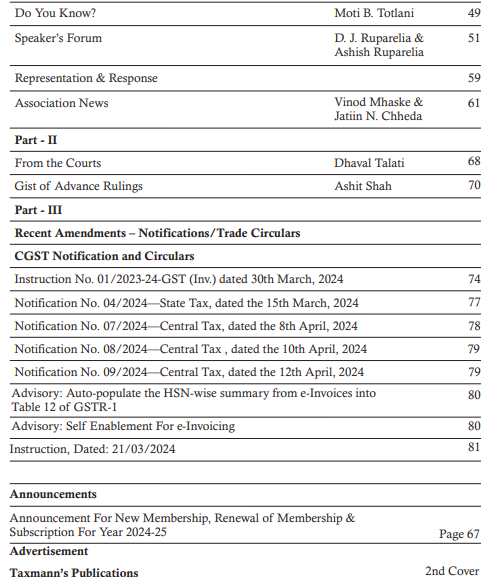

GSTPAM News Bulletin May 2024

CIRCULAR FOR RENEWAL OF MEMBERSHIP/SUBSCRIPTION CHARGES FOR THE F.Y. 2024-25

Dear Members,

RENEWAL OF MEMBERSHIP FOR F.Y. 2024-25

The Membership Fees for the year 2024-25 are due for renewal on 01.04.2024. We appreciate your Continuing support and participation in the activities of our Association.

The timely Renewal of Membership will enable the members to continuously receive the updates on various activities of GSTPAM along with the GSTReview, News Bulletin, Circulars, Messages, Webinars and online access to the website www.gstpam.org. The Life Members only need to renew the subscription charges for the GST Review. The members can also avail the benefit of discount by paying advance for subsequent two years membership fees /subscriptioncharges.

The Membership Renewal Fees received after 30th April, 2024 will be subject to approval of the Managing Committee. If the Renewal fees for a particular year are not paid, then the member is liable to pay Admission Fees again for Renewal in the subsequent year.

Delayed Renewal Members will be provided Pre Renewal GST Review subject to availability upon payment of such additional courier charges.

The details of Membership/Subscription Fees are given below for your ready reference

|

Type of Membership |

Membership Fees incl. GST | Admission Fees Incl.GST | Subscription Charges for GST

Review |

Total |

| New Membership Application | ||||

| Donor Member | 24,780.00 | – | 600.00 | 25,380.00 |

| Patron Member | 17,700.00 | – | 600.00 | 18,300.00 |

| Life Member | 11,800.00 | 944.00 | 600.00 | 13,344.00 |

| Life Member (Conversion from Ordinary) | 11,800.00 | 590.00 | 600.00 | 12,990.00 |

| Ordinary Local Member | 1,770.00 | 590.00 | – | 2,365.00 |

| Ordinary Outstation Member | 1,475.00 | 590.00 | – | 2,065.00 |

New Membership Application (Firm/LLP)

| Ordinary Local Member | 1,770.00 | 944.00 | 0 | 2,174.00 |

| Ordinary Outstation Member | 1,475.00 | 944.00 | 0 | 2,419.00 |

| Patron Member | 17,700.00 | 0 | 600.00 | 18,300.00 |

| Donor Member | 24,780.00 | 0 | 600.00 | 25,380.00 |

Advance Membership/ Subscription charges for subsequent two years 2025-26& 2026-27 (Non-Refundable)

| Ordinary Local Member | 3,186.00 | – | – | 3,186.00 |

| Ordinary Outstation Member | 2,665.00 | – | – | 2,665.00 |

| Life Member (Individual/Firm/LLP) | 0 | – | 1200.00 | 1,200.00 |

| Patron Member | 0 | – | 1200.00 | 1,200.00 |

| Donor Member | 0 | – | 1200.00 | 1,200.00 |

Subscription for GST Review for F.Y. 2024-25 by Non-Members

| Subscription fees for GSTR | – | – | 1000.00 | 1,000.00 |

Advance Membership / Subscription charges for subsequent two years 2025-26& 2026-27 (Non-Refundable)

| Subscription Fees -GSTR | 0 | – | 2000.00 2,000.00 |

Modes of Payment:-

| Cheque | A/c Payee Cheque drawn in favor of “The Goods & Services Tax Practitioners’ Association of Maharashtra” payable at Mumbai. |

| NEFT Details | The Goods & Services Tax Practitioners’ Association of Maharashtra

Bank of India, Mazgaon Branch Current Account No. 007020100001816, IFSC Code – BKID0000070.Online generated transaction Acknowledgement should be sent by email on [email protected] along with membership and payment details Members are requested to send their physical form to the association for Approval, Issuance and Office record. |

| Cash | Renewal form along with requisite amount will be accepted between 10.30 a.m. and 5.30 p.m. on all working days except Saturday at our Office at

Mazgaon Library – Mazgoan: 1stFloor, 104, GST Bhavan, Mazgaon, Mumbai – 400 010 Or Bandra Library – GST Bhavan, Ground Floor, A Wing, Bandra Kurla Complex, Bandra (East), Mumbai – 400 051. Or Mazgaon Tower – 8 & 9, Mazgaon Tower, 21, Mhatar Pakhadi Road, Mazgaon, Mumbai – 400 010. |

| Identity

(New Members) |

New Members should provide the following as Identity Proof : PAN, Aadhar Card, Constitution Document.

Address Proof(any one) : Electricity Bill / Passport/ Aadhar Card / Driving License/ Voter id/ Ration Card along with Membership Form |

| Identity Card (For Renewals) | Ordinary Local/Outstation Members should provide Two Photographs along with the Renewal Form for issue of I- cards. |

| Online Payment Link | Members can make online payment on our website www.gstpam.org are requested to download Members Renewal form from website.Update the latest details in the form, scan it and mail at email [email protected]

Payment Link : https://www.gstpam.org/online/renew-membership.php If you are login first time? Click here for create your password |

We value your continuation of the membership and look forward to your renewal to this effect.

Dated:- 01.04.2024

Vinod Mhaske

Jatin Chheda

Hon. Jt.Secretary

|

Guidance Cell Email ID for queries Members can send their queries at [email protected] |

ORDER FORM FOR GSTPAM REFERENCER 2024-25

(Members are requested to take out the photocopy of the Order Form for booking)

To

The Convenor,

GSTPAM Referencer Committee

The Goods & Services Tax Practitioners’ Association of Maharashtra

Room No. 8 & 9, Mazgaon Tower, Mhatar Pakhadi Road,

Mazgaon, Mumbai – 400 010

Dear Sir,

Please book my/our order of GSTPAM Referencer for the year 2024-25 as given below.

| Sr. | Particulars | Price per copy if booked prior to 15th July 2024 | Price per copy if booked after to 15th July 2024 | Qty | Total RS. |

| 1 | GSTPAM Referencer 2024-25 Part I & II

(GST, VAT & Allied Law Referencer & Updated GST Rate schedules). |

700 | 750 | ||

| 2 | Courier Charges (For Outstation members only) (per set) | 130 | 130 | ||

| 3 | Courier Charges (For Local members only) (per set) | 100 | 100 |

Note:

- Referencer will be published in Part I & II (for GST, VAT & Allied Laws Referencer & Updated GST rate schedules).

- Applicants requiring more than 5 copies of the Referencer are required to give a request on their letter head along with the order form. Tax Practitioner’s Associations can place order in bulk quantity by making request on their letterhead signed by the Association’s President and Secretary.

- Applicants will be issued receipt at the time of placing of their order. Applicants are requested to bring receipt at the time of taking the delivery of the Referencer. No delivery of the Referencer shall be given, unless the receipt for payment is submitted at the counter. If the receipt for payment is lost, than no delivery of the Referencer shall be given.

The payment for the above order of………………………………………………………………………………… (Rupees in words) is made herewith by Cash /Card /Cheque /Demand Draft No. ………….…………… dated ……….……………… drawn on……………………………………………… Bank………………….. Branch, Mumbai.

Membership Number………………………….. Address.………………………………………………………

Name ……………………………………… ……………………………………………………………………..

……………………………………………… ……………………………………………………………………..

Office Tel No…………………………………… Residence Tel No……………………………………………

E-mail: …………………………………………. Mobile No.…………………………………………………

PROVISIONAL RECEIPT

Received with thanks payment of. ………………… from…………………. vide Cash /Card /Cheque /NEFT/Demand Draft No. …………………………. Date………………………. drawn on………………………………………………… Bank …………………………………… Branch, Mumbai.

Signature ……………………………

Date…………………………………. Name of staff of GSTPAM……………………

Note:

- Please fill in all the details in the above form and send the same to the GSTPAM’s office at Tower or at Mazgaon library along with requisite payment.

- For Direct Deposit / NEFT payment – Bank of India, Mazgaon – Account No. 007020100001817, IFSC Code – BKID0000070. Acknowledgement of the same should be sent by email: [email protected] along with duly filled form.

- Online Payment Link : https://www.gstpam.org/online/purchase-publication.php

- Please mention your name and membership number on the reverse side of the Cheque / Demand Draft.

- The counter timings are from 10.30 a.m. to 5.30 p.m. on Monday to Friday.

- The Cheque / DD should be drawn in the name of “THE GOODS AND SERVICES TAX PRACTITIONERS’ ASSOCIATION OF MAHARASHTRA

|

Topics |

|

CHAPTER – I |

| • Basic Concepts of GST |

| • Time and Value of Supply of Goods and Services |

| • Input Tax Credits |

| • Determination of Nature of Supply |

| • Registration under GST |

| • Returns |

| • Payment of Taxes, Interest ,Penalties & Other levies |

| •Refunds |

|

CHAPTER – II |

| • Demand & Recovery |

| • Assessements and Audit Under GST |

| • Liability to pay in Certain Cases |

| • Inspections, Search, Seziure and Arrest |

| • Advance Ruling Provisions |

| • Appeals Provisions |

| • Offences and Penalties |

| • E-way Bill |

| • E-Invoice |

| • AAR Referncer 23-24 |

| • Input Service Distributor & Cross-Charge |

| • TDS/TCS Provisions |

| • GST Composition Scheme |

| • Reverse Charge Mechanism |

| • Anti-Profiteering Provisions |

|

CHAPTER – III |

| • GST Rates of Taxable Goods |

| • GST Rates for Taxable Services |

| • Index of Exempted Goods |

| • Index of Notified Exempted Services |

| • Index of Notified Goods under RCM |

| • Index of Notified Services under RCM |

|

CHAPTER – IV |

| • Gist of Important Judgments of the Tribunals, High Courts and Supreme Court |

| • Central Sales Tax Act, 1956 |

| • Maharashtra State Tax on Professions Trades, Callings & Employments Act, |

| • The Maharashtra Stamp Act, 1958 |

| • Maharashtra State Budget Highlights 2024-2025 |

THE GOODS & SERVICES TAX PRACTITIONERS’ ASSOCIATION OF MAHARASHTRA

INTENSIVE STUDY COURSE CIRCULAR FOR THE YEAR 2023-24

Respected Members,

It is 7th year of the GST act is implemented. After implementation of GST, whole fraternity of Indirect Tax Practitioners and Trade are facing various challenges with regard to implementation, transition, interpretation, practical aspects, prescribed schedule rates, AAR, Department Audit, various notices related to ITC mismatch and so on.

We all are aware about the practical difficulties we are facing while applying the rules and procedures of the GST law and the frequent amendments to the law especially due to frequent lockdown. With the view to update our fellow members on the latest development in law and to discuss the practical issues arising there from, our association has been regularly conducting Intensive Study Course. This year the Intensive Study Course is designed to enable the members to study and discuss various issues on Indirect Tax Laws mainly on GST Law, as well as on profession tax, etc.

With the same enthusiasm to discuss mainly on various aspects of GST Law, We are starting our hybrid mode Intensive Study Course for the year 2023-24 from Friday, 15-12-2023 onwards.

The Intensive Study Course is such an academic activity of our association which is designed to facilitate the members to study and discuss various issues in group. At the intensive study Course, one of the members acts as a group leader and leads the discussion on issues of the relevant subject / topic and one of the seniors in the profession monitors the discussion. The meetings are generally arranged ON Hybrid mode on 1st, 3rd and 5th Friday of the month during 3.30 p.m. to 6.00 p.m. There are around 15-16 meetings will be arranged for the Intensive Study Circle.

1st The inaugural meeting of the Intensive Study Course is scheduled to be held on Friday, 15-12-2023 between 3.30 p.m. & 6.00 p.m. on hybrid mode on the subject “Issues and Intricacies in GSTR 9 / 9C along with implications on Notices by GST Department”. The topic will be lead by Group Leader CA Dharmen Shah and the Monitor of CA Mayur Parekh.

The group strength is restricted to a limited number of members to facilitate better interaction within the group. The Intensive Study Course Fee is fixed at Rs. 1,650/- including GST for Members and Rs. 1,850/- including GST for Non members. You are requested to enroll at the earliest to avoid disappointment. Kindly use photocopy of the Enrolment form printed here in below. Also write your email address and mobile number for better communication.

9892512345/9870008752

Note :

- The First Meeting of the ISC is proposed to be a HYBRID meeting. The members joining the ISC are requested to fill the attached form for selection of Only Physical Mode or Only Virtual Mode. The Physical mode will be continued only if majority participants opt for the Physical Mode. (Else only Virtual meetings shall be held no Hybrid Meeting shall be held)

- GST lectures will be in form of group discussion, which will be helpful to study the GST law.

- If the materials are received 3 days earlier to the date of meeting, the same will be circulated through mails to the participants.

- Participants are requested to discuss only the points related to the particular topic of the meeting and to come prepared for the subject, which will be helpful for the discussion.

Pranav Kapadia Chairman

Hiral Shah Convenor

Sanjay Gajra Jt.Convenor

Sujoy Mehta Jt.Convenor

Bhavin Mehta Jt.Convenor

9224386682 9821441740 9892512345 9870008752

THE GOODS & SERVICES TAX PRACTITIONERS’ ASSOCIATION OF MAHARASHTRA ENROLMENT FORM FOR INTENSIVE STUDY COURSE CIRCULAR FOR THE YEAR 2023-24

To,

Convener,

Intensive Study Course

The GSTPAM, Mazgaon, Mumbai – 400 010.

Dear Sir,

Please enroll me as a participant for the Intensive Study Course for the year 2023-24. The Registration fees of Rs.1,650/- (for members) / and Rs.1,850/- (for non-members) 18% Including GST is enclosed herewith by Cash /DD / Cheque No.___________dated__________drawn on_____________

Particulars of Member/Participant :

Name:_________________________________________________________

Educational Qualification: ___________________________________________________

Address for Communication:_________________________________________________________

Telephone No. Office :__________________________ Res. ________________________

Email ID :____________________________ Mob. No, _________________________

GSTPAM Membership No: _____________________________________________________

GSTIN (if Applicable): _____________________________________________

I also wish to be a group leader for the subject of ______________ and suitable available date will be :__________________________

I would like to attend the Meeting (Please Tick only one option)

Only Physical Mode

Only Virtual ModeThe Physical mode will be continued only if majority participants opt for the Physical Mode

Signature______________________

Note :-

- Please issue the Cheque in favour of ”The Goods & Services Tax Practitioners’ Association of Maharashtra” (FULL NAME IS REQUIRED TO BE STATED ON THE CHEQUE AS PER RBI DIRECTION).

- For NEFT payment – Bank of India, Mazgaon- Account No. 007020100001816, IFSC – BKID0000070. Acknowledgement generated through online transaction should be emailed on [email protected] along with Enrolment Form and payment details.

- Online Payment Link: https://www.gstpam.org/online/event-registration.php

- Outstation members are requested to make payment online payment.

- The enrollment form along with payment proof should be submitted at Room No. 104, Vikrikar Bhavan, Mazgaon, Mumbai – 400010.

- Kindly carry the receipt of payment to attend the Lecture.

- The Association reserves the right to change and alter the schedule if required.

INVITATION OF NOMINATIONS

| Election Committee: |

| Chief Election Officer: |

| Shri J. D. Rawal |

| Members: |

| Shri Ramesh Gandhi |

| Shri Pradip Kapadia |

| Shri Ashvin Acharya |

| Shri Shashank Dhond |

| Shri Chirag Parekh |

| Shri Vijay Sachiv |

|

Invitee: |

| Shri Pravin Shinde – President |

(For the posts of office Bearers and Members of the Managing Committee for the year 2024 – 2025)

Pursuant to the appointment made by the Managing Committee as provided in Article 17(1) of the Constitution of the Association and in exercise of the powers conferred under Article 17(2), Nominations are hereby invited from the members of the Association, eligible to contest as per Article 17(3) of the Constitution, for the following posts for the year 2024-25:

- One President

- One Vice-President

- One Hon. Treasurer

- Two Hon. Jt. Secretaries

- Fifteen members of the Managing Committee

(1) The nomination forms for the above posts can be procured from the office of the Association or from the Library at Mazgaon and also available on GSTPAM website.

(2) The nomination Form should reach the office of the Association at Mazgaon Tower not later than 5.00 p.m. on Wednesday, 19.06.2024 as per article 17(2) of the Constitution. No Nomination Form will be accepted on the last day; i.e. on Wednesday, 19.06.2024 at Library at GST Bhavan, Mazgaon, Mumbai 400 010.

(3)As per article 17(2) of the Constitution, the last date of submission of duly filled up and signed nomination Forms is Wednesday, 19.06.2024 up to 5 p.m. Nomination Form can also be submitted through e-mail of the candidate to the specially created e-mail ID of the Association for the purpose of the election i.e. at: [email protected] and also can be filed physically at Mazgaon Library and Mazgaon Tower respectively as per the date mentioned in clause 2. The procedure of how to submit the online Nomination Form is prescribed at point No. (13) of this circular.

(4) Any member of the Association who is not in arrears of fees and whose delay in payment of fees has been condoned by the Managing Committee on or before the date of filing of his / her nomination Form, shall be eligible to file the nomination, subject to the provision of Article 17(3) of the Constitution which is reproduced herein below at point No. (12).

(5) The Nomination should be proposed by one member and seconded by another member of the Association (other than the members of the Election Committee), who are not in arrears of membership fees and whose delay, if any, in payment of membership fees has been condoned by the Managing Committee on or before the date of filing of such Nomination Form, as per provision of Article 17 (4) of the Constitution. The further procedure for online submission of Nomination Form through an E- mail is explained in point No. (13) of this circular.

(6) No member shall contest for more than one post as per Article 17(5) of the Constitution.

(7) As per Article 17(6) of the Constitution, a contestant shall be entitled to withdraw his / her nomination if he / she so wishes on or before Saturday, 22.06.2024 up to 5.00 p.m. Intimation of Withdrawal Form may be done through the candidate’s e-mail ID which he / she had provided in his / her Nomination For m to the Association’ s newly created ID for the pur pose of e l ection i . e. [email protected]. However, if any candidate wishes to withdraw his / her Nomination Form by submitting it physically he / she can do so by submitting the same at Mazgaon Library or at the Association’s Office at the address herein mentioned before by Friday, 21.06.2024 up to 5.00 p.m. Please note that physical withdrawal of Nomination Form shall be accepted at the Mazgaon Library only up to Friday, 21.06.2024 and thereafter on Saturday, 22.06.2024, the withdrawal Form shall be accepted only at Association’s Office at Mazgaon Tower up to 5.00 p.m.

(8) Election will be conducted as per Article 17 of the Constitution. Attention of the candidates is invited to Clause 15A inserted in Article 17, whereby a contestant, who desires recounting, shall ask in writing for recounting of votes within 15 minutes from the time of declaration of election results by the Chief Election Officer.

(9) Election at Mumbai shall be conducted between 11.00 a.m. and 5.00 p.m. on Friday, 19.07.2024 at the GSTPAM, Library, Room No. 104, 1st Floor GST Bhavan, Mazgaon, Mumbai-400 010.

(10) Election at District places shall take place on Monday, 15.07.2024 as per schedule given here in below.

(11) Nominations Forms Proposed / Seconded by any Member of the Election Committee shall be rendered the Nomination Form as invalid.

(12) ELECTIONRULES:

Article 17 (3): Any member of the Association who is not in arrears of annual membership fees and/or of Additional Membership Fees of the Association on the date of filing of nomination and whose delay in paying such fee is condoned by the Managing Committee on or before the date of filing of nomination shall be eligible to file nomination for a post of the office bearer or a member of the managing committee.

Provided that a Member of the Association shall be eligible to file the Nomination Form for following posts subject to the fulfilment of the criteria mentioned against each post in the Table given herein below:

| Post | Eligibility Criteria for filing the Nomination Form |

| Managing Committee Member | Eligible only if the Applicant has been a Member of the Association for at least two consecutive years (24 months from the date of admission) on the date of filing Nomination Form. |

| Hon. Jt. Secretary or Hon. Treasurer | Eligible only if the Applicant has been a Member of the Managing Committee for a period of at least two years. |

| Vice-President | Eligible only if the Applicant has held the position as an Office Bearer of the Association for a period of at least two years. |

| President | Eligible only if the Applicant has held the position as an Office Bearer of the Association for a period of at least two years. |

13. Procedure to submit Election Nomination Form through an E-mail :

Subject to Note No. (2) and (4) of this circular, the Nomination Form may be filled up and signed by thecontestant, proposer and seconder and should be scanned and the same should be sent through the E-mail ID of the contestant mentioned by the candidate as mentioned in the Nomination Form as per Article 17(6) of the Constitution .

14. In case of any Covid-19 like wave or any force majeure, the election committee is authorized to change or modify any of the directions related to the such election and decision of the Election Committee shall be binding on all. Any such decision shall be informed to all the members through Email/Whatsapp/GSTPAM website/ GST Review etc.

15. Outstation Election Centers:

| Sr. No | Election Centre at Outstation Place-as per Article 17A | Time |

| 1. | Dhule | 11.00 AM To 02.00 PM |

| 2. | Jalgaon | 11.00 AM To 02.00 PM |

| 3. | Kolhapur | 11.00 AM To 02.00 PM |

| 4. | Nagpur | 01.00 AM To 04.00 PM |

| 5. | Nashik | 02.00 PM To 05.00 PM |

| 6. | Pune | 11.00 AM To 02.00 PM |

| 7. | Aurangabad | 11.00 AM To 02.00 PM |

| 8. | Sangli | 11.00 AM To 02.00 PM |

| 9. | Solapur | 11.00 AM To 02.00 PM |

| 10. | Thane | 02.00 PM To 05.00 PM |

| 11. | Sindhudurg | 02.00 PM To 05.00 PM |

Note: The list of the above outstation election centers is based on the data available with the Association on the date of Notice, the same can change if updated data is made available to the election committee.

For and on behalf of the Election Committee-GSTPAM

Sd/-

Place: Mumbai- 400 010

Shri J. D. Rawal

Dated : 16th April, 2024.

Chief Election Office

GST, MVAT & ALLIED LAW UPDATESCompiled by Adv. Pravin Shinde |

|

| Notification under Central Tax | ||

| Notification No. | Date of Issue | Subject |

| 08/2024 -Central Tax | 10.04.2024 | Seeks to extend the timeline for implementation of Notification No. 04/2024-CT dated 05.01.2024 from 1st April, 2024 to 15th May, 2024 |

| 09/2024 -Central Tax | 12.04.2024 | seeks to extend the due date for filing of FORM GSTR-1, for the month of March 2024 |

|

Maharashtra Goods and Services Tax Act, 2017 (MGST) |

||

| Notification No. | Date of Issue | Subject |

| 01A/2024-

State Tax (Rate) |

23.04.2024 | Seek to amend Notification No 1/2017 – State Tax (Rate) Dt. 29.06.2017 |

|

The Maharashtra Value Added Tax Act, 2002 |

||

| News & Updates | Date Of Issue | Subject |

| VAT-1524/CR-

15/Taxation-1 |

24.04.2024 | Notification u/s. 20 (6) of MVAT Act, 2002 exemption of late fees |

| C(A&R)3/PWR/JUR IS-2023/1/ADM-8 | 24.04.2024 | MVAT Territorial Jurisdiction of Joint Commissioner of Sales Tax (Nodal 1), Pune |

|

The Maharashtra State Tax on Professions, Trades, Callings and Employments Act, 1975 |

||

| News & Updates | Date Of Issue | Subject |

| VAT-2024/CR-

14/Taxation-3 |

24.04.2024 | Notification for Late Fees waiver for Profession Tax Payers |

The two most important days in your life are the day you are born and the day you find out why.

– Mark Twain

LATEST CASE LAWS ON GSTCompiled by CA. Aloke R. Singh |

|

2024 (5) TMI 406 – ALLAHABAD HIGH COURT

M/S RD ENTERPRISES VERSUS UNION OF INDIA THROUGH DIRECTOR GENERAL DIRECTORATE AND 2 OTHERS

Dated:- 6-5-2024

In: GST

Writ Tax No. – 699 of 2024

Provisional attachment of bank account – HELD THAT:- The cause of action does not appear to exist, insofar as the revenue authorities have realised that provisional attachment order dated 16.2.2023 does not survive.

It appears to be a common mistake being caused by revenue authorities where provisional attachment orders may never continue for more than one year are allowed to exist beyond that end date. Such error on the part of the revenue authorities leaves the assessee with no option but to approach this Court for effective direction on the revenue authorities to actually lift the provisional attachment.

In face of the statutory provision being unequivocally clear, the revenue authorities when called upon by this Court, take a stand as has been noted in the present facts. Thus, the provisional attachment orders are actually lifted only upon the revenue authorities being questioned about the illegality of their action, by this Court.

Once the statutory law admits of no doubt and the revenue authorities do offer correction to the error committed by them upon being pointed out by this Court, it is found that such litigation whenever it arises to be wholly avoidable – petition disposed off.

2024 (5) TMI 403 – ALLAHABAD HIGH COURT

EVEREADY INDUSTRIES INDIA LTD. LKO. THRU. SIGNATORY SH. SOUNIK MUKHERJEE VERSUS STATE OF U.P. THRU. SECY. MINISTRY FINANCE, U.P. LKO. AND ANOTHER

Dated:- 3-5-2024

In: GST

Writ Tax No. – 114 of 2024

Maintainability of petition – availability of alternative remedy – Violation of principles of natural justice – no opportunity of personal hearing was granted – SCN does not provide any date, place and time of hearing despite the same being mandatory procedure.

Availability of alternative remedy of appeal – HELD THAT:- The Court thereafter observed that the stand taken by the respondents that the petitioner has alternative remedy of appeal under Section 107 of the Act cannot be accepted. Insofar as it is settled law that availability of alternative remedy, is not a complete bar to entertain a writ petition under Article 226 of the Constitution of India and has referred to exceptions that have been carved out to alternative remedy by the Hon’ble Supreme Court with regard to three cases i.e. (i) where there is complete lack of jurisdiction in the officer or authority to take the action or to pass the order impugned; or (ii) where vires of an Act, Rules, Notification or any of its provisions has been challenged; or (iii) where an order prejudicial to the writ petitioner has been passed in total violation of principles of natural justice.

Opportunity of personal hearing – HELD THAT:- The action taken against the petitioner under Section 74(9) of the Act does not provide for personal hearing to be given to the concerned person chargeable with tax or penalty. It only states that the proper officer shall after considering the representation, if any, made by the person chargeable with tax determine the amount of tax, interest and penalty due from such person and issue an order.

It has been argued that sub-clauses of Section 75 of the Act relate to the procedure to be followed by the Officer after remand of the matter by the appellate authority or tribunal or the court and sub-section (4) should be read in that context and it requires that an opportunity of hearing shall be granted where a request is received in writing from the person chargeable with tax or penalty or where an adverse decision is contemplated against such person – the petitioner has also argued that Section 75(4) of the Act would be otiose as if this Court comes to the conclusion that the argument raised by the learned counsel for the State-respondents is liable to be accepted as Section 74(1) of the Act also contemplates issuance of a notice and calling for a reply.

This Court having considered the submissions made by the learned counsel for the parties has gone through the leading judgment in the case of BHARAT MINT AND ALLIED CHEMICALS VERSUS COMMISSIONER COMMERCIAL TAX AND 2 OTHERS [2022 (3) TMI 492 – ALLAHABAD HIGH COURT] and find that the said judgment although has read into the language of Section 75(4) of the Act and the right of “personal” hearing, it has not mentioned any causes omissus on the part of the legislature reading into the statute words like “personal” hearing” as the Act itself only states that an opportunity of hearing shall be given.

Order is reserved – Till pronouncement of the judgement, the impugned orders passed by the assessing authority shall remain stayed.

2024(5)TMI401–KARNATAKAHIGHCOURT

SRI K.G. PATIL, SRI BASAVARAJ B. ARESHANKAR VERSUS STATE OF KARNATAKA, THE ASST. COMMISSIONER COMMERCIAL TAXES, AUDIT-1 VIJAYAPURA, THE EXECUTIVE ENGINEER, PWP AND IWTD, VIJAYAPURA, THE EXECUTIVE ENGINEER, RURAL DRINKING WATER AND SANITATION DIVISION, VIJAYAPURA, THE EXECUTIVE ENGINEER KBJNL, THE EXECUTIVE ENGINEER, PANCHAYATHRAJ ENGINEERING DIVISION, VIJAYAPURA

Dated:- 2-4-2024

In: GST

Writ Petition No. 200206 of 2024 (T-RES) C/W Writ Petition No. 200204 of 2024

Liability to pay the differential GST amount (being the difference between GST and VAT) for each the works contract / composite supply executed by the petitioner – works contract – HELD THAT:- The issue involved in the present writ petitions would fall under category KVAT regime as is enunciated in SRI CHANDRASHEKARAIAH, M/S. GOVINDE GOWDA AND SONS, M/S. D.K. CONSTRUCTIONS, M/S. SRI AYYAPPA CONSTRUCTIONS, M/S. ANNAPOORNESHWARI CONSTRUCTIONS, M/S. BHOOMIKA BUILDERS, VERSUS THE STATE OF KARNATAKA, THE UNION OF INDIA, THE GOODS AND SERVICES TAX COUNCIL, PRINCIPAL COMMISSIONER OF CENTRAL TAX, COMMISSIONER OF COMMERCIAL TAXES, CAUVERY NEERAVARI NIGAMA LIMITED, AND OTHER [2023 (6) TMI 93 – KARNATAKA HIGH COURT] where it was held that ‘I find considerable force in the submission made by the learned Senior counsel for the petitioners that the tax component is an independent component which the petitioners do not retain as a profit and is a statutory payment to be made.’

When there is a concluded contract and rate has been fixed in KVAT regime for the work contract as per schedule rate, petitioners cannot be directed to pay the Goods and Service Tax for the work that they have completed and received payment.

SCN in respect of the writ petitioners are without any basis – Petition allowed.

PARTHASARATHY NARASIMHAN VERSUS DEPUTY COMMERCIAL/STATE TAX OFFICER, CHENNAI

Dated:- 1-4-2024 In: GST

W. P. No. 8798 of 2024 And W. M. P. Nos. 9798 & 9800 of 2024

Rejection of rectification petition – turnover of the petitioner was erroneously reported in the GSTR 1 return – petitioner states that the correct turnover was reported in the GSTR 3B return and the entire tax liability is on account of an inadvertent error committed while filing the GSTR 1 return – HELD THAT:- The petitioner’s reply dated 05.02.2024 has been placed on record. In such reply, the petitioner asserted that the correct turnover was Rs. 92,28,895/- and not Rs. 9,22,89,895/- as wrongly reported in the GSTR 1 return. Since the petitioner did not file the annual return for the relevant assessment period, it appears that the petitioner did not rectify this error in the annual return. A tax liability of Rs. 1,48,20,834/- was imposed on the petitioner under the impugned assessment order. Prima facie, it appears that such tax liability had arisen only on account of the turnover reported in the GSTR 1 return.

The interest of justice warrants that the petitioner be provided an opportunity to establish that the genuine turnover was only Rs. 92,28,895/- and not Rs. 9,22,89,895/-. Solely for such reason, the impugned order calls for interference – the impugned order dated 20.12.2023 is quashed and the matter is remanded for reconsideration.

Petition disposed off by way of remand.

2024(5)TMI363–CALCUTTAHIGHCOURT

M/S. MAA AMBA BUILDERS & ANR. VERSUS THE ASSISTANT COMMISSIONER OF REVENUE, STATE TAX, BUREAU OF INVESTIGATION NORTH BENGAL HQ & ORS.

Dated:- 2-5-2024

In: GST

WPA 842 of 2024

Detention of goods alongwith penalty – e-way bill in the present case had expired on the date when the vehicle-in-question along with the goods were intercepted – HELD THAT:- There is no reference to the ground of non-evasion of tax or deliberate delay.

Simply because there was no extension of the e-way bill, the same does not pre-supposes that there was an intention to evade tax. There is no finding either by the adjudicating officer or by the appellate authority as regards the intent of evasion of tax. There appears to be no material available to conclude evasion of Tax.

Hon’ble Supreme Court in the case of Vardan Associates [2024 (2) TMI 189 – SUPREME COURT] had been pleased to observe that the appellant cannot shirk from its responsibilities to comply with the requirements in law to generate a fresh e-way bill or to seek extension thereof. But the observations made by the Hon’ble Supreme Court in the said judgment are in relation to a challenge as regards payment of tax and penalty and not in relation to the factum of presumption being drawn on the intention to evade tax on the non-extension of the validity of the e-way bill.

Petition disposed off.

Don’t watch the clock; do what it does. Keep going. – Sam Levenson

– Mark Twain

SUMMARY OF RECENT ADVANCE RULING UNDER GSTCompiled by CA Aditya Surte |

|

1. a) Amount collected by members of RWA as a contribution towards corpus fund is not in the nature of a deposit in truest sense of term as such money is not refunded to contributors, but is an advance payment made by members of RWA for receiving a supply of common area maintenance services to be provided to members by RWA in future, therefore, same would be taxable and appellant will be liable to pay tax at the time of receipt of such amount in accordance of section13(2) of CGST Act.

(Gujarat Appellate Authority for Advance Rulings in Order No. GUJ/GAAAR/APPEAL/2023/05, decided on 04/10/2023 in the case of Varachha Co-op. Bank Ltd.)

b) Where electricity charges collected by RWA for consuming electricity for common area from its members on pro-rata basis, not only includes common area electricity charges but also charges for other services like security, scavenging, water supply, maintenance of garden etc, thus, services relating to electricity charges are bundled with supply of goods and services for common use of its members and hence form a part of composite supply where principal supply is supply of common area maintenance service and therefore, 18% GST as applicable to services of maintenance of premises would be applicable to appellant.

(West Bengal Appellate Authority for Advance Rulings vide Order No. 01/WBAAAR/Appeal/2024, decided on 02/04/2024 in the case of Prinsep Association of Apartment Owners)

2. Where applicant, an SEZ unit has availed services from an advocate towards execution of lease agreement for premise in GIFT city, applicant was not required to pay GST under RCM on said services in accordance with Notification 10/2017-Integrated Tax (Rate), dated 28/06/2017 subject to furnishing a LUT or a bond as specified in condition (i) of para 1 of Notification No. 37/2017-Central Tax, dated 04/10/2017.

(Gujarat Authority for Advance Rulings vide Order No. GUJ/GAAR/R/2024/08, decided on 16/04/2024 in the case of Abans Alternative Fund Manager LLP)

3. Where applicant is supplying services of manpower with machine and anti-termite treatment with goods, hence, aforesaid services can be termed as composite supply but not pure services, therefore, applicant is not entitled to avail exemption in terms of Sl. No. 3 of Notification No.12/2017-CT(Rate) dated 28/06/2017.

(Rajasthan Authority for Advance Rulings vide Order No. RAJ/AAR/2023-24/20, decided on 29/02/2024 in the case of Mpower Saksham Skills)

4. Supply of teachers and lecturers to BBMP schools / colleges by applicant is covered under pure services being provided to local authority by way of activity in relation to a function “promoting educational aspects” to municipality under Article 243W of the Constitution of India and are eligible for exemption under Sl. No. 3 of Notification No. 12/2017-Central Tax (Rate), dated 28/06/2017.

(Karnataka Authority for Advance Rulings vide Order No. KAR ADRG/12/2024, decided on 15/04/2024 in the case of Crystal Infosystems & Services)

5. Where applicant collects commission as percentage of value of digital gold sold through its platform and entire sale proceeds are paid directly to seller of digital gold through escrow account, applicant does not qualify as ‘agent’ of the seller but is an electronic commerce operator for the purposes of GST law and hence is covered under Notification No. 52/2018-Central Tax.

(Karnataka Authority for Advance Rulings in Advance Ruling No. KAR ADRG/08/2024, decided on 28/02/2024 in the case of Changejar Technologies Pvt. Ltd.)

6. Where constituent members of Authority for Advance Ruling during personal hearing of instant matter were different from members at time when decision was pronounced, therefore, there was a violation of principles of natural justice; ruling of Authority for Advance Ruling was set aside.

(Rajasthan Appellate Authority for Advance Rulings vide Order No. RAJ/AAAR/11/2023-24, decided on 20/02/2024 in the case of Umed Club)

7. Applicant provides building on rent to municipality who provided same to Schedule Caste Development Department for Government Welfare Departmental Hostels and Government Social Welfare College Boys Hostels. There is no direct relation between services provided by applicant and functions discharged by municipal corporation under Article 243W read with Schedule XII to Constitution of India. Hence, services provided by applicant do not qualify for exemption under Notification No. 12/2017-CT (Rate), dated 28/06/2017.

(Telangana Authority for Advance Rulings vide Order No. 05 of 2024, decided on 09/02/2024 in the case of Navya Nuchu)

Do the difficult things while they are easy and do the great things while they are small. A journey of a thousand miles must begin with a single step.

– Lao Tzu

INCOME TAX UPDATESCompiled By By Adv. Ajay Talreja |

|

ITAT disallows cost of improvement incurred by Company for individual ‘s flat

The Income Tax Appellate Tribunal (ITAT) Pune has made a significant ruling in the case of Arun Tulshidas Kharat Vs DCIT, disallowing the claim of cost of improvement incurred by a company for an individual’s flat. This decision, dated 14th June 2023, underlines the stringent scrutiny applied by tax authorities on claims related to capital gains and the necessity for taxpayers to maintain precise and verifiable records.

Detailed Analysis The appellant, Arun Tulshidas Kharat, challenged the decision of the Commissioner of Income Tax (Appeals) [NFAC], which had confirmed the disallowance made by the Assessing Officer (AO) concerning the cost of improvement on a flat sold during the Assessment Year (AY) 2014-15. The core issue revolved around the rejection of Rs.28,02,003/- claimed as the Index Cost of Improvement during the computation of Long Term Capital Gain (LTCG) on the sale of the flat. The AO observed that most of the bills and vouchers submitted for the cost of improvement were not in the name of the assessee but in the names of Wings Travel Management India Private Limited and Smt. Bharati Kharat, thereby questioning their validity in support of the assessee’s claim. Despite the submission of additional evidence to the CIT(A) and arguments regarding the substantive improvement work done on the property, both the AO and CIT(A) found the claims unsubstantiated, primarily due to the lack of direct evidence tying the expenses to the assessee personally. The ITAT, upon review, upheld the decisions of the lower authorities, emphasizing the absence of concrete documentary evidence to prove that the assessee had incurred the expenditure for the improvement of the said property. The tribunal pointed out that the bills issued in the name of Wings Travel Management India Private Limited, an independent entity, could not be considered proof of expenditure incurred by the assessee for the improvement of his property.

Furthermore, the tribunal dismissed a declaration from Wings Travel Management India Private Limited, considering it a self-serving document lacking independent verification. The ruling underscored the principle that expenditure on capital improvements must be directly attributable and verifiable by the individual claiming the benefit under tax laws.

Suryshree Blocks Pvt. Ltd. Vs DCIT (ITAT Ahmedabad)

In the case of Suryshree Blocks Pvt. Ltd. vs DCIT before the ITAT Ahmedabad, the issue of penalty under Section 271(1)(c) of the Income Tax Act arose due to alleged inaccurate particulars of income furnished by the assessee. However, the ITAT’s decision sheds light on the necessity of finding specific inaccuracies to levy penalties. Detailed Analysis: The appeal filed against the penalty order stemming from the assessment year 2015-16 raised crucial questions regarding the nature of inaccuracies alleged by the Assessing Officer. The primary contention was the disallowance under Section 36(1)(iii) related to interest on borrowed funds for acquiring capital assets. The Assessing Officer initiated penalty proceedings under Section 271(1)(c) for furnishing inaccurate particulars of income. During the proceedings, the assessee argued that the interest expenses were calculated and disclosed, albeit treated as non-capitalized expenses. The assessee maintained that this was a genuine mistake and not a deliberate attempt to conceal income or furnish inaccurate particulars. Furthermore, the penalty notice lacked specificity regarding the exact grounds for penalty imposition, as required by law. The ITAT, considering the submissions and legal precedents, ruled in favor of the assessee. It emphasized that the term “inaccurate particulars” implies details not accurate or exact, and in the absence of concrete findings by the Assessing Officer, penalty imposition under Section 271(1)(c) was unwarranted.

Moreover, the failure to specify the grounds for penalty in the notice further invalidated the penalty imposition. Drawing from the Supreme Court’s rulings and legal principles, the ITAT concluded that the penalty was not sustainable. The assessee’s actions did not amount to deliberate concealment or furnishing of inaccurate particulars.

Therefore, the ITAT upheld the appeal and deleted the penalty.

Switching in Mutual Funds: Meaning and Taxability

What is switching in mutual funds? Switch is a term used to denote the process of moving one’s investment (in whole or in part) from one scheme to another within the same fund house. Additionally, you have an option of making a switch-in or switch-out between funds of different fund houses. In case of a switch-in, you make a redemption in one fund and invest it in another while in case of a switch-out you transfer your investments from one fund house to another. It should be noted that there may be exit loads and taxes on capital gains involved in these transactions One can choose to convert his regular plan into a direct plan under the same fund. Regular plans involve distributor commissions, unlike direct plans which do not thus reducing overall costs when investing in the scheme. Nevertheless, with a direct plan, you will need to handle your investment management individually.

What are the advantages of switching? A single advantage that comes along with switching is the possibility of stopping investment in an underperforming fund and starting in a good one, which will significantly increase your portfolio return. Also, by switching to a direct plan from a regular plan, you can decrease your investment cost. On another note, switching is an effective tool when planning goals. It can help you maintain your wealth by turning from equity to debt as you draw nearer to achieving your goal. Several reasons can lead to switching between mutual funds. For instance, you may want to shift your investment strategy and move from regular to direct; alternatively, if you are nearing your goal and would like to protect your capital, you might want to switch from equity to debt funds. Another reason could be due to the under performance of the fund in which you have invested and consequently wish to invest in a better-performing fund. You might also consider moving between growth and dividend or vice versa. Whatever the reason, you must follow the same process for switching your mutual fund investments.

How to switch from one mutual fund scheme to another?

You can change from one scheme to another within the same fund house by filling out a switch form from the asset management company (AMC) or visiting their website and then switching your investments. An alternative route would be to go to the websites of mutual funds’ independent platforms and make this switch easily. The investors need to understand that if their investments do not exceed Rs 2 lakhs, then the transaction will happen on the same day if they have requested it before 3 pm. But if the amount invested crosses the Rs 2 lakh mark, you may have to wait for two days or so to get your mutual fund units. To change the funds between two different fund houses, you will need to redeem your investments in the old fund and then repurchase the new units. You should wait until you get your money back from the old fund before you can invest in the new one. What are the factors to consider before switching? Switching your mutual fund investment has some consequences. The factor you must consider before switching is Exit load which means mutual funds have an exit load, which is a penalty for withdrawing your funds before a specific duration, which is one year for most mutual funds. If you switch your investments within one year, you will have to pay an exit load of around 1% to the fund house, secondly a lock-in period, Equity Linked Saving Schemes (ELSS) come with a lock-in period of three years. This means you cannot withdraw your investments before three years. So, you cannot switch your investments before the completion of three years. However, you can stop investing in the fund, another factor is Taxation, Switching involves selling your investment in one fund (or plan) and buying units of another fund (or plan). If you have made a profit on your investment, it will be taxable at the applicable rate, last one is portfolio management, Switching from a regular to a direct plan requires you to manage your portfolio. You will have to track and monitor your portfolio on your own. Switching to a direct plan also requires you to have market knowledge that will help manage your portfolio. What are the Tax implications of switching between mutual funds? When you switch out and switch between mutual funds, your gains will be taxable. If you switch out of an equity fund, your gains will be taxable gains will be taxable similar to equities. Short-term capital gains tax will be levied for gains if you switch within one year. In contrast, long-term capital gains tax will be levied for gains above Rs 1 lakh if you switch after one year from the investment date. If you are switching from a debt fund, gains within three years are considered short-term capital gains and will be taxed per your income tax slab. The long-term capital gains tax is gains earned after three years from the date of investment and will be taxed at 20% with an indexation benefit. In the case of hybrid funds, they are taxed as per their allocation to equity and debt. If the portfolio has more debt, they are taxed like debt funds. In contrast, if the portfolio has more equity, they are taxed like equity funds.

Is there a penalty for switching mutual funds? No, as of today there is no penalty for switching between funds. However, fund houses can levy an exit load if you switch before a specific period but the gains you have earned so far are subject to capital gains tax which depends on the duration of fundholding To sum up, mutual fund switches could be a potential way for the investor to gain control over their investment strategy on a more comprehensive scale, considering significant factors such as performance rates of the fund, investment goals, and expenses. When an investor considers switching from one fund to another, whether within the same house or to a different one, they must understand the tax implications and consequences of this decision. Swaps can enhance returns and lower costs, but it is necessary to be aware of exit loads, lock-in periods, taxation implications, and how they will affect portfolio management. Thus, an investor who weighs these factors against his or her financial objectives will be able to manage mutual fund investments effectively.

Assessment Order issued without taking into consideration reply filed by Assessee is not valid

The Hon’ble Delhi High Court in the case of Emco Cables Pvt. Ltd. v. Union of India [W.P. 1622 of 2024 dated February 27, 2024] disposed of the writ petition, thereby holding that, the reply filed by the Assessee should be taken into consideration at the time of passing the Assessment Order and in case where proper reply/explanation has not been filed and when further details are required, the Revenue Department is obliged to seek the relevant documents/details. Facts: The Revenue Department (“the Respondent”) issued the Show Cause Notice dated September 24, 2023 (“the SCN”), against Emco Cables Pvt. Ltd. (“the Petitioner”) wherein it was alleged that the Petitioner has under-declared output tax, claimed excess Input Tax Credit (“ITC”) and claimed ITC from cancelled dealers and non-taxpayers for which detailed reply was filed by the Petitioner. However, the Respondent vide order dated December 29, 2023 (“the Impugned Order”) recorded that, the reply filed by the Petitioner is not satisfactory and directed that DRC-07 should be issued in the present case. Aggrieved by the Impugned order, the Petitioner filed a writ petition contending that the Petitioner has filed a detailed reply.

Issue: Whether the Assessment Order issued without taking into consideration the reply filed by the Assessee is valid?

Held: The Hon’ble Delhi High Court in the case of W.P. 1622 of 2024 held as under: Noted that, the Proper Officer was required to consider the reply on merits and thereafter form an opinion on whether the reply filed by the Petitioner was sufficient or not. Further Noted that, even if the Proper Officer was of the view that the reply filed by the Petitioner is incomplete and further details were required, the said details could have been sought from the Petitioner. However, as per the records no such opportunity was granted to the Petitioner. Opined that, the Proper Officer merely held that, no proper reply/explanation was received which ex-facie shows that, the Proper Officer of the Respondent has not perused the reply submitted by the Petitioner. Held that, the Impugned Order is set aside and the matter is remitted back to the Proper Officer for re-adjudication.

Conclusion: In light of the court’s ruling, assessment orders must meticulously consider the submissions made by the assessee. The case underscores the significance of procedural fairness and thorough examination in administrative proceedings. As the matter is remitted for re-adjudication, it reaffirms the principle of due process in taxation matters, ensuring fair treatment of taxpayers.

Commission cannot be disallowed merely for increase in Rate of Commission

Srinathji Yamunaji Enterprises Vs ITO (ITAT Mumbai)

Introduction: In a recent case before the Income Tax Appellate Tribunal (ITAT) Mumbai, the issue of disallowance of excessive commission paid by Srinathji Yamunaji Enterprises was brought into question. The tribunal ultimately overturned the decision, highlighting the lack of evidence and business necessity. The Hon’ble ITAT, Mumbai allowed the appeal and set aside the demand. It held: (i) there is no allegation that the commission agent (foreign party) is related or the commission paid is bogus or the exports are not genuine, then such expenditure cannot be disallowed;

(ii) there is no contrary evidence placed on record by the Revenue;

(ii) accepts that due to global slow down, the commission agent had to put in extra efforts and hence, higher commission was paid. Therefore, the expense was incurred wholly and solely for the purposes of business only.

The Hon’ble Income Tax Appellate Tribunal, Mumbai. The appellant is an exporter of goods. For assessment year 2013-2014, it filed return of income. The case was selected for scrutiny under section 142(1) and order came to be passed under section 143(3) disallowing expenditure on commission paid to foreign entities. The case of the Revenue was that the export sales of the appellant have increased by 45% as compared to previous year, however, the commission paid has increased by 142%. The CIT(A) confirmed the said demand. Hence, appeal. The Hon’ble ITAT, Mumbai allowed the appeal and set aside the demand. It held: (i) there is no allegation that the commission agent (foreign party) is related or the commission paid is bogus or the exports are not genuine, then such expenditure cannot be disallowed; (ii) there is no contrary evidence placed on record by the Revenue; (iii) accepts that due to global slow down, the commission agent had to put in extra efforts and hence, higher commission was paid. Therefore, the expense was incurred wholly and solely for the purposes of business only.

Conclusion: The case of Srinathji Yamunaji Enterprises vs. ITO before the ITAT Mumbai underscores the importance of substantiating expenses in line with business necessity. The tribunal’s decision highlights the need for concrete evidence and justification when challenging expenditure claims. In this instance, the lack of evidence and the business context led to the reversal of the decision to disallow excessive commission expenses.

Deceased Partner’s Heirs Not Liable for Firm’s Obligations: SC

Annapurna B. Uppin & Ors. Vs Malsiddappa & Anr. (Supreme Court of India)

The Supreme Court’s recent judgment in the case of Annapurna B. Uppin & Ors. Vs Malsiddappa & Anr. sheds light on the liability of legal heirs concerning firm debts upon the death of a partner. The case revolves around a complaint filed by Malsiddappa, alleging non-payment of invested funds in a partnership firm. This detailed article delves into the facts, analysis, and conclusion of this significant legal matter. The crux of the matter lies in whether legal heirs inherit liabilities of a deceased partner in a partnership firm. The complainant, Malsiddappa, asserted that the legal heirs, including the appellants, were liable for the debt owed by the firm. However, the appellants contested this claim, stating they were not part of the partnership and thus not liable. The Supreme Court meticulously analyzed the partnership deeds and the legal framework to render its decision. It highlighted that the complainant was indeed a partner as per the registered partnership deed. However, upon the death of the managing partner, Basavaraj Uppin, in 2003, the firm’s status ceased to exist. Furthermore, the Court emphasized that the investment made by Malsiddappa was a commercial transaction, not falling under the purview of consumer protection laws. The appropriate recourse for such disputes lies within the jurisdiction of civil courts The Court also affirmed the legal principle that the legal heirs of a deceased partner do not automatically inherit the liabilities of the firm. Unless explicitly stated in a fresh partnership deed, the legal heirs remain unaffected by the firm’s debts. In conclusion, the Supreme Court’s judgment clarifies the non-liability of legal heirs for firm debts upon a partner’s demise. The ruling underscores the importance of legal documentation and adherence to partnership laws. It also reaffirms the distinction between commercial disputes and consumer grievances, guiding parties towards the appropriate legal recourse. This landmark decision sets a precedent for future cases involving partnership liabilities and legal heirs’ obligations. While dismissing the complaint, the Court leaves open the possibility for the complainant to seek alternative remedies through competent forums.

You have to grow from the inside out. None can teach you, none can make you spiritual. There is no other teacher but your own soul.

– Swami Vivekananda

| GIST OF TRIBUNAL JUDGEMENTS (VAT)

Compiled by CA Rupa Gami |

|

- M/s Chemolink Industries in S.A. Nos. 85 and 86 of 2017 dated 15/01/2024

Revision proceedings u/s 57 of BST Act was initiated against the orders passed under summary assessment under the BST Act and CST Act. The Revision Orders so passed were confirmed in first appeal by the Jt. Commr. of Profession Tax and second appeal was preferred. The appellant submitted that the order so passed in first appeal was without jurisdiction and that the revision order was passed without pointing out any discrepancy and there was no illegality or impropriety while passing the orders. The revision orders being passed only on presumptive ground of amount of ITC as percentage of turnover in subsequent year being lesser than the amount of ITC as percentage of turnover of purchases of current year, the same was not a valid reason. The matter was covered by the decision in the case of M/s Midas Equipment vs State of Maharashtra in Second Appeal Nos. 120 and 121 of 2002 decided on 19/01/2007. Also the notices of revision and revision orders and also the proceeding sheets initiating revicion were very short, cryptic and brief. The Second Appeals were allowed.

(Petitioner represented by Adv. N.V.Tapare)

- M/s Nexus Petrochem Pvt. Ltd. in Vat S.A. No. 243 of 2020 dated 15/01/2024

High Seas Sales were disallowed by considering the General Clause in the agreement which read “the sale being on warehouse sale, the buyers will make their own arrangement for obtaining delivery of the goods from the custom and port authorities and make the payment for customs duty part warehouse charges, wharfage handling and transport charges and for the clearance of the material at their own risk.” It was submitted by the appellant that the goods were never kept in the bonded warehouse as is evident from the documents submitted and that the first appeal authority has misunderstood the general clause of the agreement. Since all the documents were not produced before the lower authorities for verification of the claim of sale in the course of import and no prejudice would be caused to the Department, in the interest of justice, the matter was remanded to first appellate authority to verify all documents and decide the appeal afresh.

(Petitioner represented by Adv. V.R.Rao)

- M/s Agarwal and Company in S.A. Nos. 05. 06 and 07 of 2020 dated 16/01/2024

The first appeal authority had forfeited the excess collection of tax and reduced the same from refund. The dealer had filed returns by showing indirect tax collection at 10% and by showing inclusive of tax collection in sale bills at 10%. The first appellate authority had confirmed the levy of tax at 4%. The dealer had reimbursed itself of the tax in sale price at 10%. It had not refunded the tax to its customers at 6%. If 6% tax was to be refunded to the dealer, it would amount to unjust enrichment. This appeal is dismissed. Where the tax was paid without claiming deduction under rule 46A in the subsequent year, the appeal was allowed and remanded for reworking the tax liability.

(Petitioner represented by Adv. P.C.Joshi)

- M/s Chetak Steel and Shree Sai Rolling Mill in Vat S.A. Nos. 268, 269 and 270 of 2018 dated 20/01/2024

Set off was disallowed by completing assessment under section 23(5) of the MVAT Ac t. The appellant contended that such assessment was without jurisdiction since the same can be initiated only when there is evasion of tax. The material relied upon for coming to the satisfaction of non-payment by the vendor or about hawala purchases was not delivered to the appellant along with notice. Opportunity of hearing and cross-examination was not given in appeal. The appellant relied on the case of Mahalaxmi Cotton Ginning Pressing and Oil Industries (VAT SA 195 of 2015 dated 30/10/2017) and submitted that according to para 51, the responsibility to identify the defaulters was on the Department. The matter was remanded to the first appellate authority for granting opportunity of hearing and cross-examination to the appellant. (Petitioner represented by Adv. C.B.Thakar)

- M/s Powerdeal Energy System (I) Pvt. Ltd. in M.A. No. 70 of 2023 dated 23/01/2024

There was a delay in filing second appeal by 225 days. The appellant’s business was closed due to labour issue and the factory premises were closed. However, some C Forms were collected from the factory premises and submitted at the time of first appeal. The appellant remembered that some records had been handed over to its consultant who had expired. The appellant contacted his family members and collected some more forms from his office. And immediately second appeal was filed. Hence the delay in filing of appeal. Miscellaneous Application was allowed and delay condoned by imposing costs of Rs.5000/-.

(Petitioner represented by Adv. C.B.Thakar) - M/s Raymond Tube in M.A, Nos. 100 and 101 of 2023 dated 23/01/2024

There was a delay in filing of appeal by 149 days as the consultant who was looking into the matter was busy with the Amnesty matters and thereafter due to Diwali season and it skipped his mind to file the appeal. Miscellaneous Application was allowed and delay condoned by imposing costs of Rs.20000/- for each appeal.

(Petitoner represented by Adv.C.B.Thakar))

- Addl. Commr. of Sales Tax (Vat-III) Mah, Mumbai vs M/s Bharat Springs Pvt. Ltd. in Reference Application Nos. 09 and 10 of 2015 dated 25/01/2024

The Tribunal had decided the appeal in the above case in favour of the assessee by considering the DDQ dated 27/01/2001 as applicable whereby the front spring assembly manufactured by the assessee were held to be forgings covered by Schedule entry B-6(v)(iii) liable to tax at 4%. The order was made applicable prospective from the date of the order. On the appeal being filed before the Tribunal, the order was made applicable from prior to the date of the order. Reference Application was filed by revenue raising the following questions:

- Whether the Tribunal was justified in holding the sale of products as forgings overlooking the larger bench judgement in the assessee’s case?

- Whether the Tribunal was justified in holding that the appellant was entitled to set off under Rule 41E of BST Act?

- Whether the Tribunal was justified in differentiating the Supreme Court judgement in the case of Vasantham Foundry and larger bench decision of MSTT in case of Bharat Forge?

The respondent submitted that the Bombay High Court in the case of M/s Kulko Engineering Works Ltd. vs State of Maharashtra in 46 STC 454 has already laid down that DDQ is binding on lower authorities. That the larger bench decision in the case of Bharat Forge involved different product. Reference Application were dismissed.

(Respondent represented by Adv. C.B.Thakar)

- M/s Sea Sagar Construction in Appeal No. 57 of 2005 dated 24/01/2024

The appellant was undertaking the business activity of construction of building tower and had entered into a contract with the co-operative Housing Society. The Society had entered into an agreement with the Builders to construct the building on behalf of the Society. A DDQ was made for determination of the questions as follows:

- Whether on the agreements so entered into by the Society with the Developers and on turn by the Developers for allotment of constructed premises to the prospective allottees, the Society is liable to pay any tax under the provisions of the Works Contract Act?

- Whether the applicant is a dealer under the provisions of the Works Contract Act/

The order of the DDQ was passed by the Addl. Commr. of Sales Tax holding that the appellant was not a dealer and the transaction effected pursuant to the agreement was not a sale. The order was approved by the Commissioner of Sales Tax. Later the Commissioner reviewed the order under section 57 after issuing a notice in Form 40 holding that the appellant was a dealer and liable to tax under the Works Contract Act. It was contended by the appellant that the DDQ order so passed under section 52 could be reviewed only by complying with the procedure as laid down under section 52(2A). The determination order cannot be revised under section 57 as there is a specific provision under section 52 for review of determination order. The Tribunal relied on the Bombay High Court decision in the case of M/s Bombay Tarpaulin Merchants Association in 26 STC 45 (Bom) and held that the application was originally made u/s 52 of the BST Act and therefore the revision or review of the order u/s 52 must be in conformity with section 52(2). A determination order cannot be revised u/s 57 as there is a specific provision for review of determination order. The appeal was allowed.

(Petitioner represented by Adv. Nikita Badheka)

Perseverance is not a long race; it is many short races one after the other.

– Walter Elliot

DGFT & CUSTOMS UPDATE

By CA. Ashit K. Shah |

|

1. Notifications issued under Customs Tariff:

| Notifications No | Remark | Date |

| 22/2024

– Customs |

Exemption from export duty on exports from selected custom stations, of Kalanamak rice covered under HSN 1006 30 90, not exceeding 1,000 MTs subject to the specified conditions. | 02 -04- 2024 |

| 16/2024

– Customs |

To allow duty free imports of yellow peas covered under HSN 0713 1010, with bill of lading issued on or before stron 30.06.2024 by amending N. No. 64/2023-Customs, dated the 7th December, 2023. | 05 -04 -2024 |

| 23/2024

– Customs |

Modify the Basic Custom Duty on commonly known as smart watches and other mart wearable devices including smart rings, shoulder bands, neck bands or ankle bands;” shall be substituted by amending N. No. 57/2017 – Customs, dated 30-06-2017 | 14 -03 -2024 |

2. Notifications under DGFT:

| Notifications No | Remark | Date |

| 05/2023 | Ethe Import of Melon Seeds under ITC(HS) code 12077090 is `Free’ with effect from May 01, 2024, till June 30, 2024, on ‘Actual User’ basis to Processors of Melon Seeds having a valid FSSAI Manufacturing Licence in line FSSAI Order dated March 15, 2024. | 05 -04 -2024 |

| 05/2023 | Imposition of port restrictions on the supply of prohibited or restricted essential commodities to the Republic of Maldives for the fiscal year 2024-25, to regulate the export of essential goods to Maldives under the bilateral trade agreement between the Governments of India and Maldives. | 15 -04 -2024 |

| 07/2023 | Export of 10,000 MT of onions under HS Code 0703 10 19 to Sri Lanka through NCEL and additional 10,000 MT onions over and above notified quota of 24000 MT to UAE. | 15 -04 -2024 |

| 07/2023 | Exports of up to an aggregate quantity not exceeding 2,000 MT (tonnes) of white onion has been allowed through the specified ports, taken together, with immediate effect. Exporter shall have to get the certificate from the Horticulture Commissioner, Government of Gujarat, certifying the item and quantity of white onion to be exported. | 15 -04 -2024 |

CHARITABLE TRUSTS UPDATES

By Adv. Hemant Gandhi & CA Premal Gandhi |

|

All Charitable Trust/ Section 8 Companies and Societies existing as on 1st April 2021 were supposed to get themselves registered under Section 12 Ab of the Income-tax Act, 161 as well as get their 80G renewed also similarly. The due date for renewal of these organisation was extended twice to 30th September 2023.

Furthermore, All Organisation which were formed subsequently got a provisional registration and they were granted registration for 3 years, however they were supposed to submit an application for renewal of registration in form 10A , 6 months before the end of this registration . Furthermore, another condition in their registration certificate issued in form 10AC was that they were supposed to file form 10AB for conversion of their provisional registration to final registration within the stipulated period of 6 months from the date of commencing of their activities as mentioned in their registration certificate issued in form 10AC.

Since over the last few years, there have been a slew of amendments for these organization’s and majority of these organization’s well as their consultants were at times grappling with these due dates and therefore were not able to comply with these deadlines. Furthermore since a lot of these deadlines were being missed and the registration certificates u/s 10 23 ( C) /12 A/ 80G of these Entities were being cancelled/rejected causing huge losses as well as penalties to these Entities.

The Income-tax Department has issued a circular no 7 dated 26th April 2024 u/s 119 2 (b) of the Income-tax Act, to mitigate all the genuine hardships caused has come out with a one-time extension for all the following cases:

-

- All Entities which existed on 1st April 2021 can now file a Form No. 10 A in case of an application under clause (i) of the first proviso to clause (23C) of section 10 or under sub-clause (i) of clause (ac) of sub-section (1) of section 12A or under clause (i) of the first proviso to sub-section (5) of section 80G or in case of an intimation under fifth proviso of subsection (I) of section 35 of the Act, till 30.06.2024;

- All Entities who had to file Form No. 10 AB for conversion of provisional registration to final registration on commencement of activities, shall make an application under clause (iii) of the first proviso to clause (23C) of section 10 or under sub-clause (iii) of clause (ac) of sub-section (I) of section 12A or under clause (iii) of the first proviso to sub-section (5) of section 80G of the Act, till 30.06.2024. Furthermore, It may be also noted that extension of the above due date shall also apply in case of all pending applications of Form 10AB with the respective Commissioner of Income Tax (Exemptions), or cases where the Form 10AB is already rejected on account of selection of wrong codes.

- Furthermore, any existing trust, institution or fund who had failed to file Form No. 10A for A Y 2022- 23 on or before 30th September 2023 and subsequently, applied for provisional registration as a new trust, institution or fund and has received Form No. 10 AC, it can avail the option to surrender the said Form No. 10 AC and apply for registration for A Y 2022-23 as an existing trust, institution or fund in Form No. 10A on or before 30.06.2024.

This being a beneficial Circular which shall address all the Charitable entities and shall ensure that all the challenges currently faced by these organization’s can be resolved at the earliest.

If you need any assistance, please feel to contact on [email protected]

9 FINANCIAL LESSONS FROM LORD SHREE RAMA’S

|

|

*9 Financial lessons from Lord Shree Rama’s Life.

Last month we celebrated RAMNAVMI on 17th April. 2024. There is lot to learn from Lord Rama’s Life. I am narrating a Few Financial Lessons which we should try to implement in our life.

*1. SECURE YOUR LIFE:*

You are not Laxman, and there is no Hanuman to get Sanjeevani for you. so get health & life insurance immediately if not done till date.

*2. SET YOUR BUDGET:*

Set “Laxman Rekha” of your financial budget and make sure not to cross it due to luring online discounts. Understand the difference between need and want to be financially disciplined and select the lesser evil.

*3. CONTINGENCY FUND:*

Unexpectedly, Lord Ram was sent to ‘Vanvas’ for 14 Years and was forced to leave his luxurious Palace. Not everyone can live with such sudden changes in lifestyle. Have an adequate emergency fund to handle unforeseen circumstances.

*4. BE PATIENT/THINK LONG TERM:*

During the 14 years of ‘Vanvas’, Lord Ram faced many ups and downs, including the kidnapping of Sita. Lord Ram patiently waited until the favourable situation, rather than choosing shortcuts. Stay invested for the long term, there is no shortcut to success.

*5. CHOOSE ADVISERS WISELY:*

Kaikeyi took Manthara’s advice & Ramayan happened. Stay away from those trying to sell lucrative policies and distributors who are disguised as advisors for their own benefit.

*6. BUILD A CORPUS:*

Lord Ram, Sita, and Laxman left Ayodhya with nothing. They patiently built their network and Vanar Sena over the years in order to reach the objective of defeating Ravan. It takes patience to build a corpus, to defeat inflation in the long run.

*7. CULTIVATE DISCIPLINE:*

Lord Ram practiced “Dharma” in order to be right, responsible and disciplined in life. Apply a similar theory to your life. Save judiciously, spend carefully and invest wisely for a disciplined financial life.

*8. WIPE YOUR SLATE AND START OVER:*

14-day Lanka War marked the defeat of evil and set the stage for a new path. Similarly, forget bad decisions that you made in the past and make informed decisions to streamline your financial journey.

*9. BELIEVE IN KARMA:*

Continue to do good things and karma will eventually reach you.

Happy Investing…

A mind all logic is like a knife all blade. It makes the hand bleed that uses it.

– Rabindranath Tagore

|

Members Name |

Date of Birth |

| Khairnar Santosh Rangnath | 11 – May |

| Agrawal Anand Dinesh | 11 – May |

| Joshi Jayesh M | 11 – May |

| Chawla Munish Chander | 12 – May |

| Desai Hemant D. | 12 – May |

| Vasani Arvind G. | 12 – May |

| Bind Kishorilal Ramdular | 12 – May |

| Dedhiya Vipul K. | 12 – May |

| Bhende Suman N. | 13 – May |

| Aithal Gururaja K. V. | 13 – May |

| Dulani Premnarayan | 14 – May |

| Adhyapak J D | 14 – May |

| Kambli Prakash Vithal | 14 – May |

| Shah Sanjay Dineshchandra | 14 – May |

| Sheth Jayantilal J | 15 – May |

| Sunar Satyanarayan Chhotmal | 15 – May |

| Choudhary S U | 15 – May |

| Badheka Nikita R | 15 – May |

| Khanolkar Narayan Dattatray | 15 – May |

| Dave Paresh Jayant | 15 – May |

| Jain Sanjay Shantilal | 15 – May |

| Rawani Avinash Vinodkumar | 15 – May |

| Mavlankar Shridhar Janardan | 15 – May |

| Shrotriya Mukesh Jugalkishore | 15 – May |

| Mahale Vishal Suresh | 15 – May |

| Shah Shreyas Sudhirchandra | 15 – May |

| Balai Mayur Chandulal | 16 – May |

| Devkate Vishwajeet Laxman | 16 – May |

| Gosar Paresh V | 17 – May |

| Padia Kashyap Prataprai | 17 – May |

| Lakhani Uday B. | 17 – May |

| Sharma Sandeep Sanwarmal | 17 – May |

| Chaudhary Charu Tarachand | 17 – May |

| Vispute Prakash Ramchandra | 17 – May |

| Bid Harshil Jayantilal | 17 – May |

| Rane Vaibhav Dilip | 17 – May |

| Shah Mukund Keshavlal | 18 – May |

| Kulkarni Shripad Mohaniraj | 18 – May |

| Sahoo Chandramani Sanatan | 18 – May |

| Kulkarni Prachi Atish | 18 – May |

| Jain Jitesh Sohanlal | 18 – May |

| Bajaj Ashish Gopaldasji | 18 – May |

| Kukreja Purshottam Gangaram | 19 – May |

| N. J. Shankar | 19 – May |

| Devlekar Chandan Yashvant | 19 – May |

| Kesarkar Raghu Dhyanu | 19 – May |

| Sonawane Gaurav Vijay | 19 – May |

| Shanbhag Narayan Venkatesh | 20 – May |

| Naik Ravindra Nagesh | 20 – May |

| Joshi Niranjan Vijay | 20 – May |

| Raninga Anil Vipinbhai | 20 – May |

| Doshi Jugal Rajkumar | 20 – May |

| Sharma Naresh Kumar | 21 – May |

| Shetty Ganesh Angara | 21 – May |

| Bhatt Tushar Bhavanji | 21 – May |

| Butala Sanjay C | 21 – May |

| Dobaria Zankhana Desai | 21 – May |

| Ghag Rohit Kamlakar | 21 – May |

| Pawar Rushikesh Anandrao | 21 – May |

| Dayma Jugal M | 22 – May |

| Jain Jitendra Ghewarchand | 22 – May |

| Pujara Arvind K. | 22 – May |

| Gangwal Navneet Indarchandji | 22 – May |

| Braganza Anthony John Pascoal | 22 – May |

| Toshniwal Prashant Harigopal | 22 – May |

| Gandhi Prakash Ratilall | 22 – May |

| Gala Mulchand Bhanji | 23 – May |

| Sovani Yogesh Krishnaji | 23 – May |

| Prasad Rupali Sushil | 23 – May |

| Dhuvad Vinit Jyotindra | 23 – May |

| Ramrakhiani Deepak I | 23 – May |

| Desai Mahesh Bhagwandas | 24 – May |

| Limaye Prasad Vitthal | 24 – May |

| Patil Mandar Kamlakar | 24 – May |

| Vishwakarma Ranjeet Hinchlal | 24 – May |

| Chandraghatgi P.N. | 25 – May |

| Luthia Rajiv Jaichand | 25 – May |

| Singh Nitya Ramesh | 25 – May |

| Sutar Aparna Chandrakant | 25 – May |

| Parekh Ronak Dilip | 25 – May |