Please issue the Cheque in favour of ”The Goods & Services Tax Practitioners’ Association of Maharashtra” (FULL NAME IS REQUIRED TO BE STATED ON THE CHEQUE AS PER RBI DIRECTION).

- For NEFT payment – Bank of India, Mazgaon- Account No. 007020100001816, IFSC – BKID0000070. Acknowledgement generated through online transaction should be emailed on [email protected] along with Enrolment Form and payment details.

- Online Payment Link: https://www.gstpam.org/online/event-registration.php

- Outstation members are requested to make payment online payment.

- The enrollment form along with payment proof should be submitted at Room No. 104, Vikrikar Bhavan, Mazgaon, Mumbai – 400010.

- Kindly carry the receipt of payment to attend the Lecture.

- The Association reserves the right to change and alter the schedule if required.

INVITATION OF NOMINATIONS

| Election Committee: |

| Chief Election Officer: |

| Shri J. D. Rawal |

| Members: |

| Shri Ramesh Gandhi |

| Shri Pradip Kapadia |

| Shri Ashvin Acharya |

| Shri Shashank Dhond |

| Shri Chirag Parekh |

| Shri Vijay Sachiv |

| Invitee: |

| Shri Pravin Shinde – President |

(For the posts of office Bearers and Members of the Managing Committee for the year 2024 – 2025)

Pursuant to the appointment made by the Managing Committee as provided in Article 17(1) of the Constitution of the Association and in exercise of the powers conferred under Article 17(2), Nominations are hereby invited from the members of the Association, eligible to contest as per Article 17(3) of the Constitution, for the following posts for the year 2024-25:

- One President

- One Vice-President

- One Hon. Treasurer

- Two Hon. Jt. Secretaries

- Fifteen members of the Managing Committee

(1) The nomination forms for the above posts can be procured from the office of the Association or from the Library at Mazgaon and also available on GSTPAM website.

(2) The nomination Form should reach the office of the Association at Mazgaon Tower not later than 5.00 p.m. on Wednesday, 19.06.2024 as per article 17(2) of the Constitution. No Nomination Form will be accepted on the last day; i.e. on Wednesday, 19.06.2024 at Library at GST Bhavan, Mazgaon, Mumbai 400 010.

(3)As per article 17(2) of the Constitution, the last date of submission of duly filled up and signed nomination Forms is Wednesday, 19.06.2024 up to 5 p.m. Nomination Form can also be submitted through e-mail of the candidate to the specially created e-mail ID of the Association for the purpose of the election i.e. at: [email protected] and also can be filed physically at Mazgaon Library and Mazgaon Tower respectively as per the date mentioned in clause 2. The procedure of how to submit the online Nomination Form is prescribed at point No. (13) of this circular.

(4) Any member of the Association who is not in arrears of fees and whose delay in payment of fees has been condoned by the Managing Committee on or before the date of filing of his / her nomination Form, shall be eligible to file the nomination, subject to the provision of Article 17(3) of the Constitution which is reproduced herein below at point No. (12).

(5) The Nomination should be proposed by one member and seconded by another member of the Association (other than the members of the Election Committee), who are not in arrears of membership fees and whose delay, if any, in payment of membership fees has been condoned by the Managing Committee on or before the date of filing of such Nomination Form, as per provision of Article 17 (4) of the Constitution. The further procedure for online submission of Nomination Form through an E- mail is explained in point No. (13) of this circular.

(6) No member shall contest for more than one post as per Article 17(5) of the Constitution.

(7) As per Article 17(6) of the Constitution, a contestant shall be entitled to withdraw his / her nomination if he / she so wishes on or before Saturday, 22.06.2024 up to 5.00 p.m. Intimation of Withdrawal Form may be done through the candidate’s e-mail ID which he / she had provided in his / her Nomination For m to the Association’ s newly created ID for the pur pose of e l ection i . e.[email protected]. However, if any candidate wishes to withdraw his / her Nomination Form by submitting it physically he / she can do so by submitting the same at Mazgaon Library or at the Association’s Office at the address herein mentioned before by Friday, 21.06.2024 up to 5.00 p.m. Please note that physical withdrawal of Nomination Form shall be accepted at the Mazgaon Library only up to Friday, 21.06.2024 and thereafter on Saturday, 22.06.2024, the withdrawal Form shall be accepted only at Association’s Office at Mazgaon Tower up to 5.00 p.m.

(8) Election will be conducted as per Article 17 of the Constitution. Attention of the candidates is invited to Clause 15A inserted in Article 17, whereby a contestant, who desires recounting, shall ask in writing for recounting of votes within 15 minutes from the time of declaration of election results by the Chief Election Officer.

(9) Election at Mumbai shall be conducted between 11.00 a.m. and 5.00 p.m. on Friday, 19.07.2024 at the GSTPAM, Library, Room No. 104, 1st Floor GST Bhavan, Mazgaon, Mumbai-400 010.

(10) Election at District places shall take place on Monday, 15.07.2024 as per schedule given here in below.

(11) Nominations Forms Proposed / Seconded by any Member of the Election Committee shall be rendered the Nomination Form as invalid.

(12) ELECTIONRULES:

Article 17 (3): Any member of the Association who is not in arrears of annual membership fees and/or of Additional Membership Fees of the Association on the date of filing of nomination and whose delay in paying such fee is condoned by the Managing Committee on or before the date of filing of nomination shall be eligible to file nomination for a post of the office bearer or a member of the managing committee.

Provided that a Member of the Association shall be eligible to file the Nomination Form for following posts subject to the fulfilment of the criteria mentioned against each post in the Table given herein below:

| Post | Eligibility Criteria for filing the Nomination Form |

| Managing Committee Member | Eligible only if the Applicant has been a Member of the Association for at least two consecutive years (24 months from the date of admission) on the date of filing Nomination Form. |

| Hon. Jt. Secretary or Hon. Treasurer | Eligible only if the Applicant has been a Member of the Managing Committee for a period of at least two years. |

| Vice-President | Eligible only if the Applicant has held the position as an Office Bearer of the Association for a period of at least two years. |

| President | Eligible only if the Applicant has held the position as an Office Bearer of the Association for a period of at least two years. |

(13) Procedure to submit Election Nomination Form through an E-mail :

Subject to Note No. (2) and (4) of this circular, the Nomination Form may be filled up and signed by thecontestant, proposer and seconder and should be scanned and the same should be sent through the E-mail ID of the contestant mentioned by the candidate as mentioned in the Nomination Form as per Article 17(6) of the Constitution .

(14) In case of any Covid-19 like wave or any force majeure, the election committee is authorized to change or modify any of the directions related to the such election and decision of the Election Committee shall be binding on all. Any such decision shall be informed to all the members through Email/Whatsapp/GSTPAM website/ GST Review etc.

(15) Outstation Election Centers:

| Sr. No | Election Centre at Outstation Place-as per Article 17A | Time |

| 1. | Dhule | 11.00 AM To 02.00 PM |

| 2. | Jalgaon | 11.00 AM To 02.00 PM |

| 3. | Kolhapur | 11.00 AM To 02.00 PM |

| 4. | Nagpur | 01.00 AM To 04.00 PM |

| 5. | Nashik | 02.00 PM To 05.00 PM |

| 6. | Pune | 11.00 AM To 02.00 PM |

| 7. | Aurangabad | 11.00 AM To 02.00 PM |

| 8. | Sangli | 11.00 AM To 02.00 PM |

| 9. | Solapur | 11.00 AM To 02.00 PM |

| 10. | Thane | 02.00 PM To 05.00 PM |

| 11. | Sindhudurg | 02.00 PM To 05.00 PM |

Note: The list of the above outstation election centers is based on the data available with the Association on the date of Notice, the same can change if updated data is made available to the election committee.

For and on behalf of the Election Committee-GSTPAM

Place: Mumbai- 400 010

Dated : 16th April, 2024.

Sd/-

Shri J. D. Rawal

Chief Election Office

73rd ANNUAL GENERAL MEETING

NOTICE TO MEMBERS

NOTICE is hereby given to all the members of the Association that the 73rd ANNUAL GENERAL MEETING of the Association will be held on Friday, 19th July, 2023 at 5.00 p.m. at the GSTPAM Association Library Hall, Room. No. 104, 1st Floor, GST Bhavan, Mazgaon, Mumbai–400010, to consider the following agenda:—

- To read and confirm the minutes of the last Annual General Meeting held on 21st July,2023.

- To receive and adopt the Audited Statement of Accounts of the Association, ‘Sales Tax /GST Review’ and ‘Books and Bulletin’ for the year ended 31.03.2024 and the Balance Sheet as onthat date and to receive and adopt the Annual Report of the Managing Committee for the year 2023-24 (A copy of the report and accounts would be sent separately)

- To appoint an Audit or for the year ending 31.03.2025 and fix his honorarium.

- To receive the report of the Chief Election Officer and declare the result of the Election.

- To transact any other business that may be brought with the permission of the Chair.

Place: Mumbai

Dated: 16th April, 2024

Vinod Mhaske / Jatin Chheda

Hon.Jt.Secretaries

Notes:

- In case, if there is any change the same would be communicated to all the members.

- As per Article 13 of the Constitution of the GSTPAM, if the required quorum i.e. 40 members present in person is not there, the meeting shall stand adjourned and the adjourned meeting shall be held after lapse of half an hour from the appointed time at the same venue only to consider the items on the agenda circulated in the notice convening the meeting. Such adjourned meeting shall be deemed to be valid meeting with the members present forming the quorum and no other business than the one circulated shall be transacted at such adjourned meeting.

- Any member desiring to seek any information on the Accounts may do so at least 3 days in advance in writing so as to enable the committee to reply to the same to the satisfaction of the member concerned.

- Resolution: Any member desiring to move any resolution, other than alterations in the Articles of the Constitution of The Goods & Services Tax Practitioners’ Association of Maharashtra, in the General Meeting, should send the same duly proposed by a member and seconded by another member so as to reach the office of Association, latest by 14th June,2024

PRIZE DISTRIBUTION TO THE CHILDREN OF THE MEMBERS OF OUR ASSOCIATION WHO HAVE OBTAINED HIGHEST PERCENTAGE FOR THE ACADEMIC YEAR 2023-24

To recognize bright students of members some prizes have been instituted by our association out of specific funds received from our members. No. 104, 1st Floor, GST Bhavan, Mazgaon, Mumbai–400010, to consider the following agenda:—

The following cash prizes are to be awarded to the children of the members of our association who have obtained highest percentage of marks at the following subject or examinations held in the academic year 2023- 24.

1. POURANA MEMORIAL PRIZE

(For securing the highest percentage of marks at the B. Com Examination)

2. GALA & GALA PRIZE

(For securing the highest percentage of marks in paper of Accountancy paper at the B. Com. Examination)

3. SHRI VADILAL C. SHAH PRIZE

(For securing highest percentage of marks at the H. S. C. Examination)

4. M/S.CHHAJED & DOSHI PRIZE

(For securing highest percentage of marks at the S.S.C. Examination.)

5. LATE SMT. BHANUBEN H. VORA PRIZE

(For securing highest percentage of marks at the M.Com. Examination)

6. MR. BHARAT D. VASANI PRIZE

(For passing C.A. Final Exam)

The members are therefore requested to send the Scan copies of the Mark sheet stating the percentage of marks obtained by their children at the Examination or subject as stated above on or before 1st July, 2024 on following email ID– [email protected]

GST, MVAT & ALLIED LAW UPDATESCompiled by Adv. Pravin Shinde |

|

|

Notification under Central Tax |

||

| Notification No. | Date of Issue | Subject |

| 10/2024 -Central Tax | 29.05.2024 | Seeks to amend the Notification no. 02/2017-CT dated 19.06.2017 with effect from 5th August, 2023 |

| 11/2024 -Central Tax | 30.05.2024 | Seeks to amend Notification No. 02/2017-CT dated 19th June, 2017 to assign district of Kotputli- Behror to CGST Alwar Commissionerate |

|

Instruction and Guidelines |

||

| Notification No. | Date of Issue | Subject |

| Instruction No. 01/2024-GST | 30.05.2024 | Guidelines for initiation of recovery proceedings before three months from the date of service of demand order- reg. |

| Maharashtra Goods and Services Tax Act, 2017 (MGST) | ||

| Notification No | Date of Issue | Subject |

| Notification No. 06/2024—State Tax Dt.27.03.2024 | 31.05.2024 | Seeks to notify “Public Tech platform for Frictionless credit” as the system with which information may be shared by the common portal based on consent under sub-section (2) of section 158A of CGST Act 2017 |

| Notification No.

08/2024 —State Tax Dt. 03.06.2024 |

06.06.2024 | Seeks to extend the timeline for implementation of Notification No. 04/2024 ST dt. 21.02.2024 1st April, 2024 to 15th May 2024. |

SUMMARY OF RECENT ADVANCE RULING UNDER GSTCompiled by CA Aditya Surte |

|

1.a) Where applicant, an authorized agent of Mercedes Benz India, facilitates sales of Mercedes-Benz passenger vehicles, including electric cars where applicant purchases demo vehicles from Mercedes-Benz India to provide facilitation services and thereafter supplies same which may be made at a price lower than purchase value of said vehicle, restriction under section 17(5)(a)(A) that on ITC for motor vehicles used for transportation of fewer than thirteen persons does not apply to demo vehicles supplied after a specified time for test drives. Therefore, applicant is entitled to claim input tax credit on said demo vehicle purchases.

b) As per circular No. 178/10/2022-GST dated 03/08/2022, amount received by applicant from Mercedes Benz India towards reimbursement of loss on sale of demo car shall be regarded as consideration received against supply of services of ‘agreeing to tolerate an act’ (SAC: 9997974) and would be taxable @ 18% vide Sr. No. 35 of Notification No. 11/2017-Central Tax (Rate).

(West Bengal Authority for Advance Rulings vide Order No. 01/WBAAR/2024-25, decided on 04/04/2024 in the case of Landmark Cars East Pvt. Ltd.)

2) a) Applicant engaged in providing referrals of aspirants/applicants who wish to apply and study aboard to universities/colleges located outside India and supplying services as ‘Marketing/Recruitment/Referral Consultant’ to foreign universities/colleges on principal-to-principal basis, with no contractual relationship with prospective students cannot be considered as ‘intermediary’ for purpose of sec. 2(13) of IGST Act, as students cannot be construed as service recipients particularly in absence of consideration flowing from students to applicant.

b) Where applicant and foreign colleges are nowhere related to each other, applicant cannot be treated as establishment of a distinct person in accordance with Explanation 1 to Section 8 of IGST Act. Thus, activity of applicant for foreign college and university should qualify as ‘export of service’ in terms of Section 2(6) of IGST Act provided payments are received in convertible foreign exchange.

(Telangana Authority for Advance Rulings vide Order No. 09/2024 in A.R. Com/11/2024, decided on 09/05/2024 in the case of Center for International Admission and Visas (CIAV))

3)Where explanation to section 17(5)(d) of CGST Act states that the term “construction” includes re- construction, renovation, additions or alterations or repairs, to extent of capitalisation, to said immovable property and “Rotary Car Parking System” falls under ambit of additions to immovable property as envisaged in said explanation clause, therefore, ITC is not admissible u/s 17(5)(d) on Rotary Parking System desired to be installed by the applicant.

(Tamil Nadu Authority for Advance Rulings vide Order No. 07/ARA/2024 in Application No. 90/2023/ARA, decided on 30/04/2024 in the case of Arthanarisamy Senthil Maharaj)

4). Services provided by applicant, a Goods Transport Agency (GTA), including packing, loading, unloading, and unpacking, qualify as GTA services under Sl. No. 9(iii) of Notification No. 11/2017-Central Tax (Rate) as long as they are part of the same agreement for transport of same goods, but not if they pertain to different goods.

(Telangana Authority for Advance Rulings vide Order No. 07/2024 in A.R. Com/03/2024, decided on 26/04/2024 in the case of DRS Dilip Roadlines Ltd.)

5). Where a company, which provides GTA services, sub-contracts work orders to applicant who would in- turn provide GTA service to said company by simply hiring out their transport vehicles to said company, services so rendered by applicant cannot be classified as GTA service but will be classifiable under Heading No. 9966 as ‘Rental services of transport vehicles’.

(Maharashtra Appellate Authority for Advance Rulings in Advance Ruling No. MAH/AAAR/RS-SK/26/2020- 21, decided on 17/09/2020 in the case of Liberty Translines)

INCOME TAX UPDATESCompiled By By Adv. Ajay Talreja |

|

Bombay HC Quashes Reassessment Order against Wife as Husband Bought Property

Kalpita Arun Lanjekar Vs ITO ( Bombay High Court) In a recent case before the Bombay High Court, the legality of an income tax reassessment against a housewife, Kalpita Arun Lanjekar, came under scrutiny. The crux of the matter lies in a notice received by Kalpita Arun Lanjekar from the Income Tax Officer, Ward- 28(2)(1), under Section 148A(b) of the Income Tax Act, 1961. The notice alleged that income chargeable to tax for the Assessment Year 20162017 had escaped assessment due to high-value transactions, particularly the purchase of immovable property valued at Rs. 30,00,000 or more. Despite explanations and documentary evidence provided by Kalpita, including the fact that the property was purchased solely by her husband, the reassessment order was still issued. The order cited a lack of details regarding the source of funds for the property purchase.

However, the court’s analysis revealed flaws in the order. It was noted that the Assessing Officer failed to recognize that Kalpita had not contributed financially to the property purchase. Moreover, the Principal Chief Commissioner’s sanction for the order was deemed questionable. In conclusion, the Bombay High Court ruled in favor of Kalpita Arun Lanjekar, quashing the reassessment order. The judgment underscores the importance of thorough scrutiny in tax proceedings, especially concerning joint property ownership and individual tax liabilities. This case sets a precedent for fair treatment of individuals, particularly housewives, in income tax matters

Jewellery inherited through non-registered will qualifies as capital asset: ITAT Bangalore

ACIT Vs Sharada Narayanan (ITAT Bangalore) ITAT Bangalore held that non-registration of will doesn’t lead to any inference against its genuineness. Thus, jewellery inherited from mother in law based on non-registered will be capital assets and sell thereof results into long term capital gain.

Benefit of Indexation cannot be denied to calculate Long Term Capital Gain

Millie Dey Vs ITO (ITAT Kolkata) BRIEF FACTS OF THE CASE: Assessee; being a Co-owner of a house property sold the property in the financial year 2015-16 pertaining to assessment year 2016-17. The return for the year was duly submitted by the assessee showing a long term capital loss as arrived by the assessee on the basis of a registered valuers valuation report and got assessed u/s 143(1)(a) with NIL demand. Subsequently in the year 2021, the proceedings u/s 147 was initiated by the department of revenue and the calculation of capital gain was challenged by the L.D AO. The LD.AO made an addition of Rs 44,90.630/- in his order u/s 147 of the IT Act which was arrived after deducting the 50% share of the cost of acquisition figure which was Rs 5,00370/- from the sale consideration of Rs 50, 00,000/- as received by the assesse as her share. While calculating the Long Term capital Gain the LD. AO considered the cost of acquisition as derived by the registered valuer as on 01.04.1981 and ignored the FMV of the property in the year of sale which was also derived by the valuer in his valuation report with a reason that the base year value was arrived at by the valuer by applying a reverse indexation method hence the base year value has to be adopted.

Appeal Proceedings: Aggrieved by the order the assesse preferred an appeal before LD.CIT Appeals NFAS New Delhi where the order of the LD AO was upheld by the LD CIT (Appeals) NFAS New Delhi and the appeal of the assesse was dismissed. The LD.CIT (Appeals) held the same view as of the LD ITO and did not agree with the methods adopted by the valuation officer in determining the FMV of the property in the year of its sale. LD.CIT(Appeals) NFAC New Delhi supported the view of the LD.AO of considering the base year value as the cost of acquisition of the property.

Aggrieved by the order of the LD.CIT(Appeals) NFAC, New Delhi, assesse preferred a further appeal before the hon’ble ITAT on the ground that although a value of the base year i.e 01.04.1981 was taken into consideration and adopted by the lower authorities but no benefit of Indexation was given to the assesse as per section 48 of the Income Tax Act 1961. Further a report of valuation of a registered valuer was challenged without any corresponding factual evidence on record in the form of a valuation report of a DVO. Hon’ble ITAT allowed the appeal of the assesse on the grounds that the LD.ITO accepted the market value of the property as on 01.04.1981 and merely reduced the value as on 01.04.1981 from the sale consideration to calculate the Capital Gain but failed to give the benefit of indexation to the assesse. Further, the lower authorities did not make any effort to find out the market value of the property to challenge the valuation report of the registered valuer as well.

Investments from NRE Accounts not taxable under Section 10(d) of Income Tax

Nitin Mavji Vekariya Vs ITO (Gujarat High Court) In the case of Nitin Mavji Vekariya versus the Income Tax Officer (ITO) before the Gujarat High Court, the court dealt with the challenge to an order issued under section 148A(d) of the Income Tax Act, 1961 for the Assessment Year 2018-19.

Here’s a summary of the judgment: The petitioners, who are family members and residents and citizens of the Republic of Uganda, sought to quash and set aside the order issued under section 148A(d) of the Income Tax Act, 1961. Mr. Divatia, learned counsel for the petitioners, argued that all investments in Time Deposits and Mutual Funds were made from Non-Resident External (NRE) Accounts, and therefore, not subject to tax under Section 10(d) of the Income Tax Act. The petitioners furnished details and documents supporting their claim. The Revenue, represented by Mr. Karan Sanghani, contended that the residency period in India of the petitioners was unclear from the passport details furnished, and the investments from the NRE Accounts were unexplained. The court considered the submissions and noted that all investments were indeed made from NRE Accounts, which are exempt from taxation under Section 10(4) of the Income Tax Act. The court observed that the impugned orders lacked jurisdiction as they failed to recognize that the funds originated from NRE Accounts, which are beyond the reach of taxation authorities. Additionally, Section 10(4) of the Income Tax Act exempts such incomes from inclusion in the total income. Consequently, the court quashed and set aside the impugned orders dated 29.03.2022, ruling in favor of the petitioners. In conclusion, the Gujarat High Court ruled that the orders issued by the Income Tax Officer were without jurisdiction and allowed the petitions.

Section 271(1)(c) penalty not automatic on mere expense Disallowance or Income Enhancement

Dion Global Solutions Limited Vs ACIT (ITAT Delhi) In the case of Dion Global Solutions Limited vs. ACIT, the Delhi Income Tax Appellate Tribunal (ITAT) addressed the imposition of penalties under Section 271(1)(c) of the Income Tax Act, 1961, concerning the assessment year 2007-08.

The assessee challenged the penalty imposed on disallowance of expenses amounting to Rs. 32,95,228/- and additions on account of unearned income of Rs. 102,33,994/-. The Assessing Officer (AO) imposed a penalty of Rs. 45,98,566/- on these additions. During the hearing, the assessee did not appear, and the Tribunal proceeded ex-parte. The Departmental Representative (DR) for the Revenue referred to the ITAT’s appellate order in the quantum proceedings, where the additions made by the AO were confirmed. The Tribunal observed that while the additions were confirmed in the quantum proceedings, this does not automatically justify the imposition of penalties under Section 271(1)(c). The AO did not specify the nature of the default or provide satisfaction as required under Section 271(1B) of the Act. Therefore, the Tribunal held that the penalty imposed on the disallowance of expenses should be reversed and canceled. Regarding the addition on account of unearned revenue, the assessee argued that the receipts were treated as current liabilities in the balance sheet because the services had not been rendered, and income had not accrued to the assessee. The AO alleged that the assessee furnished inaccurate particulars of income by treating these receipts as revenue. The Tribunal found the explanation offered by the assessee plausible and noted that the assessee had made proper disclosures. While the treatment of receipts as current liabilities may not have been accepted in the quantum proceedings, it was not per se inaccurate. Therefore, the Tribunal held that the imposition of penalty on this ground was not justified.

The Tribunal emphasized that imposition of penalty under Section 271(1)(c) is not automatic and should not be imposed merely because it is lawful to do so. In this case, considering the mitigating circumstances and the plausibility of the assessee’s explanation, the Tribunal concluded that the penalty imposed on unearned revenue income was not justified. Consequently, the Tribunal set aside the first appellate order and directed the AO to reverse and delete the penalties imposed.

In summary, the Tribunal ruled that mere disallowance of expenses or enhancement of returned income does not automatically warrant the imposition of penalties under Section 271(1)(c), and penalties should be imposed judiciously, considering the circumstances of each case.

Repatriation of Funds to Non-Residents

Repatriation of funds holds crucial significance for non-residents and Non-Resident Indians (NRIs), necessitating a comprehensive understanding of regulations and taxation. This guide elucidates the permissible limits, requisite permissions, and taxation nuances governing fund repatriation from India.

Repatriation of Funds by NRIs: Brief: √ Max Limit without RBI permission: USD 1 Million.

√ Above USD 1 Million, need RBI prior approval.

√ Remittance should be by NRI only.

√ Remittance should be from his/her NRO account in India.

√ Funds remitted can be one of the following:

balances held in NRO accounts sale proceeds of assets the assets acquired by way of inheritance/legacy

As per Foreign Exchange Management (Remittance of Assets) Regulations, 2016, Para 4 “Permission for remittance of assets in certain cases”, Regulation 2:

A Non-Resident Indian (NRI) or a Person of Indian Origin (PIO) may remit through an authorised dealer an amount, not exceeding USD 1,000,000 (US Dollar One million only) per financial year, (i) out of the balances held in the Non-Resident (Ordinary) Accounts (NRO accounts) opened in terms of Foreign Exchange Management (Deposit) Regulations, 2016/ sale proceeds of assets/ the assets acquired by him by way of inheritance/ legacy on production of documentary evidence in support of acquisition, inheritance or legacy of assets by the remitter; (ii) Under a deed of settlement made by either of his parents or a relative (relative as defined in Section 2(77) of the Companies Act, 2013) and the settlement taking effect on the death of the settler, on production of the original deed of settlement; Provided that where the remittance under Clause (i) and (ii) is made in more than one instalment, the remittance of all instalments shall be made through the same Authorised Dealer. Provided further that where the remittance is to be made from the balances held in the NRO account, the account holder shall furnish an undertaking to the Authorised Dealer that “the said remittance is sought to be made out of the remitter’s balances held in the account arising from his/ her legitimate receivables in India and not by borrowing from any other person or a transfer from any other NRO account and if such is found to be the case, the account holder will render himself/ herself liable for penal action under FEMA. Further, as per Regulation 7 “Reserve Bank’s prior permission in certain cases” of the said regulations: A person who desires to make a remittance of assets in the following cases, may apply to the Reserve Bank, namely: (i) Remittance exceeding USD 1,000,000 (US Dollar One million only) per financial year –

(a) on account of legacy, bequest or inheritance to a citizen of foreign state, resident outside India; and

(b) by a Non-Resident Indian (NRI) or Person of Indian Origin (PIO), out of the balances held in NRO accounts/ sale proceeds of assets/ the assets acquired by way of inheritance/ legacy.

(ii) Remittance to a person resident outside India on the ground that hardship will be caused to such a person if remittance from India is not made;

II. Repatriation of Funds by Resident Individuals: Brief:

√ Resident Individuals can freely remit funds from India under Liberalised Remittance Scheme (LRS).

√ LRS maximum limit is upto USD 2,50,000 per individual per financial year.

√ Purpose of remittance should be other than negative list in detailed text below.

√ Upto INR 7 Lakhs no TCS shall apply.

√ Above INR 7 Lakhs, TCS shall apply: i. For remittances made upto 30th Sep, 2023 – @5% ii. For remittances made on/after 1st Oct, 2023 – @20%

√ TCS paid is NOT a cost, and can be claimed as refund/set-off against other tax liability by filing the income tax return

√ Gift is not taxable in hands of recipient between relatives

| GIST OF TRIBUNAL JUDGEMENTS (VAT)

Compiled by CA Rupa Gami |

|

1. Heak Auto Pvt. Ltd. in Restoration Application No. 01 of 2023 decided on 01.02.2024

Vat Second appeal was withdrawn in order to avail benefits under the Amnesty Scheme 2022. However, the application filed under the Amnesty Scheme was rejected as it was not in accordance with the provisions of the Settlement Act. Therefore, the Vat second Appeal was restored.

(Petitioner represented by Adv. Sumedh Hinge)

2. Reliance Port and Terminals Ltd. in Vat Appeal No. 31 and 14 of 2023 decided on 05.02.2024

One appeal was filed against the Review order passed by the Jt. Commr. of State Tax (LTU) 3, Mumbai and another appeal was filed against the rejection of Rectification Order where rectification application was made for rectification of the review order. Refund as per the Assessment Order of Rs.63613404/- was denied in Review order as well as deduction for subcontractor. All the certificates in Form 407 were submitted at the time of assessment and the deduction was granted.

The Jt. Commr. rejected the Rectification application stating that there was a possibility of refund having been issued manually. It was contended by the appellant that there was a Trade Circular No. 14T of 2015 issued by which no physical issue of cheque was permitted and it was mandatory to issue the refund through NEFT mode. The Tribunal held that if there was a possibility of issue of refund manually, the same should have been checked. Also, the Nodal officer has not bothered to reply to the letters regarding issue of refund and therefore it seems that the refund has not been issued. Matter to be remanded to the reviewing authority to pass fresh review order and also grant interest on delayed refund. (Petitioner represented by Adv. Nikita Badheka)

3. M/s Skyline Greathills in Restoration Application No. 14 of 2023 decided on 05.02.2024

Application for restoration was filed for dismissal of appeal for non-attendance and non-compliance of part payment The earlier hearing was not attended by the representative of the assessee due to his ill health and acute pain for frozeshoulder. A medical Certificate was filed. Restoration Application was allowed but due to the appellant’s negligence in prosecuting the appeal, costs of Rs.25000/- to be imposed. (Petitioner represented by STP Manish Nakade)

4. Ratan Motors in Miscellaneous Application No. 04 of 2024 decided on 06.02.2024

First Appeal Order was passed ex parte. A rectification application was filed against the order. Also, second appeal was filed after a delay of 647 days. Rectification Application was rejected on the ground that it was not covered under Section 62 of the BST Act. And also, the rectification was filed in the Form under the MVAT Act. Delay was condoned with cost of Rs.25000/-.

(Petitioner represented by Adv. Parth Badheka)

5. Yash Developers in Vat S.A. No. 372 of 2021 decided on 06.02.2024

Assessee is a builder developer undertaking works contract of construction of building and selling them. Vat was paid on the basis of instalments received from the buyers. However, the first appellate authority levied tax on the basis of agreement value in the year in which agreement was entered. Considering the Trade Circular No. 14T of 2012 with FAQs issued by the Commissioner of Tax dated 03.09.2012, the Tribunal accepted the stand of the assessee and remanded the matter to the first appellate authority to verify the turnover as per Profit and Loss Account and Form 704.

(Petitioner represented by Adv. D.V. Retharekar)

6. M/s Vaarad Ventures Limited in Miscellaneous Application No. 08 of 2024 decided on 12.02.2024

Application made for condonation of delay of 298 days. Against the first appeal order, received on 21/01/2023 the appellant had filed a restoration application on 03/02/2023 which was rejected by order dated 26/12/2023. Thereafter, the appeal was filed which resulted in the delay. Delay condoned imposing costs of Rs.20000/-

7. Indian Oil Corporation in S.A. Nos. 26 and 27 of 2022 decided on 26/02/2024

In first appeal two challans of payment made under BST Act were disallowed and the claim of exemption under Notification entry H-7 on sales against Form H was disallowed. The said Notification Entry exempted the whole of tax on the sale of petroleum products including liquefied petroleum gas out of Bombay High, manufactured or produced by any of the companies or corporations specified thereunder to any other of those companies or corporations. In CST Appeal, grounds were raised for disallowance of Forms.

The Tribunal observed that the challans for payment made were reflected in the bank accounts of the assessee and also the claim was allowed by the assessing authority. Therefore, the claim be allowed. Regarding the issue of disallowance of lubes sale to BPCL against Form H, the same was disallowed considering it as not a petroleum product. The Tribunal judgement in the case of M/s Hindustan Petroleum Corporation Ltd. vs State of Maharashtra in S.A. Nos. 998 and 999 of 2006 decided on 27/04/2007 was relied upon by the petitioner and the Tribunal hld that the petroleum products were not restricted to only entries C-II-76 and C-II-57. Lubricants manufactured from the residual of crude oil would also be considered as petroleum product. The exemption was to be allowed. In CST appeal, since the Forms were with the appellant, a chance was to be given to the appellant to produce the Forms. Matter was remanded.

(Petitioner represented by CA Sujata Rangnekar)

4. Siddhant Diamond Pvt. Ltd. in Vat S.A. No. 166 of 2019 decided on 27/02/2024

The assessee was having a refund as per the Vat Returns for the period 2006-07. Form 501 was filed for claim of refund. However, there was no notice for assessment and no assessment was completed and no refund was issued. The appellant applied for refund by a physical letter. The Asst. Commr. of State tax rejected the claim of refund with interest vide his order for the following reasons:

- That Form 501 was filed late.

- After the judgement of Vichare & Co. and Silver Dot Converters the Commissioner had issued an internal Circular no. 3A of 2015 in which it was explicitly mentioned that applications pertaining to periods 2005- 06 and 2006-07 cannot be taken for assessment since these periods have already been barred by limitation of time.

- The Minutes of Monthly review meeting held on 18th June 2016 stated that “no time barred refund application shall be granted refund, unless there is a court order and orders to release such refund are issued by Head Office.

The first appellate authority confirmed the rejection order. The appellant filed this second appeal and relied on various case laws, Article 144 of the Indian Constitution and Section 151 of the Code of Civil Procedure, 1908. The Tribunal relied on the judgements of M/s Vichare & Co. Pvt. Ltd. (Writ Petition No. 557 of 2015 dated 03/03/2015) and M/s Madhav Gems and Others (Vat S.A. Nos. 09 and 10 of 2020, 99 of 2020 and 42 of 2020 decided on 17/08/2023 and held that the appellant was entitled to refund and interest thereon.

(Petitioner represented by Adv. G.V.Khare)

DGFT & CUSTOMS UPDATE

By CA. Ashit K. Shah |

|

1. Notifications issued under Customs Tariff:

| Notifications No | Remark | Date |

| 24/2024

– Customs |

|

03-05- 2024 |

| 25/2024

– Customs |

Amendment to the List 34A and List 34B in the Appendix to the Table of. No. 50/2017 – Customs. The amendment primarily focus on updating the list of authorized banks for handling specified customs transactions and operations, particularly in relation to the exemption of gold or silver imports from IGST. | 06-05- 2024 |

| 08/2024

– Customs (ADD) |

Impose or levy of Anti-dumping duty on import of ‘Pentaerythritol’ falling under tariff item 2905 42 90, originating in or exported from China PR, Saudi Arabia and Taiwan, and imported in to India, for a period 5 years from the date of publication of notification. | 16-05- 2024 |

| 02/2024

– Customs (CVD) |

Extend the levy of Countervailing Duty (CVD) on ‘Saccharin in all its forms’ falling under tariff item 2925 11 00, originating in or exported from China PR, into India, up to and inclusive of the 28th February, 2025. | 28-05- 2024 |

2. Notifications under DGFT:

| Notifications No | Remark | Date |

| 10/2024-25 | The export policy of “Onions” is amended from “prohibited” to “free” subject to MEP of USD 550 per Metric Ton (MT) with immediate effect and until further orders. | 04 -05 -2024 |

| 11/2024-25 | The export policy of “Non-Basmati White Rice” falling under tariff 1006 30 90 amended whereby 14,000 MT of Non-Basmati White Rise to Mauritius has been permitted through National Co-operative Exports Limited (NCEL). | 04 -05 -2024 |

| 12/2024-25 | The import policy of “Yellow Peas” falling under tariff 0713 10 10 amended whereby as per revised policy, import is “Free” without the MIP condition and without Port restriction, subject to registration under online Import Monitoring System, with immediate effect for all import consignment where Bill of Lading (Shipped on Board) is issued on or before 31-10-2024. | 08 -05 -2024 |

| 13/2024-25 | The government continues imposing restrictions on importing unregistered information technology (IT) and electronics products.

It means imports of new, second-hand, or refurbished IT and electronic goods will be restricted unless they are registered with the Bureau of Indian Standards (BIS) and comply with its labeling requirements. The import policy has been notified under ‘Electronics and Information Technology Goods (Requirement of Compulsory Registration Order), 2021. In case goods are imported without mandatory registration, they will have to be re-exported after reaching a port. “…else customs authorities shall deform the goods beyond use and dispose of the goods as scrap under intimation to the Ministry of Electronics and Information Technology.20-05-2024 |

20 -05 -2024 |

CHARITABLE TRUSTS UPDATES

By Adv. Hemant Gandhi & CA Premal Gandhi |

|

Income-tax on Charitable Institutions or Trust

Let us analyse the income tax on various categories of income of charitable trust:

| Category of income | Income subject to tax | Taxability |

| Donations/voluntary contributions | Voluntary contributions with a specific direction to form part of corpus of trust or institution | Exempt* |

| Voluntary contribution without such specific direction | Forms part of income from property held under trust | |

| Anonymous donations i . e., donations where donee does not maintain record of identity/any particulars of the donor | Donation exceeding higher of:

|

Taxed at 30% |

| Anonymous donation received by trust established wholly for religious and charitable purpose on | Taxable in the same manner as voluntary contributions (without specific direction) as above | |

| Income from property held under trust for charitable or religious purpose | Income applied for charitable or religious purpose in India | Exempt* |

| Income accumulated or set aside for the application towards charitable or religious purpose in India | Exempt* to the extent of 15% of such income. This means at-least 85% of income from property to be applied for charitable and religious purpose in India as above and balance 15% can be accumulated or set aside. [See below comment on 85%] | |

| Income from property held under trust created for charitable purpose w h i c h t e n d s t o p r o m o t e international welfare in which India is interested | CBDT either by general or special order has directed that such income shall not be included in the total income of trust | Exempt* |

| Capital gain from asset held under trust in whole | Net consideration is utilised fully for acquiring another capital asset | Entire capital gain is deemed to have been applied for charitable and religious purpose and hence is exempt* |

| Net consideration is utilised partially for acquiring another capital asset | Capital gain utilised in excess of cost of old asset transferred is considered to have been applied for charitable and religious purpose and is exempt* |

*Only Charitable/ religious trust or institution registered under Section 12AB enjoys the exemption

“Wishing our members a very HAPPY BIRTHDAY!!”

|

Members Name |

Date of Birth |

| Desai Rajendra K. | 11 – June |

| Vichare Bhalchandra Vasant | 11 – June |

| Gadhia Kavita Jayantilal | 11 – June |

| Dhole Shashikant Krishna | 11 – June |

| Jagatap Mahesh Vishnu | 11 – June |

| Patil Amar Ramchandra | 11 – June |

| More Surekha Tukaram | 11 – June |

| Rathi Rahul Dinesh | 11 – June |

| Samal Manohar Ratan | 11 – June |

| Agrawal Pramod K. | 12 – June |

| Roy Shouvik Kumar | 12 – June |

| Sawant Vinod Laxman | 12 – June |

| Patel Govind Jayanti | 12 – June |

| Soni Niki Suresh | 12 – June |

| Markale Arun S. | 13 – June |

| Suterwala Aliraza Safakhat | 13 – June |

| Gosher Jigar Pradip | 13 – June |

| Naphade Siddhesh Satish | 13 – June |

| Modi Sunil Jayantilal | 13 – June |

| Shah Vijay H | 14 – June |

| Shetty Nagesh Ponkra | 14 – June |

| Gandhi Mukesh P. | 14 – June |

| Bajaria Bharat J. | 14 – June |

| Parekh Chirag S. | 14 – June |

| Mathekar Manoj Damodar | 14 – June |

| Saraf Nikunj Nirmal | 14 – June |

| Atha Jalaram B | 14 – June |

| Erra Srinivas Hari | 15 – June |

| Bohra Mazhar Ali | 15 – June |

| More Raghunath Shivaji | 15 – June |

| Parthasarathy C K | 15 – June |

| Pathan Tahirkhan Ashrafkhan | 15 – June |

| Shah Samir Vrajlal | 15 – June |

| Katwala Krunal Bhupendra | 15 – June |

| Jangid Dinesh Shankarlal | 15 – June |

| Memon Munaf Iqbal | 15 – June |

| Ganatra J. Harilal | 16 – June |

| Sonawane Rajendra Ratan | 16 – June |

| Shaikh Mushiroddin Muneeroddin | 16 – June |

| Jobanputra Sanjay Hariram | 16 – June |

| Sheth Jimmy Vinaychandra | 16 – June |

| Bhatt Monarch Mahendra | 16 – June |

| Diwakar Rohit Lakhanlal | 16 – June |

| Sonawani Sunil K. | 17 – June |

| Limaye Prashant Shankar | 17 – June |

| Marfatia Jayesh Vipin | 17 – June |

| Thigale Bhalchandra Namdev | 17 – June |

| Shah Pruthviraj Chandulal | 18 – June |

| Akali Rajratansingh H. | 18 – June |

| Shyamsaika Ganeshkumar Loknath | 18 – June |

| Bhandari Abhay Mansukhlal | 18 – June |

| Shah Dharmesh Yogesh | 18 – June |

| Maniar Nikhil Dinesh | 18 – June |

| Agarwal Ronak Nileshkumar | 18 – June |

| Shaikh Raziya Ebrahim | 18 – June |

| Doshi Hitesh J. | 18 – June |

| Kapadia Pranav P. | 19 – June |

| Shah Parag Kishor | 19 – June |

| Dhariya Pradeep Mohan | 20 – June |

| Wani Rajesh Govind | 20 – June |

| Vishwakarma Dhirendrakumar | 20 – June |

| Parmar R. S | 21 – June |

| Ruwala Ajit Ramanlal | 21 – June |

| Katti Avinash B. | 21 – June |

| Parikh Nimish Dashrathlal | 21 – June |

| Shetty Vijay Shekhar | 21 – June |

| Konasirasgi Sanjeevkumar Sadashiv | 21 – June |

| Tejam Shankar | 21 – June |

| Nalawade Vinod Ganpatrao | 22 – June |

| Doshi B. A | 22 – June |

| Shaikh Abdul Qadir Gulas | 22 – June |

| Gala Navin Ratanshi | 22 – June |

| Thole Anil H. | 22 – June |

| Pore Rahul Ramchandra | 22 – June |

| Palitanawala Shabbir A. | 22 – June |

| Rao Gunapal Shankar | 22 – June |

| Shah Hemang K | 22 – June |

| Patil Vikas Vasantrao | 22 – June |

| Rajani Pritesh Jethalal | 22 – June |

| Shekhawat Kuldeesingh Vijendrasingh | 22 – June |

| Bawaadam Saifee F. | 23 – June |

| Chaudhari Prasad Hari | 23 – June |

| Vedang Parvindar Singh Baldev | 23 – June |

| Parekh Kamlesh M | 23 – June |

| Garud Vikas Keshav | 24 – June |

| Dedhia Shailesh Premji | 24 – June |

| Patil Vijay Amrutrao | 24 – June |

| Chiplunkar Prashant Mahadeo | 24 – June |

| Jain Sonu Surendra | 24 – June |

| Somaiya Bharat D. | 25 – June |

| Parmar Paresh Chunilal | 25 – June |

| Hakee Deepak Narayan | 25 – June |

| Joshi Mukund Narayan | 25 – June |

| Gosavi Ashish Satish | 25 – June |

| Agrawal Vaibhav Vitthaldas | 25 – June |

| Deshmukh Adil Manzur | 26 – June |

| Shah Ashish Gopaldas | 26 – June |

| Shah Nilima D. | 26 – June |

| Bhoir Sandeep Prabhakar | 26 – June |

| Chotai Nikunj Rajesh | 26 – June |

| Kapadia Kiran Pratap | 27 – June |

| Shah Rajeshkumar G | 27 – June |

| Shridhar Sandeep Hansraj | 27 – June |

| Momaya Afzal Ahmed | 27 – June |

| Jindal Tripti | 27 – June |

| Kante Pravinkumar Bharamappa | 27 – June |

| Bharat H. Chaniary | 28 – June |

| Shah Sunil Girdharlal | 28 – June |

| Choudhari Sachin Triambakrao | 28 – June |

| Kasar Santosh Namdev | 28 – June |

| Patkar Vinaya Vinayak | 29 – June |

| Belwalkar Niranjan Arun | 29 – June |

| Paliwal Garvit Ghanshyam | 29 – June |

| Pange Sonal Ravindra | 29 – June |

| Deshpande M. D | 30 – June |

| Joshi Ramesh Gurunath | 30 – June |

| Kapat Haren Chandra Sahadeb | 30 – June |

| Desai Amit Narendra | 30 – June |

| Desai Tushar S. | 30 – June |

| Dhabalia Himanshu D | 30 – June |

| Gunukula Hanumantharao Rao | 01 – July |

| Nachankar Ulhas Yashavant | 01 – July |

| Sahu Somnath Juri | 01 – July |

| Shah Kamlesh Babulal | 01 – July |

| Irpachi Devidas Madhao | 01 – July |

| Siddiqui Mumtaz A | 01 – July |

| Golchha Javrichand Pukhraj | 01 – July |

| Badgude Pradip Sudhakar | 01 – July |

| Chitalikar Manojkumar Sharad | 01 – July |

| Pandit Santosh S. | 01 – July |

| Vaishnav Suresh Bherudas | 01 – July |

| Pal Shailesh Pratapbahadur | 01 – July |

| Nikam Sanjay | 01 – July |

| Soni Sangeeta Kamlesh Kumar | 01 – July |

| Swain Sujata . | 01 – July |

| Chipade Shrikant Vivekanand | 01 – July |

| Suthar Laxman | 01 – July |

| Phadtare Jayesh Sopan | 01 – July |

| Mundhra Mehul Mahavirprasad | 01 – July |

| Motwani Rajkumar Jhamandas | 01 – July |

| Kanungo Milapchand M. | 02 – July |

| Kulkarni Suhas Laxmikant | 02 – July |

| Anchaliya Suresh Shantilal | 02 – July |

| Lohiya Satyanarayan Chaganlal | 02 – July |

| Patil Ashok Pundlik | 03 – July |

| Karve Uday Madhusudan | 03 – July |

| Surve Aarti Rajesh | 03 – July |

| Gond Mintoo Rajaram | 03 – July |

| Jain Vicky Rameshkumar | 03 – July |

| Shaha Sneha Sagar | 03 – July |

| Agarwal Bhanwarlal Shankarlal | 03 – July |

| Nagda Jambukumar Bhanwarlal | 04 – July |

| Fulia Jitendra Damji | 04 – July |

| Prajapati Umesh Govindji | 04 – July |

| Durugkar Mohsin Anis | 04 – July |

| Shah Pratik Rajendra | 04 – July |

| Khan Mohsin Khan Aslam | 04 – July |

| Ingale Yogesh Rajendra | 04 – July |

| Bagadia Ajit S. | 05 – July |

| Choudhary Radheyshyam R | 05 – July |

| Manghnani Ashok Kumar Mohanlal | 05 – July |

| Zota Hemesh Aeventilal | 05 – July |

| Shaha Prashant Himatlal | 05 – July |

| Sasane Kunal Dilip | 05 – July |

| Choudhary Bhagraj Ramlal | 05 – July |

| Shah Arvind M. | 06 – July |

| Nayak Prabhakar Vasudev | 06 – July |

| Zanwar Dilip Vitthaldas | 06 – July |

| Bhawar Chandrakant Dnyaneshwar | 06 – July |

| Jain Yashveer Rajkumar | 06 – July |

| Kabra G. R. | 07 – July |

| Biyani P. C. | 07 – July |

| Dhanuka Kamal V. | 07 – July |

| Jain Tarun J | 07 – July |

| Karale Jitendra P. | 07 – July |

| Laddha Vivek | 07 – July |

| Shaikh Abdulkarim Abdulwahab | 07 – July |

| Kamat Prabhakar D. | 08 – July |

| Shah Pravin R | 08 – July |

| Agarwal Narendra Kishinchand | 08 – July |

| Bhandari Ashok G. | 08 – July |

| Navagrah Rajendra Vinayak | 08 – July |

| Shirke Dhananjay Janardan | 08 – July |

| More Sanjay K. | 08 – July |

| Chavan Sandip Vishram | 08 – July |

| Shah Akshay Rajendra | 08 – July |

| Chhallani Badalchand L | 08 – July |

| Kelkar Sanjay Mukund | 09 – July |

| Dongre Shivkumar Chandrashekhar | 09 – July |

| Chadha Kapil Kumar | 09 – July |

| Taral Vineet Madhukar | 09 – July |

| Jain Ramesh Bakhtawar Mal | 10 – July |

| Mathuria Mihir Vijaykumar | 10 – July |

| Nankani J. D. | 10 – July |

OUR PUBLICATIONS AVAILABLE FOR SALE

| Sr. No. | Name | Price ₹ |

| 1 | FMCG & Pharmaceutical Industry – GST Issues & Challenges | 150/- |

| 2 | Transitional Provision | 50/- |

| 3 | 46th RRC Book | 175/- |

| 4 | Referencer 2022-23 | 375/- |

| 5 | Referencer 2023-24 | 750/- |

| 6 | Mega Full Day Seminar Booklet 2.7.2022 | 130/- |

| 7 | Half Day Seminar Booklet 17.11.2022 | 100/- |

| 8 | Maharashtra Goods & Service Tax Act along with Rules (MGST Bare Act) | 850/- |

| 9 | Short Publication GST practical guides (5 Book Series) | 555/- |

| 10 | 47th RRC Book | 250/- |

| 11 | Charitable Trusts | 300/- |

| 12 | Mega Full Day Seminar Booklet 09.02.2024 | 150/- |

| 13 | 48th RRC Book | 250/- |

Payment Link for Publication on sale :https://www.gstpam.org/online/purchase-publication.php

GSTPAM News Bulletin Committee for Year 2023-24

Pravin V. Shinde President |

Pradip Kapadia Chairman |

Aloke R. Singh Convenor |

Ashish Ruparelia Jt. Convenor |