GSTPAM News Bulletin March 2022

CIRCULAR FOR RENEWAL OF MEMBERSHIP/SUBSCRIPTION CHARGES FOR THE F.Y. 2021-22

Dear Members,

RENEWAL OF MEMBERSHIP FOR F.Y. 2021-22

The Membership Fees for the year 2021-22 are due for renewal on 01.04.2021. We appreciate your Continuing support and participation in the activities of our Association.

The timely Renewal of Membership will enable the members to continuously receive the updates on various activities of GSTPAM along with the GST Review, News Bulletin, Circulars, Messages, Webinars and online access to the website www.gstpam.org. The Life Members only need to renew the subscription charges for the GST Review. The members can also avail the benefit of discount by paying advance for subsequent two years membership fees /subscription charges.

The Membership Renewal Fees received after 30th April, 2021 will be subject to approval of the Managing Committee. If the Renewal fees for a particular year are not paid, then the member is liable to pay Admission Fees again for Renewal in the subsequent year.

Delayed Renewal Members will be provided Pre Renewal GST Review subject to availability upon payment of such additional courier charges.

The details of Membership/Subscription Fees are given below for your ready reference:

|

Type of Membership |

Membership Fees incl. GST |

Admission Fees Incl. GST |

Subscription Charges for GST Review |

Total |

|---|---|---|---|---|

|

New Membership Application |

||||

|

Donor Member |

24,780.00 |

– |

600.00 |

25,380.00 |

|

Patron Member |

17,700.00 |

– |

600.00 |

18,300.00 |

|

Life Member |

11,800.00 |

944.00 |

600.00 |

13,344.00 |

|

Life Member (Conversion from Ordinary) |

11,800.00 |

590.00 |

600.00 |

12,990.00 |

|

Ordinary Local Member |

1,770.00 |

590.00 |

– |

2,360.00 |

|

Ordinary Outstation Member |

1,475.00 |

590.00 |

– |

2,065.00 |

|

New Membership Application (Firm/LLP) |

||||

|

Ordinary Local Member |

1,770.00 |

944.00 |

0 |

2,714.00 |

|

Ordinary Outstation Member |

1,475.00 |

944.00 |

0 |

2,419.00 |

|

Patron Member |

17,700.00 |

0 |

600.00 |

18,300.00 |

|

Donor Member |

24,780.00 |

0 |

600.00 |

25,380.00 |

|

Advance Membership/ Subscription charges for subsequent two years 2022-23 & 2023-24 (Non-Refundable) |

||||

|

Ordinary Local Member |

3,186.00 |

– |

– |

3,186.00 |

|

Ordinary Outstation Member |

2,655.00 |

– |

– |

2,655.00 |

|

Life Member (Individual/Firm/LLP) |

0 |

– |

1,200.00 |

1,200.00 |

|

Patron Member |

0 |

– |

1,200.00 |

1,200.00 |

|

Donor Member |

0 |

– |

1,200.00 |

1,200.00 |

|

Subscription for GST Review for F.Y. 2021-22 by Non-Members |

||||

|

Subscription fees for GST |

– |

– |

1,000.00 |

1,000.00 |

|

Advance Membership / Subscription charges for subsequent two years 2022-23 & 2023-24 (Non-Refundable) |

||||

|

Subscription Fees -GST |

0 |

– |

2,000.00 |

2,000.00 |

MEMBERSHIP FEES RENEWAL FORM

Link for CIRCULAR FOR RENEWAL OF MEMBERSHIP/SUBSCRIPTION CHARGES

https://www.stpam.org/sites/default/files/4.gstpam_membership_form_0.pdf

SUBSCRIPTION OF GST REVIEW FORM

Link for GST Review

https://www.stpam.org/sites/default/files/1614317239625_1614317015557_subscription_renewal_form_.pdf

Modes of Payment:-

|

Cheque |

A/c Payee Cheque drawn in favor of “The Goods & Services Tax Practitioners’ Association of Maharashtra” payable at Mumbai. |

|

NEFT Details |

The Goods & Services Tax Practitioners’ Association of Maharashtra Bank of India, Mazgaon Branch Online generated transaction Acknowledgment should be sent by email on [email protected] along with membership and payment details Members are requested to send their physical form to the association for Approval, Issuance and Office record. |

|

Cash |

Renewal form along with requisite amount will be accepted between 10.30 a.m. and 5.30 p.m. on all working days except Saturday at our Office at Mazgaon Library – Mazgoan: 1st Floor, 104, GST Bhavan, Mazgaon, Mumbai – 400 010 Or Bandra Library – GST Bhavan, Ground Floor, A Wing, Bandra Kurla Complex, Bandra (East), Mumbai – 400 051. Or Mazgaon Tower-8 & 9, Mazgaon Tower, 21, Mhatar Pakhadi Road, Mazgaon, Mumbai – 400 010. |

|

Identity (New Members) |

New Members should provide the following as Identity Proof : PAN, Aadhar Card, Constitution Document. Address Proof(any one) : Electricity Bill / Passport/ Aadhar Card / Driving License/ Voter id/ Ration Card along with Membership Form |

|

Identity Card (For Renewals) |

Ordinary Local/Outstation Members should provide Two Photographs along with the Renewal Form for issue of I-cards. |

|

Online Payment Link |

Members can make online payment on our website Payment Link : https://www.stpam.org/payonline/845 |

We value your continuation of the membership and look forward to your renewal to this effect.

Mahesh Madkholkar

Parth Badheka

Hon. Jt. Secretary

Dated:- 04.08.2021

RECENT ADVANCE RULINGS UNDER GSTBrief Analysis by |

|

-

Whether vouchers are goods or money or actionable claim and whether trading in vouchers attracts GST?

Appellant is engaged in the business of providing marketing services in the area of sourcing and supply of e-vouchers. Appellant issues vouchers having pre-defined face value to its customers who in turn can redeem the vouchers at any of the specified merchants who have agreed to accept the vouchers as consideration for goods or services supplied by them. Appellant enters into agreement with merchants for the purchase of several types of vouchers such as ‘gift vouchers’, ‘cashback vouchers’ and ‘open vouchers’ which are redeemable with the specified merchants.

Appellant approached the Karnataka AAR (KAAR) to obtain a ruling on the question of applicability of GST on the sale of vouchers and time of supply thereof. The KAAR vide its order dated 30/07/2021 held that the supply of vouchers is taxable and the time of supply in case of all three types of vouchers would be governed by sec. 12(5) of CGST Act. The KAAR also held the vouchers to be goods and liable to GST @ 18% as per entry no. 453 of Schedule III of Notification No. 01/2017-CT(R), dated 28/06/2017.

In appeal, the Appellant submitted that the voucher signifies assignment of beneficial interest or a right to claim the goods which are not in possession of the beneficiary, either actual or constructive. The voucher itself has no value. It is only a claim for beneficial interest in the goods or services assured in the voucher. The voucher gives the beneficiary a specific right to the goods or services underlying it. Therefore, the voucher answers to the definition of “actionable claim” as defined in sec. 2(1) of CGST Act, 2017 r/w sec. 3 of the Transfer of Property Act, 1882. The Appellant thereby prayed that the ruling of KAAR be set aside and it be held that the vouchers by themselves are not goods or services.

The Karnataka AAAR by referring to the RBI guidelines issued under the Payment and Settlement Systems Act, 2007 concluded that the vouchers in question are undoubtedly payment instruments recognised by RBI. At the same time, by referring to the definition of “money” u/s 2(75) of CGST Act, the Appellate Authority agreed with the finding of the KAAR that the vouchers are not used by the Appellant to settle an obligation and hence cannot be considered as ‘money’ and that it takes the colour of money only when it is redeemed by the beneficiary at the time of purchase of goods and/or services. The Appellate Authority further observed that the voucher in the hands of the Appellant does not settle an obligation but rather creates an obligation. The definition of money also makes it clear that it is only when the payment instrument is used as consideration to settle an obligation, does it qualify as ‘money’. This occurs only when the voucher is redeemed. Until then it is just an instrument recognised by the RBI but is not ‘money’. Therefore, the voucher in the hands of the Appellant cannot be termed as ‘money’.

Regarding the question of whether the vouchers can be considered as ‘goods’, the Appellate Authority referred to the definition of “goods” under the CGST Act, the definitions of “movable property” and “immovable property” under the General Clauses Act, 1977 and observed that the vouchers have both a value and an ownership and the ownership gets transferred from the person who first purchases the voucher from the issuer to the ultimate beneficiary who redeems the voucher. Therefore, the vouchers qualify to be considered as movable property and hence qualify as ‘goods’.

Regarding the Appellant’s contention that the vouchers are in the nature of actionable claims, the Appellate Authority analysed the definition of “actionable claim” as provided u/s 3 of the Transfer of Property Act, 1882 and concluded that the vouchers cannot be considered as actionable claim since although the vouchers is a movable property, it is in the possession of the claimant at the time of the claim.

While distinguishing the argument of the Appellant that vouchers are akin to lottery tickets and its reliance on the Supreme Court’s decision in the case of Sunrise Associates holding that lottery tickets are actionable claims, the Appellate Authority observed that while lottery tickets have no innate value, it is not so in the case of vouchers. The value of the voucher is the extent to which a beneficiary can claim possession of goods and/or services from the specified suppliers.

The Appellate Authority upheld the ruling of KAAR on all the aspects of value, rate of tax and time of supply of vouchers by the Appellant.

(Karnataka AAAR Order No. KAR/AAAR/11 OF 2021-22 dated 22/12/2021 in the case of Premier Sales Promotion Pvt. Ltd.)

-

Whether GST is payable on recovery of part amount from employees towards provision of canteen and bus transportation facility at subsidised rates?

Whether GST is payable on notice pay recovery made from employees?

Applicant is a company engaged in developing, manufacturing and marketing of pharmaceutical products. It provides canteen and bus transportation facility to its employees at subsidised rate as part and parcel of the employment arrangement. Applicant has engaged third-party service provides to provide the said facilities and the service providers raise invoices with applicable GST on the Applicant. Applicant recovers a certain portion of the consideration paid to such third-party service providers from its employees. Further, in cases where employees resign and leave employment without serving the mandated notice period, the Applicant deducts salary for the unserved tenure of notice period as a compensation for breach of the terms of employment agreement by the employees (commonly known as “notice pay recovery”).

The Authority observed that the provision of canteen facility to the employees is a welfare measure, also mandated by the Factories Act and is not at all connected to the functioning of their business of developing, manufacturing and marketing pharmaceutical products. Further, the said activity is not a factor which will take the applicant’s business activity forward. It further observed that the canteen facility is provided to the employees by the third-party vendors and not by the Applicant. Therefore, the Applicant is not providing any canteen facility to its employees, in fact Applicant is a receiver of such services. The Authority concluded that the Applicant is not liable to pay GST on the recoveries made from the employees towards providing canteen services at subsidised rates for the reason that the provision of canteen facility by the Applicant to its employees is not a transaction made in the course or furtherance of business. Applying the same analogy for the provision of bus transportation facility to employees at a subsidised rate, the Authority observed that GST would not be payable on the recoveries made from employees towards providing bus transportation facility.

Regarding the issue of notice pay recovery, the Authority relied on the ruling of Madhya Pradesh AAAR in the case of Bharat Oman Refineries Ltd. (Advance Ruling No. MP/AAAR/07/2021, dated 08/11/2021 as well as the decision of the Hon’ble Madras High Court in the case of GE T&D India Ltd. v. Deputy Cmmr. of Central Excise, LTU, Chennai reported in 2020-VIL-39-MAD-ST to conclude that the recovery of notice pay from dues of employee / payment of notice pay by the employee who could not serve the notice period as per contractual agreement does not amount to supply and is not liable to GST.

(Maharashtra AAR Order No. GST-ARA- 119 OF 2019-20/B-03 dated 04/01/2022 in the case of Emcure Pharmaceuticals Ltd.)

-

Whether subscription charges for access to online legal database are exempt from GST when collected from educational institutions?

Applicant is in the business of providing online text-based information such as online books, newspapers, periodicals, directories, etc. (Judgements/ Notifications/ Bare Acts/ Rules/ E-books/ News/ Articles) through their website to law firms, lawyers, companies, government, judiciary, law schools. As per the Applicant’s understanding of the law, the said service is liable to be taxed @ 18%. However, a question arose as to whether the supply of such services to law schools is eligible for exemption under Entry No. 66 of Notification No. 12/2017-CTR which reads as under:

“Services provided to an educational institution by way of supply of online educational journals or periodicals.”

The Authority observed that the exemption is applicable only to supply of online educational journals or periodicals and that the said entry does not cover supply of e-books, newspapers, directories and non-educational journals or periodicals. The Authority further observed that the invoices issued by the Applicant to the educational institutions describe the services as ‘Annual subscription to online database’ and there is no mention of “online educational journals or periodicals”. As such, the Applicant is collecting a subscription fee which is nothing but the fee charged to gain access to the data available in the database and to download the articles for information.

The Authority further distinguished the database from journals or periodicals by referring to the dictionary meaning of the terms and concluded that the services provided by the Applicant to the educational institutions do not fall under the entry of the exemption notification.

(Uttar Pradesh AAR Order No. UP ADRG 87/2021 dated 25/11/2021 in the case of Manupatra Information Solutions Pvt. Ltd.)

INCOME TAX UPDATESBy CA. Ajay Talreja |

|

TAXATION OF GOLD AND GOLD PRODUCTS

There are many avenues through which one can invest in gold. The major mediums are jewellery, gold coins, gold ETF, Sovereign Gold Bonds (SGB), and Gold Deposit Certificates (GDC). The profits on these products are taxed differently. For the purposes of taxation, we can divide the products into two categories. In the first categories are gold products like jewellery, gold coins and gold ETF and the other category comprises of SGB and GDC . Let us examine the tax implications of both the categories of gold products.

Tax on physical gold, Gold ETF and gold mutual funds units The investments in gold products of the first category are treated as capital asset under the income tax laws so any gains realised over its acquisition cost is taxed under the head “Capital Gains”. However, those who deal in gold as jeweller or bullion traders, the same gets taxed as business profits in respect of their investments in gold/ jewellery for business purposes. However, the gold jewellery and gold coins held by these persons as personal investments are treated as capital assets only like other taxpayers. The rate at which your profits on gold products gets taxed depends on the period for which you have held the investments. In case the product is sold after 36motnhs the profits are treated as long term capital gains and taxed at the flat rate of 20% after applying the cost inflation index to the cost of acquisition. In case these are sold within 36 months, the gains are treated as short term capital gains and taxed at the slab rate applicable to you. Since many of us get the gold jewellery as gift or as inheritance, the cost for the purpose of computing capital gains is taken the cost of purchase for the previous owner who had paid for it. The gift of jewellery received at the occasion of marriage, from certain specified relatives and the one inherited are fully tax free at the time of its receipt. But gift of jewellery from other person are exempt only as long as aggregate of all the gifts in any form received by you during the year does not exceed fifty thousand rupees. Once the aggregate of all the gifts from all the sources excluding the above gifts crosses the magic figure of fifty thousand rupees whole of the value of gifts received by you becomes taxable in your hands. Though the gift from relatives, on the occasion of marriage and as inheritance are fully tax free in your hands but you will have to pay capital gains tax as and when you sell such jewellery in future. For computing the capital gains in such special cases the holding period for capital gains is computed with reference to the period from the date when it was bought by any of the previous owners. For example, for the gold jewellery gifted to you by your mother which she had received from her father at the time of her marriage and which was purchased by your grandfather for Rs one lakhs, then Rs. one Lakhs shall be taken as your cost of acquisition for you at the time of sale. In case the jewellery was bought before April 1, 2001, the market value as on 1st April 2001 is to be taken as your cost and which is to be further increased by applying the cost inflation index. As per the explicit language of the law, the indexation benefit in case of jewellery received by as inheritance/ gift is available only from the year in which you actually received it. However, few of high courts have allowed the benefit of indexations from the year in which the previous owner who had in fact bought it for a consideration.

Taxation of SGB and GDC The GDC issued against tender of gold under the Gold Monetisation Scheme 2015 are not capital asset under the income tax laws therefore the appreciation in value during its tenure are fully tax free on redemption/ maturity of such deposits. The interest which you received against these certificates is also exempt from income tax. However, the interest paid by the government on your SGB, which is also part of the gold monetisation scheme, is to be included in your income and gets taxed at your slab rates. The appreciation in value of SGB at the time of its redemption is tax free but if you sell these bonds in open market the profits made will get taxed as

capital gains ; short term or long term depending on the holding period. The exemption at the time of redemption is available whether you have originally applied for the SGB or have purchased in the open market regardless of the holding period. How can you save on such long term capital gains In case you have long term capital gains on sale of any of the above gold products, you can avail exemption under Section 54F provided you invest the sale consideration in buying or constructing a residential house within specified period under Section 54 F of the Income Tax Act. In case you do not invest the full consideration, the exemption will get reduced proportionately. I am sure by now you have fully understood the tax implications of investing in various gold products. In my opinion if you wish to just invest in gold for long period to take benefit of appreciation in its price, SGB offers you tax efficient avenue of doing so.

How to check if the income tax notice is true

Here’s how to verify the income tax notice you received:

Step 1: Visit www.incometax.gov.in

Step 2: On the Home page, under the ‘Our Services’ option, select ‘Authenticate’.

Step 3: A new webpage will open on your computer screen. You will be given two options to authenticate the documents you received.

You can certify the document either by PAN, year of assessment, notification section, month and year of issue or by DIN. In both cases, you will need to enter your mobile number. If you selected the first option, i.e., PAN, by assessment year, then select that option and enter the required details along with the mobile number.

On the other hand, if you choose the second option, you need to enter the DIN mentioned on the notice and mobile number.

Step 4: One-time password (OTP) will be sent to your mobile number. The OTP received will only be valid for 15 minutes.

Step 5: After entering OTP, click on ‘Continue’. Once the OTP is authenticated, if the notice or order issued to you is genuine, it will appear on the website. The website will show you the message: “Yes, the notice is valid and issued by the Income Tax Authority”. However, if the notice issued to you is not true, the website will say, “No such record was found for the document number / given criteria”. This facility will help the taxpayers to face the problem of fake notices. This tool provided by the e-filing portal can be used to verify the authenticity of documents or communications received from the department or any order issued by the tax authorities. Using this functionality, phishing emails and fraudulent communications Any documents or suggestions received by email are also uploaded to the e-filing portal from the department, however, its authenticity can also be verified using this tool.

INCOME TAX CIRCULARS & NOTIFICATIONSCompiled by |

|

No Circulars have been issued in the month of February.

|

Income Tax Notifications |

||

|---|---|---|

|

Notification No. |

Date of Issue |

Subject |

|

13/2022 |

10.02.2022 |

Corrigendum – Notification No. 11/2022 dated 27.01.2022 may be read as Notification No.12/2022. |

|

14/2022 |

03.03.2022 |

For the purpose of section 35(1)(ii) of the Income-tax Act, 1961 r.w.rs 5C and 5E of the Income-tax Rules, 1962, the Central Government hereby approves ‘Sri Shankara Cancer Foundation, Bangalore (PAN:AAHTS5593F)’ under the category of ‘University, College or other institution’ for Scientific Research. This Notification shall apply from the Previous Year 2021-22 and accordingly shall be applicable for Assessment Years 2022-2023 to 2026-2027. |

DGFT & CUSTOMS UPDATEBy CA. Ashit Shah |

|

-

Social Welfare Surcharge

Social Welfare Surcharge (SWS) is levied and collected, as a duty of customs is calculated @ 10 % on the aggregate of duties, taxes and cesses which are levied and collected by the Central Government as a duty of customs on goods imported into India.

Clarification was sought on the issue of applicability of SWS on goods that are exempted from basic customs duty or taxes or cesses which are levied as a duty of customs.

It is clarified that the amount of SWS payable would be ‘Nil’ in cases where the aggregate of customs duties (which form the base for computation of SWS) is zero even though SWS has not been exempted.

[Circular No. 3/2022 – Customs, dated 01-02-2022]

-

Import of goods at concessional rate of Duty Rules

Certain amendments were carried out in existing Customs (Import of Goods at Concessional Rate of Duty) Rules, 2017 vide N. No. 07/2022 – Customs (NT), dated 01-02-2022. These changes are aimed at simplifying the procedures with a focus on automation and making the entire process contact-less and come in to force from 01-03-2022. Detailed procedure to be followed by importer is provided in Circular.

[Circular No. 4/2022- Customs, dated 27-02-22]

-

Revoking Anti-dumping Duty on Flat rolled product of Steel

Anti-dumping Duty (ADD) imposed on imports of “Flat rolled product of steel, plated or coated with alloy of Aluminum or Zinc” originating in or exported from China PR, Vietnam and Korea RP vide Notification No. 16/2020-Cus (ADD) dated 23.06.2020.

[N. No. 7/2022 – Customs (ADD), dated 01-02-2022]

-

Anti-dumping Duty on Aluminum Foil

Anti-Dumping Duty (ADD) on imports of “Aluminium foil of thickness ranging from 5.5 micron to 80 micron” originating in or exported from People’s Republic of China, imposed vide Notification No. 23/2017-Customs (ADD), dated 16th May, 2017. The levy is further extended till 15th June, 2022.

[N. No. 8/2022 – Customs (ADD), dated 14-02-2022]

-

Anti-dumping Duty on Tiles

Anti-dumping duty (ADD) on imports of ‘Glazed/Unglazed Porcelain/Vitrified tiles in polished or unpolished finish with less than 3% water absorption falling under headings 6907 or 6914 of the First Schedule to the Customs Tariff Act, 1975, originating in, or exported from, the People’s Republic of China and imported into India. The product does not cover Micro-crystal tiles, Full body tiles and Thin Panels below 5 mm thickness. Duty is imposed for a period of 5 years.

[N. No. 9/2022 – Customs (ADD), dated 24-02-2022]

-

Anti-dumping Duty on Jute Products

Anti-dumping duty (ADD) on imports of “Jute products” namely, Jute Yarn/Twine (multiple folded/cabled and single), Hessian fabric, and Jute sacking bags falling under Tariff Headings 5307, 5310, 5607 or 6305 of the First Schedule to the Customs Tariff Act, originating in or exported from Bangladesh and Nepal was imposed vide N. No. 01/2017-Customs (ADD), dated 5th January, 2017. The levy is further extended till 30th June, 2022.

[N. No. 10/2022 – Customs (ADD), dated 24-02-2022]

-

Countervailing Duty (CVD) on Stainless Steel Flat Products

Countervailing duty (CVD) was imposed on imports of “Certain Hot Rolled and Cold Rolled Stainless Steel Flat Products” originating in or exported from China PR vide Notification No. 1/2017- Customs (CVD) dated 07.09.2017. This levy is now removed on rescinds of the notification.

[N. No. 01/2022 – Customs (CVD), dated 01-02-2022]

-

Last date of submitting applications for incentives under MEIS, SEIS, ROSCTL etc. extended to 28.02.2022

The last date of submitting applications under MEIS, SEIS, ROSCTL, ROSL and 2% additional ad hoc incentive has been further extended. Earlier the extended date was 31.01.2022 and it has been further extended till 28.02.2022.

[Notification No. 53/2015-2020 – DGFT, dated 01-02-2022]

CHARITABLE TRUSTS UPDATESBy Adv. Hemant Gandhi & |

|

Provisions Applicable to Section 10(23C) Registered Institutions like registered Education or Medical Institutions. [With effect from assessment year 2023-24]

The Educational or Medical Institutions registered under Section 10 (23C) of the Income-tax Act,1961 were enjoying many benefits like not compulsory maintenance of books of return or fling of returns, exemption in mode of investment or spending and accumulation of income etc all of this is going to change with the proposals as enumerated in the Union Budget, this will be sweeping changes and unless these Institutions do not tighten their way of working, they may soon face the wrath of the Income Tax Department.

Under the existing provisions of the Act, a trust or institution is required to apply 85% of its income during any previous year. If it is not able to apply 85% of its income during the previous year, it can accumulate such income for a period not exceeding 5 years. As per Section 11(2), the accumulation of income allowed subject to the fulfilment of certain conditions. However, there are no such conditions provided explicitly under the third proviso to Section 10(23C) of the Act.

The Finance Bill, 2021 proposes to insert Explanation 3 to the third proviso of Section 10(23C) to provide for accumulation related conditions similar to Section 11.

Conditions to be complied with

If 85% of the income is not applied, wholly and exclusively for the objects for which the trust or institution is established, during the previous year but is accumulated or set apart, either in whole or in part, for application to such objects, such income so accumulated or set apart shall not be included in the total income of the previous year of the person in receipt of the income, provided the following conditions are complied with:

-

Such person furnishes a statement in the prescribed form and in the prescribed manner to the Assessing Officer, stating the purpose for which the income is being accumulated or set apart and the period for which the income is to be accumulated or set apart, which shall in no case exceed 5 years.

-

The money so accumulated or set apart is invested or deposited in the forms or modes specified in section 11(5).

-

The statement is furnished on or before the due date specified under Section 139(1) for furnishing the return of income for the previous year.

However, while computing the period of 5 years, the period during which the income could not be applied for the purpose for which it is so accumulated or set apart, due to an order or injunction of any court, shall be excluded.

Taxability of Accumulated Income

The income accumulated shall be deemed to be the income of such trust or institution in the following events:

|

Circumstances |

Income of Previous Year |

|---|---|

|

Income applied for purposes other than wholly and exclusively for the objects for which the trust or institution is established |

In which it is so applied |

|

Income ceases to be accumulated or set apart for application |

In which it ceases to be so accumulated or set apart |

|

Ceases to remain invested or deposited in Section 11(5) modes |

In which it ceases to remain so invested or deposited |

|

Income not utilised for the purpose for which it is so accumulated or set apart. |

Being the previous year of the period, for which the income is accumulated or set apart but not utilised for the purpose for which it is accumulated or set apart. |

|

Credited or paid to any trust or institution registered under section 12AA or section 12AB or institutions referred under sub-clauses (iv), (v), (vi) and (via) of section 10(23C). |

In which it is credited or paid to other trust or institution. |

Non-application of income in circumstances beyond the control

It is proposed to insert an Explanation 5 to the third proviso to Section 10(23C) of the Act to enable the Assessing Officer to allow trusts or institutions, in the circumstances beyond their control, to apply such accumulated income for such other purpose in India as is specified in the application by such person subsequent to fulfilment of specified conditions.

These other purposes are required to be in conformity with the objects for which the trust or institution is established. If it is done, it shall be deemed as if the purpose specified by such person in the application under this Explanation were a purpose specified in the notice given to the Assessing Officer.

However, the Assessing Officer shall not allow the application, of any accumulated income to be credited or paid to any trust or institution registered under section 12AA or Section 12AB or institutions referred under sub-clauses (iv), (v), (vi) and (via) of section 10(23C).

4.8. Provisions of accreted income extended to institutions approved under section 10(23C) [Applicable from Assessment Year 2023-24]

The Finance Act, 2016 introduced Chapter XII-EB to tax the accreted income of the trust in certain cases. Such tax is attracted when the organisation is converted into a non-charitable organisation or gets merged with a non-charitable organisation or a charitable organisation with dissimilar objects or does not transfer the assets to another charitable organisation.

Such tax on accreted income shall be levied at the maximum marginal tax rate, and this tax is in addition to income-tax chargeable in the hands of trust or institution.

The Finance Bill, 2022 proposes amendments to Sections 115TD. 115TE and 115TF to make them applicable to any trust or institution under the first regime.

After the proposed amendments, the provisions of tax on accreted income shall be as under:

When will the accreted tax be levied?

Tax on accreted income is levied in the following circumstances:

-

If a trust is converted into any form which is not eligible for grant of registration under section 12AA or Section 12AB, or approval under sub-clauses (iv), (v), (vi) and (via) of section 10(23C).

-

If it is merged with any entity which is not having objects similar to it and not registered under section 12AA or Section 12AB or approved under sub-clauses (iv), (v), (vi) and (via) of section 10(23C).

-

If it failed to transfer upon dissolution all its assets to any other specified person within 12

months from the end of the month in which the dissolution takes place.

When is trust deemed to be converted?

A trust or an institution shall be deemed to have been converted into any form not eligible for registration under section 12AA or Section 12AB or approval under sub-clauses (iv), (v), (vi) and (via) of section 10(23C) in the following cases:

-

If the registration or approval granted to it has been cancelled.

-

It has adopted or undertaken modifications of its objects which do not conform to the conditions of registration, and it has not applied for fresh registration or its application for fresh registration has been rejected.

Rate of tax on the accreted income

The tax on accreted income shall be levied at the maximum marginal tax rate, and this tax is in addition to income-tax chargeable in hands of trust or institution. This shall be leviable even if the trust or institution does not have any other income chargeable to tax in the relevant previous year. Further, no deduction or credit can be taken by the trust or institution for such tax levied on accreted income.

Calculation of Accreted Income

Accreted income shall be the aggregate fair market value (FMV) of the total assets of trust as reduced

by the total liability as on the specified date. The specified date shall be the following:

-

the date of the order cancelling the registration or approval as the case may be;

-

the date of adoption or modification of any object;

-

the date of merger with an entity which is not having similar objectives and not registered or approved;

-

the date of dissolution where the trust fails to transfer all its assets to any other registered trust or institution.

Computation of FMV of Assets

The Fair Market Value of the total assets shall be computed in accordance with Rule 17CB. However, the following assets (and their respective liabilities, if any) shall be ignored while calculating the accreted income:

-

Amount of pre-paid taxes (i.e., TDS, TCS, Advance tax) as reduced by the amount of Income- tax refund claimed;

-

Any amount shown in the balance-sheet as asset which does not represent the value of any asset (i.e., unamortized amount of deferred expenditure, deferred tax asset, etc.);

-

Any asset which has been directly acquired by the trust or institution out of its agricultural income;

-

Any asset acquired by the trust or institution during the period beginning from the date of its creation or establishment and ending on the date from which the registration under section 12AA or Section 12AB or approval under Section 10(23C) became effective. Exclusion of such asset shall be allowed only if the trust or institution has not been allowed any exemption under Sections 11 and 12 or Section 10(23C) during the said period;

-

Any asset which has been transferred to any other trust or institution registered under Section

12AA or Section 12AB or approved under Section 10(23C) within the specified period.

Computation of Liabilities

The total liability of the trust or institution shall be the book value of liabilities in the balance sheet on the specified date but not including the following:

-

capital fund or accumulated funds or corpus, by whatever name called;

-

reserves or surpluses or excess of income over expenditure, by whatever name called;

-

Contingent Liabilities;

-

Provisions for unascertained liabilities; (e) Excess provision for tax (including deferred tax liability).

Time Limit to pay tax

The trust or institution shall be liable to pay the tax on accreted income to the credit of the Central Government within 14 days. The period of 14 days shall be counted from the specified date which shall be the date as explained in below circumstances.

In case of cancellation of registration

If the registration of trust is cancelled and the trust does not file an appeal under Section 253 to Tribunal, the period of 14 days shall be counted from the date on which the filing of appeal expires.

However, if cancellation order is challenged in an appeal to the Tribunal, the period of 14 days shall be counted from the date on which order confirming cancellation of registration is received by trust.

In case of modification of objects

If objects of the trust have been modified and trust do not apply for fresh registration, the period of 14 days shall be counter from the end of the previous year in which objects of trust have been modified.

However, if trust applies for fresh registration but his application is rejected and trust does not file an appeal to the Tribunal, the period of 14 days shall be counted from the date on which the period for filing of appeal to Tribunal expires. In case an appeal is filed to the Tribunal, the time period shall be counted from date on which order confirming cancellation of registration is received by the trust.

In my view, the provisions of 10(23C) are more or less the mirror image of section 11 to 13 of the Act. I would not be surprised that in couple of years they get merged into one section. Hold your Breath for the same. I am saying so at the cost of putting my neck on the line but I shall take that risk.

GOLDEN RULES OF INVESTMENTBy Mr. Tushar P. Joshi |

|

Benefit of Starting Early

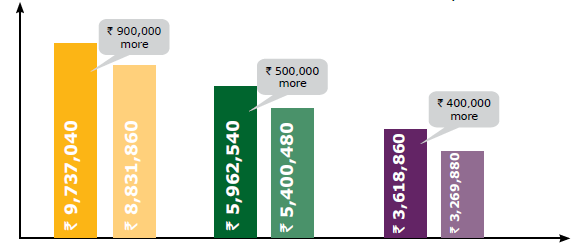

Annual Saving of ₹ 20,000 per year, started by two individuals at different ages, until age 65 at 10% investment yield

Person who invested same amount, however, started just one year before other person, got much higher maturity amount. HENCE START EARLY

| Cost of Waiting | ||||

|---|---|---|---|---|

|

Age |

25 |

25 |

|

|

Investment Period |

25th-31st yrs (7 years) |

32nd years onwards | ||

|

Amount of Investment per year |

₹ 20,000 |

₹ 20,000 | ||

|

Total Investment |

₹ 1,40,000 in 7 years |

₹ 6,60,000 in 33 years | ||

|

Value at the end of 15th year |

₹ 447,410 |

₹ 251,580 | ||

|

Value at the end of 30th year |

₹ 1,868,942 |

₹ 1,749,940 | ||

|

Value at the end of 40th year |

₹ 4,847,554 |

₹ 4,889,500 | ||

Note : Assumption of 10% annual growth

WITH MUCH LESSER INVESTMENT JAY’S MATURITY PROCEEDS ARE ALMOST EQUAL TO VEERU, BETTER TO START EARLY THAN TO PAY FOR COST OF WAITING.

Power of Compounding

|

Amount Investment (in `) |

||||||

|

₹ 1,000 per month |

₹ 3,000 per month |

₹ 5,000 per month |

||||

|

Years |

Amount Invested |

Fund Value |

Amount Invested |

Fund Value |

Amount Invested |

Fund Value |

|

5 |

60,000 |

78,082 |

1,80,000 |

2,34,247 |

3,00,000 |

3,90,412 |

|

10 |

1,20,000 |

2,06,552 |

3,60,000 |

6,19,656 |

6,00,000 |

10,32,760 |

|

15 |

1,80,000 |

4,17,924 |

5,40,000 |

12,53,773 |

9,00,000 |

20,89,621 |

|

20 |

2,40,000 |

7,65,697 |

7,20,000 |

22,97,091 |

12,00,000 |

38,28,485 |

|

25 |

3,00,000 |

13,37,890 |

9,00,000 |

40,13,671 |

15,00,000 |

66,89,452 |

|

30 |

3,60,000 |

22,79,325 |

10,80,000 |

68,37,976 |

18,00,000 |

1,13,96,627 |

COMPOUNDING CAN MAKE EVEN SMALL INVESTMENT BECOME LARGE WITH TIME!

UPDATES ON FINANCECompiled by

|

|

Highest 1 Year FD Rates (As on 01st March 2022) < ₹ 2 Crore.

|

Institution |

1 Year FD Rate |

|

Equitas Small Finance Bank |

6.00% |

|

Yes Bank |

5.75% |

|

Jana Small Finance Bank |

6.75% |

|

RBL Finance Bank |

6.25% |

|

Indusind Bank |

6.00% |

Note : Senior Citizens would generally get 0.50% more than the above mentioned rates.

Post Office Deposit Rates (As on 01st March 2022).

|

Particulars |

Rate of Interest |

Maximum Deposit (Rs) |

|

Post Office Saving Account |

4.00% p.a. |

No Limit |

|

National Saving Recurring Deposit Account |

5.8% p.a. |

No Limit |

|

National Saving Time Deposit Account |

5.5% p.a. (Upto 3 Yrs) |

No Limit |

|

Senior Citizen Saving Scheme Account (SCSS) |

7.40% p.a. |

15,00,000/- p.a. |

|

Public Provident Fund (PPF) |

7.1% p.a. (Annually Compounded) |

1,50,000/- p.a. |

|

National Savings Certificates (NSC) |

6.8% p.a. (Annually Compounded) |

No Limit |

|

Kisan Vikas Patra (KVP) |

6.9% p.a. (Annually Compounded) |

No Limit |

|

Sukanya Samriddhi Accounts |

7.6% p.a. (Annually Compounded) |

1,50,000/- p.a. |

Lowest Home loan Rates for Self Employed Professionals (As on 01st March 2022).

|

Institution |

Rate |

|

Union Bank of India |

6.60% onwards |

|

Kotak Mahindra Bank |

6.55% onwards |

|

Saraswat Co-op Bank |

6.70% onwards |

|

HDFC Bank |

6.70% onwards |

|

HSBC Bank |

6.45% onwards |

Top Performing Mutual Funds (As on 01st March 2022).

|

Fund Name |

Current NAV |

1 Year Returns |

|

Invesco India Infra – Direct (G) |

33.74 |

61.20% |

|

Axis Small Cap Fund – Direct (G) |

64.99 |

61.22% |

|

Invesco India Infra –(G) |

27.05 |

55.28% |

|

Axis Small Cap Fund (G) |

61.25 |

60.25% |

Major Currency Rates (As on 01st March 2022).

|

Country |

In Rs. on 01/04/21 |

In Rs. on 01/02/22 |

In Rs. on 01/03/22 |

Change MoM (Rs) |

YTD Returns |

|

United States of America (USA) – USD($) |

73.13 |

74.55 |

75.75 |

1.60% |

3.58% |

|

United Kingdom (UK) – GBP (₤) |

101.34 |

100.25 |

100.93 |

-0.67% |

-0.40% |

|

European Union (EU) – Euro (€) |

86.30 |

83.78 |

83.78 |

0% |

-2.92% |

Major Commodity Rates (As on 01st March 2022).

|

Commodity |

Rate on 01/04/21 |

Rate on 01/02/22 |

Rate on 01/03/22 |

Change MoM |

YTD Returns |

|

Gold (MCX) – 10 Gms |

45,420.00 |

47,705.00 |

51,564.00 |

8.08% |

13.52% |

|

Silver (MCX) – 1 Kg |

65,092.00 |

61,643.00 |

67,904.00 |

10.15% |

4.32% |

|

Crude Oil (MCX) – 1 Unit (BBL) |

4,515.00 |

6,567.00 |

9,830.00 |

49.68% |

117.71% |

Indian Indices

|

Index |

1st April 2021 |

1st February 2022 |

1st March 2022 |

MoM Returns |

YTD Returns |

|

Sensex (BSE) |

50,029.83 |

58,862.57 |

55,468.90 |

-5.76% |

10.87% |

|

Nifty 50 (NSE) |

14,867.35 |

17,576.85 |

16,605.95 |

-5.52% |

11.69% |

|

Bank Nifty |

33,858.00 |

38,450.50 |

35,372.80 |

-8.00% |

4.47% |

Global Indices

|

Index |

1st April 2021 |

1st February 2022 |

1st March 2022 |

MoM Returns |

YTD Returns |

|

Dow Jones (USA) |

33,153.21 |

35,405.24 |

33,813.48 |

-4.49% |

1.99% |

|

Nasdaq (USA) |

13,480.11 |

14,346.00 |

13716.70 |

-4.38% |

1.75% |

Disclaimer : Utmost care has been taken to present accurate figures. However, the reader is advised to verify the same and consult a Financial Advisor before taking any financial decision.

OUR PUBLICATIONS AVAILABLE FOR SALE

|

Sr. No. |

Name |

Price ₹ |

|

1 |

E-way Bill under GST |

100/- |

|

2 |

GST Refunds – Law, Procedure Practice |

200/- |

|

3 |

Export of Goods and Services & Supplies to & form Special economic zones under the GST Laws |

60/- |

|

4 |

Import of Goods and Services under the Goods & Services Tax Laws |

50/- |

|

5 |

MSTT Case Law Digest 2009-14 |

400/- |

|

6 |

Transitional Provision |

50/- |

|

7 |

46th RRC Book |

175/- |

Payment Link for Publication on Sales : https://gstpam.org/payonline1/847

GSTPAM News Bulletin Committee for Year 2021-22

Parth Badheka Chairman |

Jatin N. Chheda Jt. Convenor |

Aloke R. Singh Jt. Convenor |

This News Bulletin is available on GSTPAM website

www.gstpam.org/news